From GMM:

Enter The Selling Zone

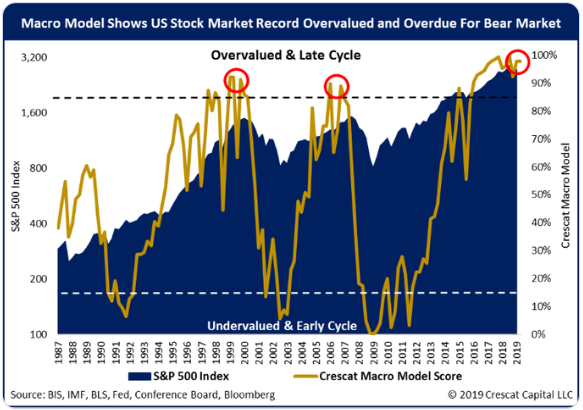

We have entered the selling zone — S&P 3025-3100 — to execute the Get Shorty trade. This also provides an excellent opportunity for long-term investors to start cutting back on risk if they have not already been doing so.

You know our view. Rarely should LT investors reduce risk in a significant manner, maybe just three to four times during their working lives, but this is one of those times, we believe.

Structural Headwinds

The tectonic plates of the global international economic order are breaking apart and moving in the wrong direction and valuations are at historic extremes.

Not to mention the absurdity that “billions upon billions” of fixed-income securities seem to enter the negative interest rate Twilight Zone on a daily basis.

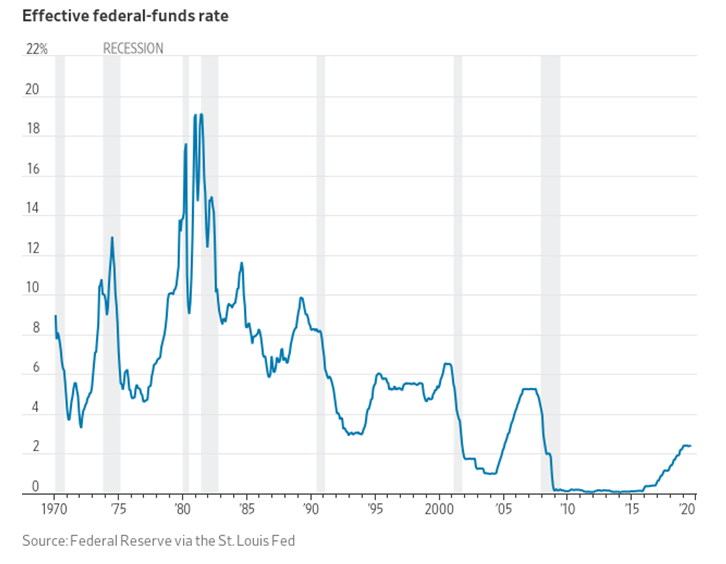

Moreover, the Fed is about to take the unprecedented action of cutting rates next week with stocks at historical highs and inflation marching higher. That signals, at least to us, a Fed gone political and that policymakers have created a beast they cannot tame.

We expect the summer Friday afternoon ramp into the close, which will be an opportunity to start letting some go or setting some up. It’s hard to sell strength but much more enjoyable than selling into weakness and into a big hole.

Stocks Out Of Runway

The charts below illustrate that history dictates that stocks have very little room to run to the upside from current levels. We could be wrong and ‘this time may be different.”

We seriously doubt it, however, but discipline always trumps conviction and that is why we have a hard stop at 3125 to cover. We will then wait to put them out at even more absurd valuations.

Long-term investors that do sell should have a Plan B to get reinvested if they are wrong.

Good luck, folks. See ya’ thirty-plus percent lower.

Micro Metrics

https://global-macro...e-selling-zone/