VIX - Buy signal with the extreme move - Bad for stocks, but maybe too extreme as the S&P 500 price is hanging below the Bollinger Band. Favors sideways to up near term.

Posted 03 August 2019 - 03:05 PM

VIX - Buy signal with the extreme move - Bad for stocks, but maybe too extreme as the S&P 500 price is hanging below the Bollinger Band. Favors sideways to up near term.

Posted 03 August 2019 - 03:06 PM

Expect a Chinese reaction next week:

Beijing was very disappointed with the latest flip-flops of the US. It's understood Chinese side always has a plan B, which includes a series of countermeasures. "China won't fight the battle unprepared. You will see it,"a well-informed official told me on condition of anonymity.

Posted 03 August 2019 - 03:08 PM

Getting real hot in the Trade War ring:

Washington's capriciousness has become the biggest obstacle to China-US trade talks. White House statement said trade talks in Shanghai are constructive, but President Trump announced new tariffs soon. Can the US be trusted?

Mr. President, your brag about higher tariffs contradicts common sense of the economics. It also goes against your actual strong wish for a trade deal. Since tariff is so good, trade talks seem unnecessary. Interesting. Are American voters so easy to fool?

Hu Xijin 胡锡进 added,

Posted 03 August 2019 - 03:10 PM

Really?

JPMorgan: "our view is that the BOJ will cut the short-term policy rate by 20bp to -30bp in September."

"One Of The Two Markets Will Prove Wrong": Why JPMorgan Thinks The Fed Failed

"One Of The Two Markets Will Prove Wrong": Why JPMorgan Thinks The Fed Failed

Posted 03 August 2019 - 03:11 PM

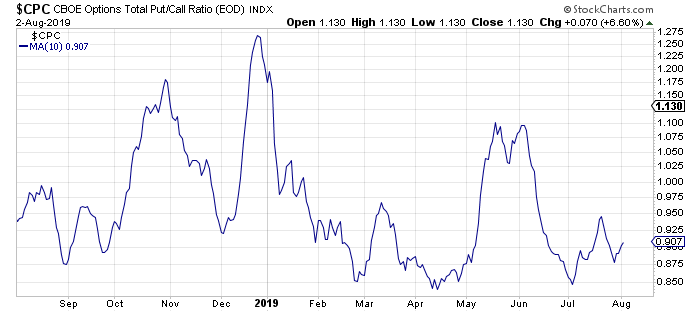

10 dma of total put/call ratio

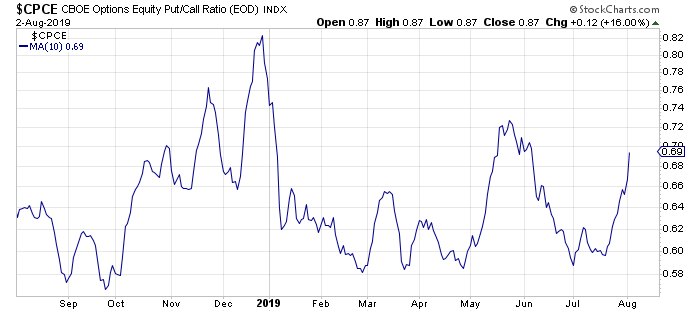

10 dma of equity put/call ratio

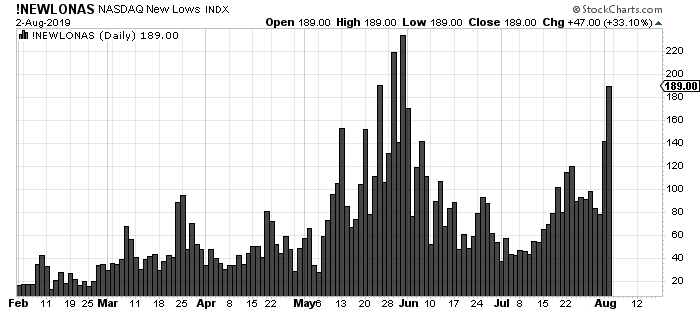

NYSE new lows jump to highest since May.

Naz new lows jump to highest since May.

Posted 03 August 2019 - 03:12 PM

I am still 90% cash... but I can't stay on the sidelines for much more.

Will start buying, gradually

Barron's thinks Cash is a great idea. The Case for Going Into Cash Now https://www.barrons.com/articles/the-case-for-cash-now-51564759828 … via @BarronsOnline

Posted 03 August 2019 - 03:13 PM

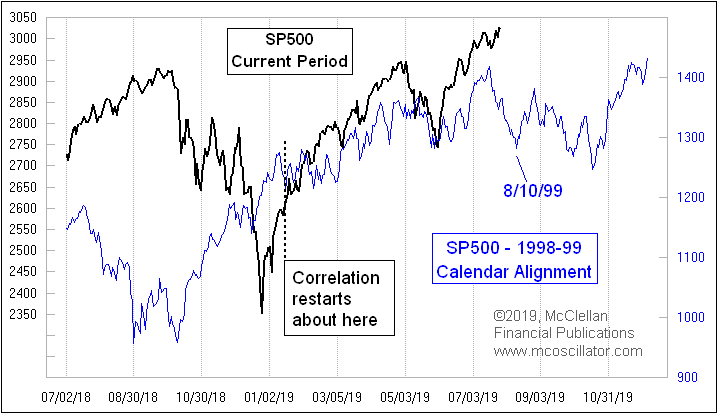

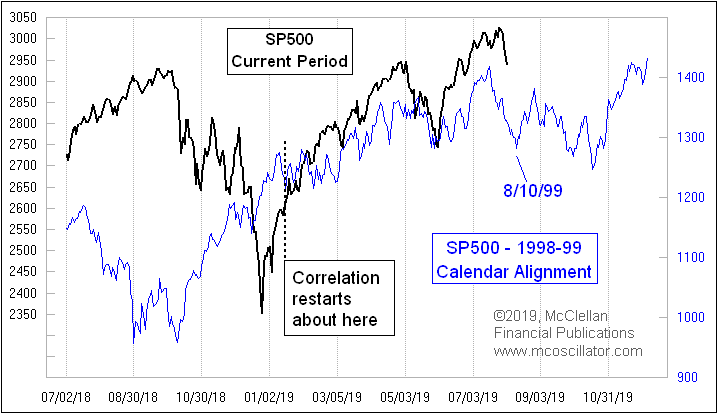

The SPX restarted a tight correlation with the 1999 pattern in mid-January 2019. It was working great until last week. So either the higher high last week is a break from 99's pattern, or the market has gone off track, will soon realize it, & work hard to make up for lost time.

I got mocked by a few people when I posted this chart on Monday. Here is an update.

Posted 03 August 2019 - 03:16 PM

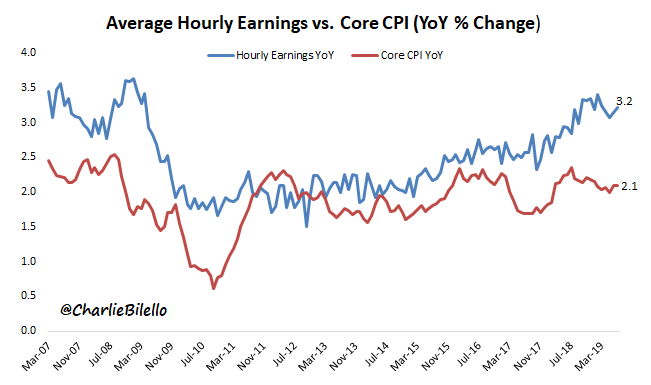

Inflation, finally? Nah, don't think so, not as yet

US Hourly Earnings were up 3.2% over the past year. Have outpaced Core CPI (2.1% currently) for 80 consecutive months. #payrolls

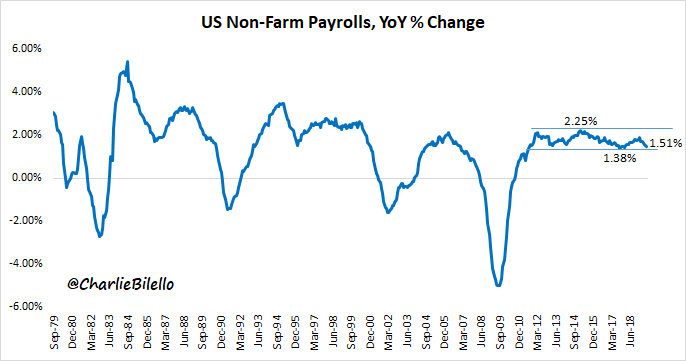

Payrolls: +1.51% YoY & market is expecting 2 more rate cuts by yr-end. Lowest YoY growth of expansion: Sep 2016 to Sep 2017 (+1.38%). Fed hiked rates 3x during this period. Highest YoY growth of expansion: Feb 2014 to Feb 2015 (+2.25%). Fed held rates at 0% during this period.

Posted 04 August 2019 - 08:32 PM

YUAN-ponizing

Here we go: CHINA'S OFFSHORE YUAN WEAKENS PAST 7 PER DOLLAR TO RECORD LOW PBOC SETS YUAN FIXING WEAKER THAN 6.9 FOR FIRST TIME THIS YEAR The currency war begins