I am in full agreement with Lance's opinion - market us setting up for a big drop

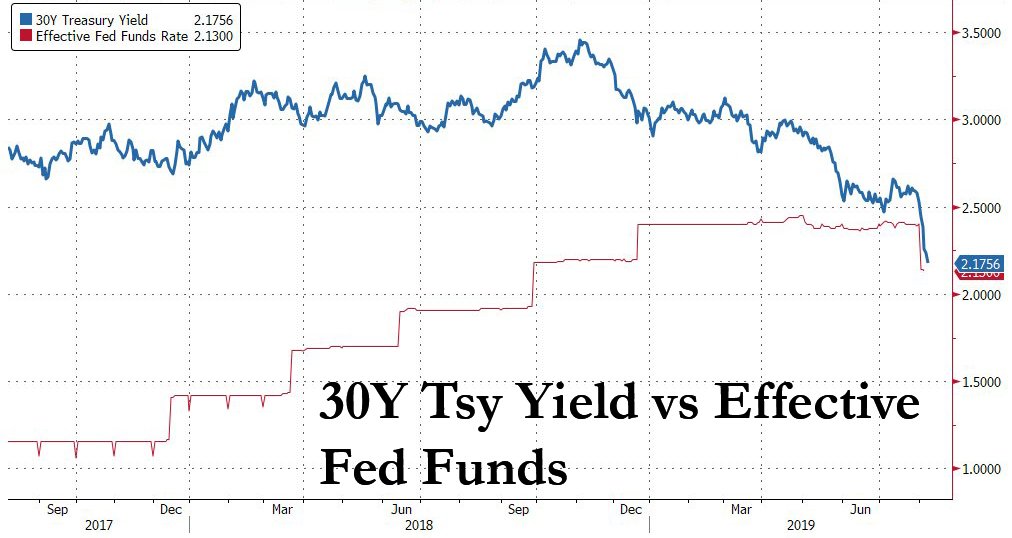

Caveat: if FED cuts before Sep meeting and floods the system with QE then markets will rally at least 5%

But, that postpones the inevitable: a big drop is coming; in the interim, trade ST with the market and be prepared.

I had one of my best NQ & VXX days yesterday as the market quickly recovered from overnight lows then soared, pulled back, then roared ahead.... great market moves to daytrade.

Any rally should be used to reduce portfolio risk in the short term as the test of the 200-dma is highly probable.

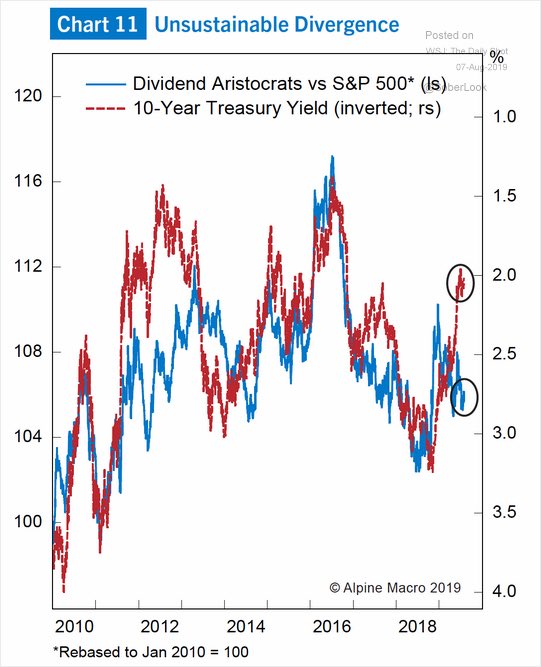

Given that monthly data is very slow-moving, longer-term signals can uncover changes to the trend which short-term market rallies tend to obfuscate.

Interestingly, despite recent "all-time" highs in the S&P 500, the monthly signals have all aligned to "confirm" a "sell signal."

With both earnings and corporate profits under pressure, this may be the start of a bigger corrective process like we witnessed in 2018.

https://seekingalpha...tRoadblock=true