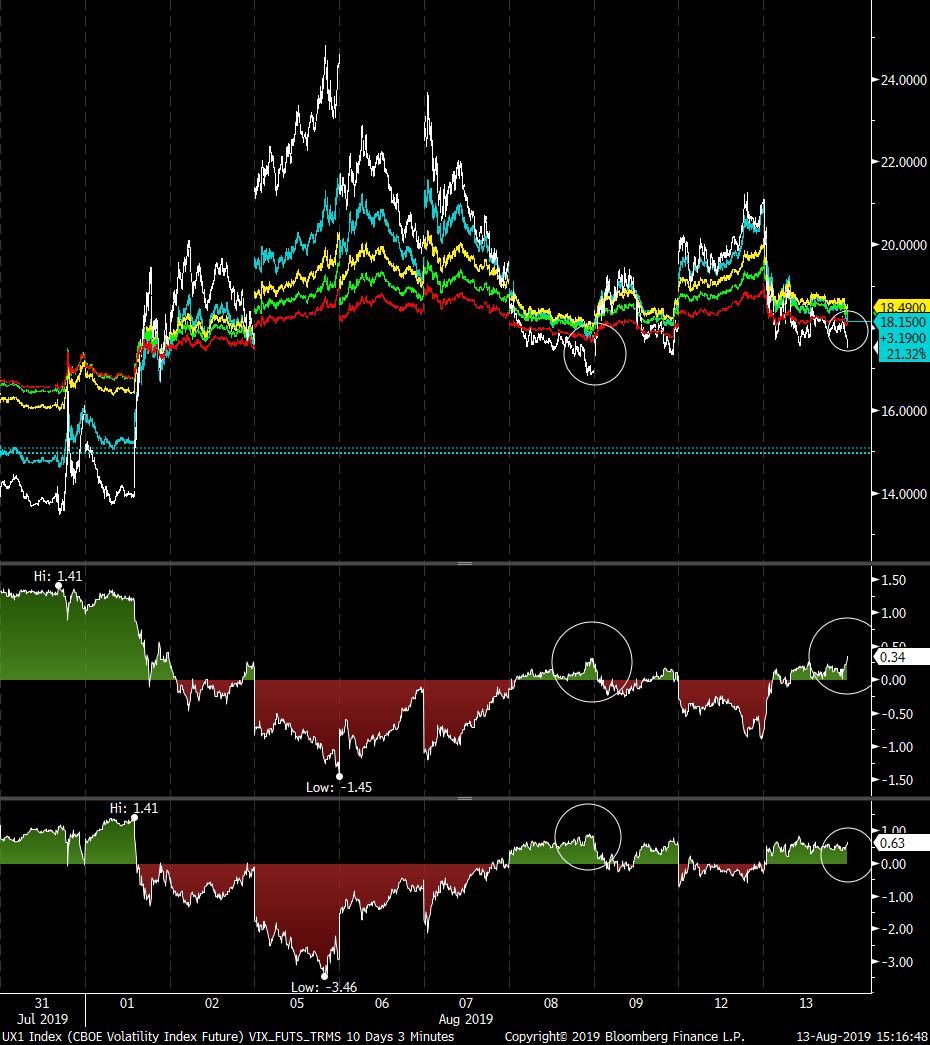

This has been my busiest morning for a long while, since those wildly bullish weeks in January.

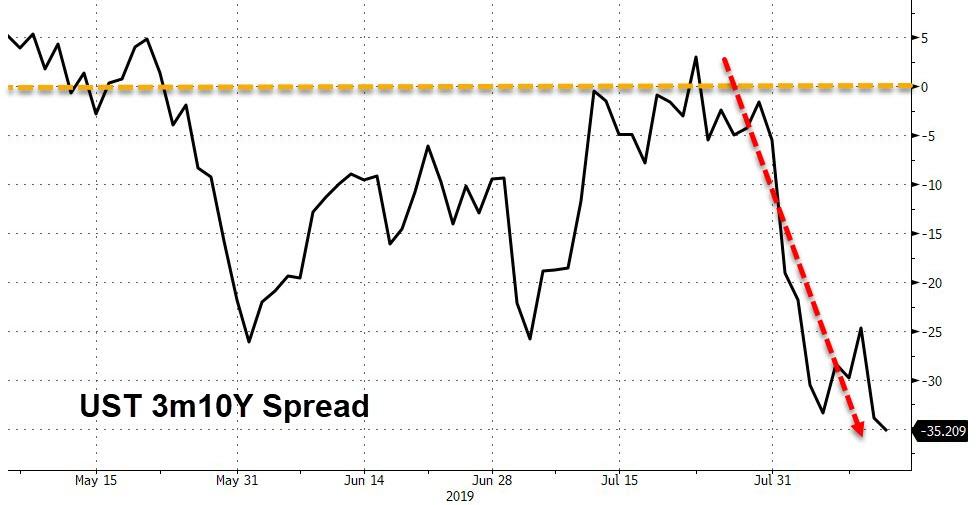

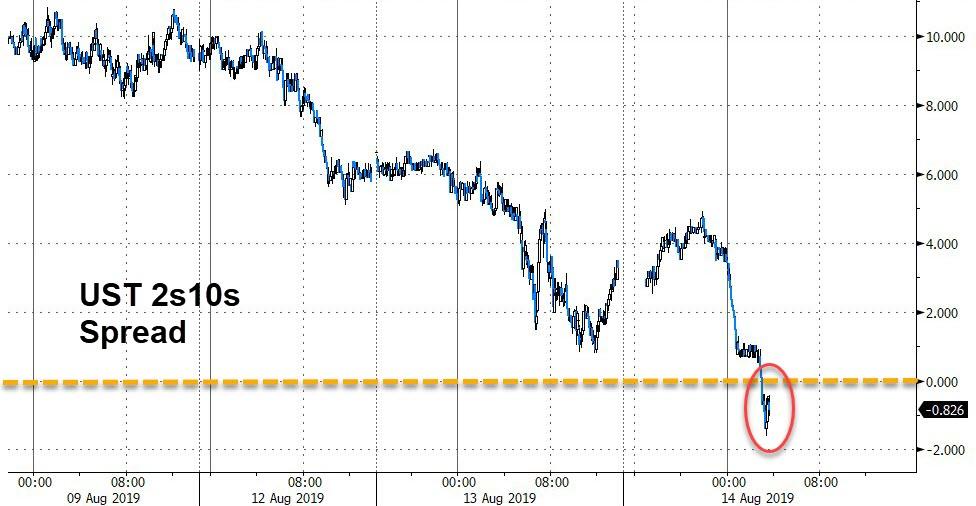

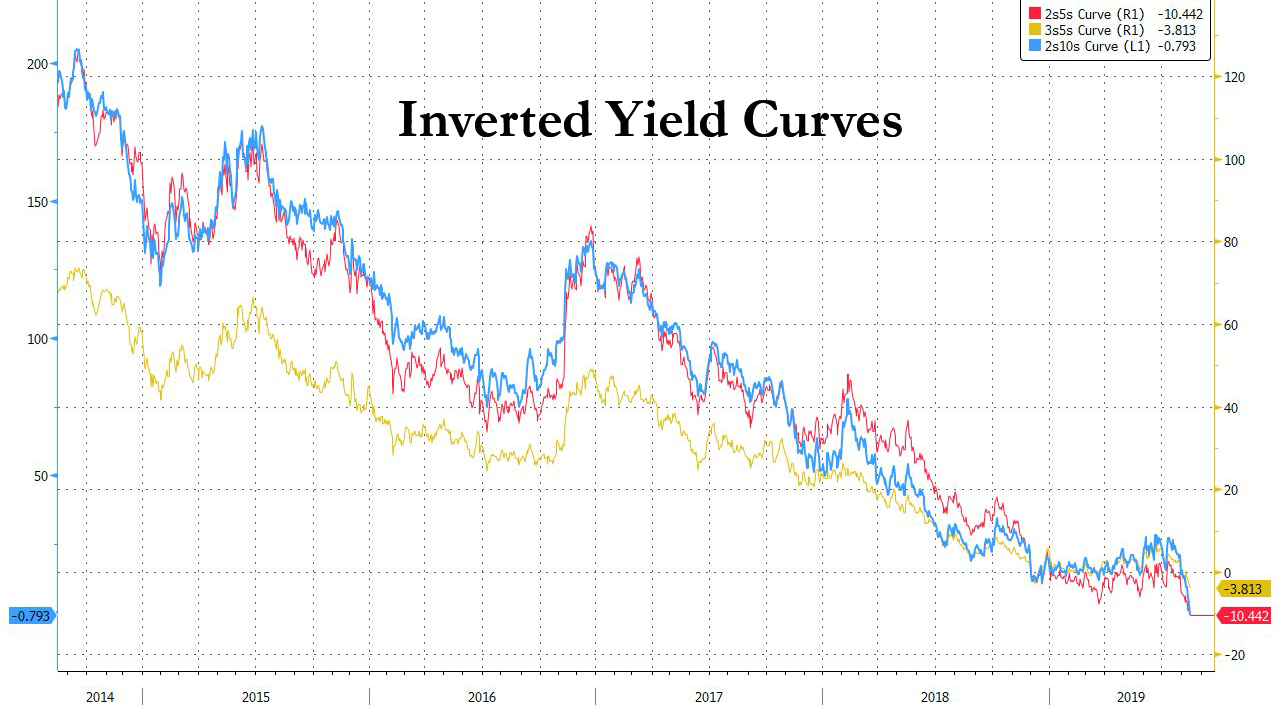

Everyone seems excited about the yield curve inversion. More reason for the FED to come in, and they will. BE VERY ALERT for more wild sings and reversals.

Recession Countdown Begins: UST 2s10s Yield Curve Inverts For First Time In 12 Years

"Actually we're reading the spread wrong," Larry Kudlow says of the flattening yield curve. "There's no recession in sight right now." #DeliveringAlpha https://cnb.cx/2zOaKgh