I dont post here often any longer but this one is important for those dip buyers among us.

We will make a lasting and significant cycle LOW (lower low than 8/15) on August 28/29th. Im thinking we bottom between 2680-2720. Im keeping powder dry for this opportunity. Itll be the penultimate dip to buy for year end rally. The next cycle date of significance is Sept. 19th (might be a low but itll be a higher low).

*if this comes to fruition.....then I am your Huckleberry....

LOL.... Waiting on the next tweet.... Thanks Doc!

My VXF position is currently in cash...... waiting to see how this plays out.....

https://stockcharts....947&a=684168589

Jeff Clark's Market Minute Yesterday Was No Big Deal (Yet)

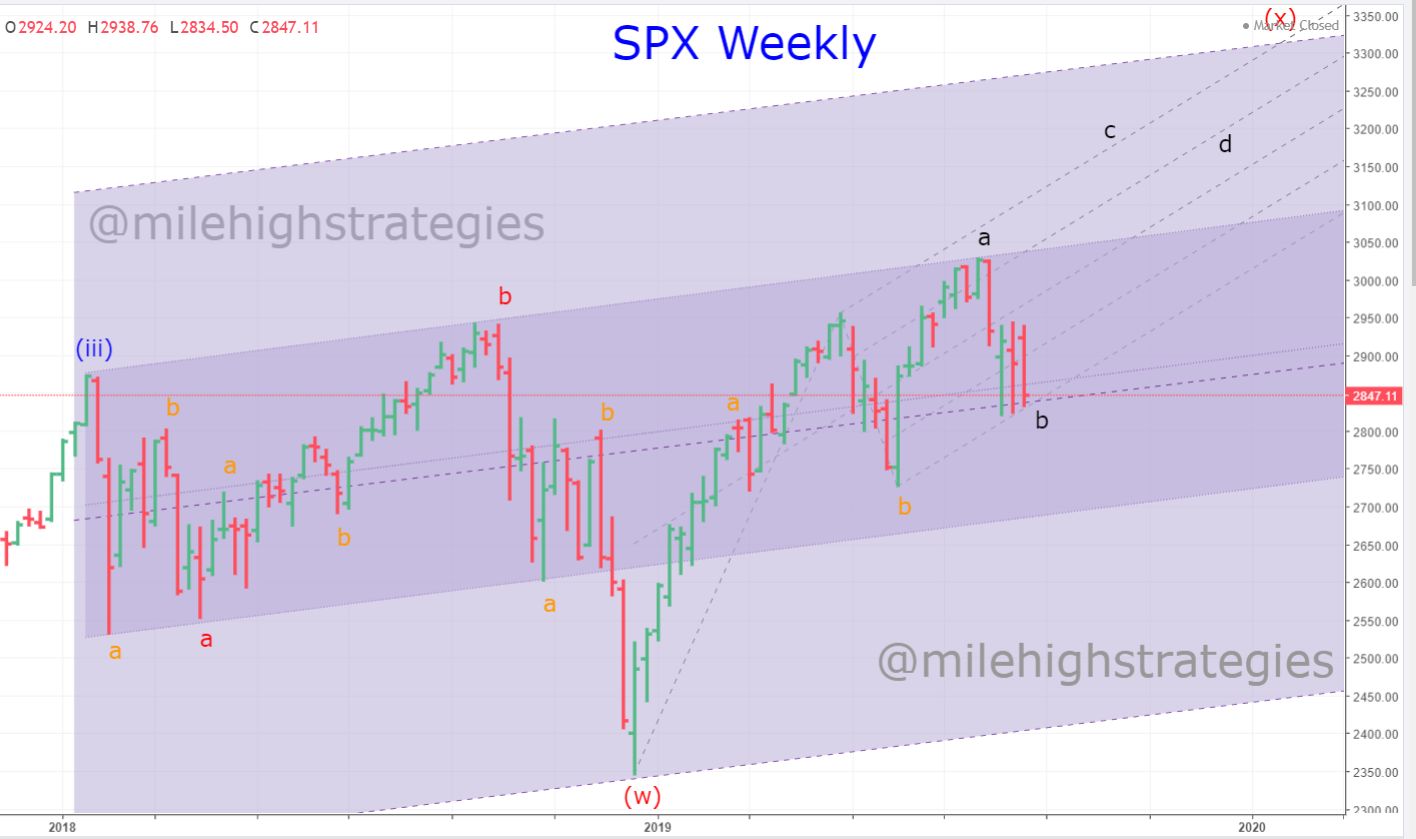

Take a look at this updated chart of the S&P 500 I first showed you on Wednesday…

On Wednesday, we noted the market was gearing up for a big move in one direction or the other. And while stocks have pulled back from where they were on Wednesday, we haven’t yet seen that “big move.” Instead, the S&P has simply pulled back from resistance and is now approaching support.

No big deal… yet.

So, where do we go from here?

Let me describe the two possible scenarios I see…

If the S&P can hold up here, bounce, and head back up towards the 2930 resistance level, then the odds greatly favor an upside breakout. Lots of technical indicators are quite oversold. The proverbial rubber band is stretched pretty far to the downside. Investor sentiment – a contrary indicator – is extremely bearish. So, there’s lots of tinder available to fuel a breakout rally.

On the other hand, if the S&P 500 continues lower and breaks below support at the 2740 level once again, then the market is most likely going to break down.

I’ve often commented that multiple tests of support (and resistance) are similar to jumping up and down on a frozen lake. Each test weakens the ice just a bit – until, eventually, it breaks.

You can see a perfect example of the ice breaking if you take another look at the above chart and notice what happened last December. Back then, it was the third test of support that finally broke the ice.

The current setup looks eerily similar to how things looked in early December – with one really important distinction…

We’re still holding above support.

Like I said… If the market can hold here, bounce, and start to move back up, then the odds favor a breakout to the upside rather than the downside. Traders should pay close attention to what happens early next week.

Best regards and good trading,

https://www.jeffclarktrader.com/

Edited by robo, 24 August 2019 - 09:03 AM.