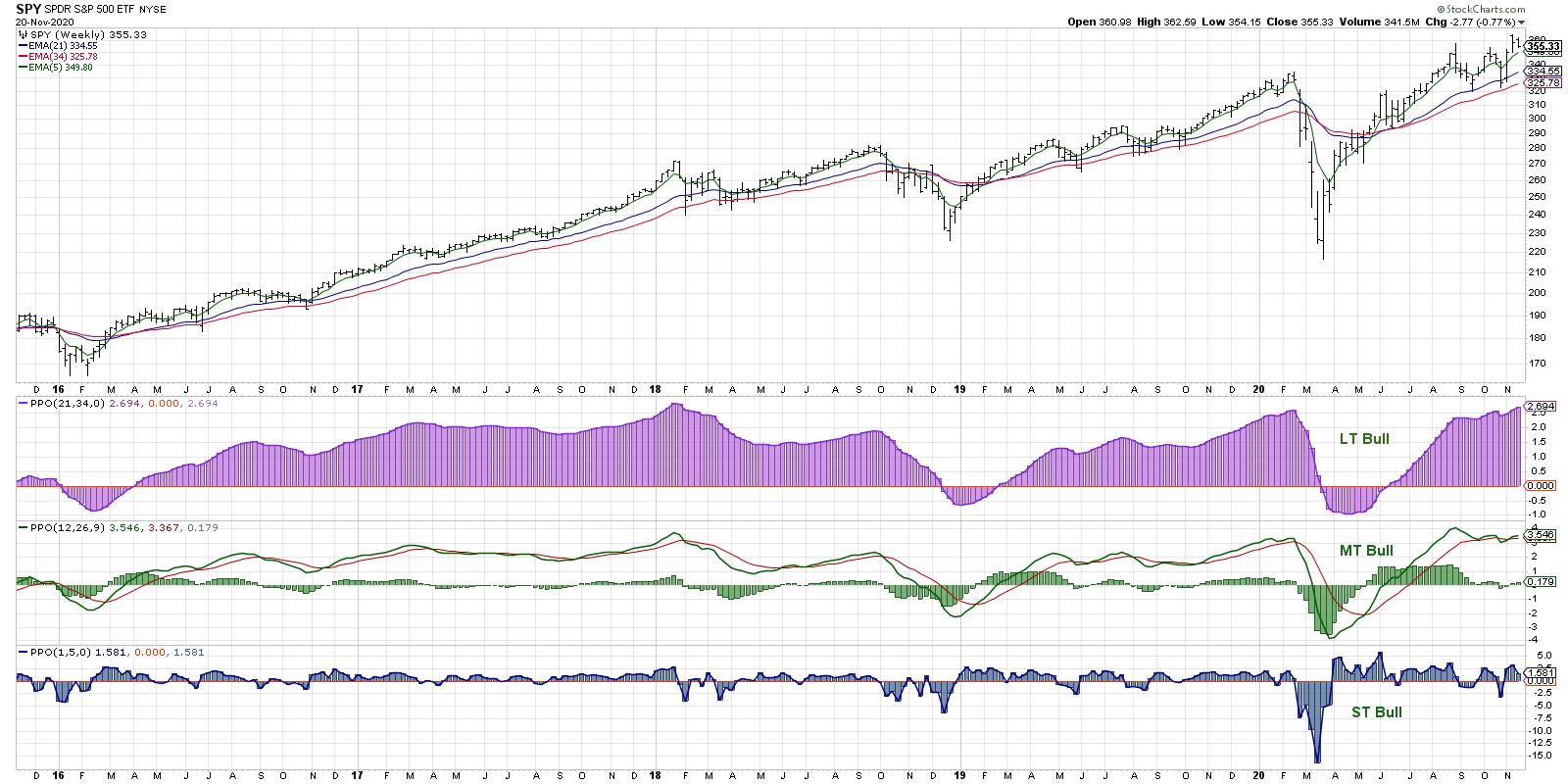

The S&P 500 finished the week down a modest 0.8% but remain within a stone’s throw of all-time highs.

As expected, the rate of gains slowed as we approached last week’s intraday highs and the market is quickly settling into a 3,500(ish) to 3,650(ish) trading range ahead of the Thanksgiving holiday.

Stocks rallied 10% in early November and anyone predicting that rate of gains to continue clearly doesn’t understand how this game works. I still like this market and am anything but bearish, but two steps forward, one step back. That’s how this works. Always has, always will.

Most of the big headlines are already behind us. Investors who are afraid of this spike in Covid infection rates have already sold. Those that wanted to buy the vaccine breakthroughs have already bought. And now everyone is sitting around waiting for what comes next.

Maybe these infection rates moderate naturally without oppressive government-imposed shutdowns. Or maybe we fall back into another round of punishing stay-at-home orders. At this point, no one knows for sure.

While things turn out less bad than feared most of the time, the biggest challenge for this market is prices are already near the highs. That means there isn’t much margin for error. Stocks are priced for a good outcome and any hiccup will send us lower.

Limited upside if things go right and lots of downside if things go wrong. That makes this a poor place to own stocks. I don’t mind holding long-term investments because that time horizon is measured in years, not months. But for anything shorter-term, we need to be careful because the risk/reward is currently skewed against us.

https://cracked.mark...th-this-market/