https://www.siliconi...?msgid=33410786

TOP CYCLE

#2

Posted 18 September 2021 - 12:39 PM

Edited by redfoliage2, 18 September 2021 - 12:40 PM.

#3

Posted 18 September 2021 - 01:33 PM

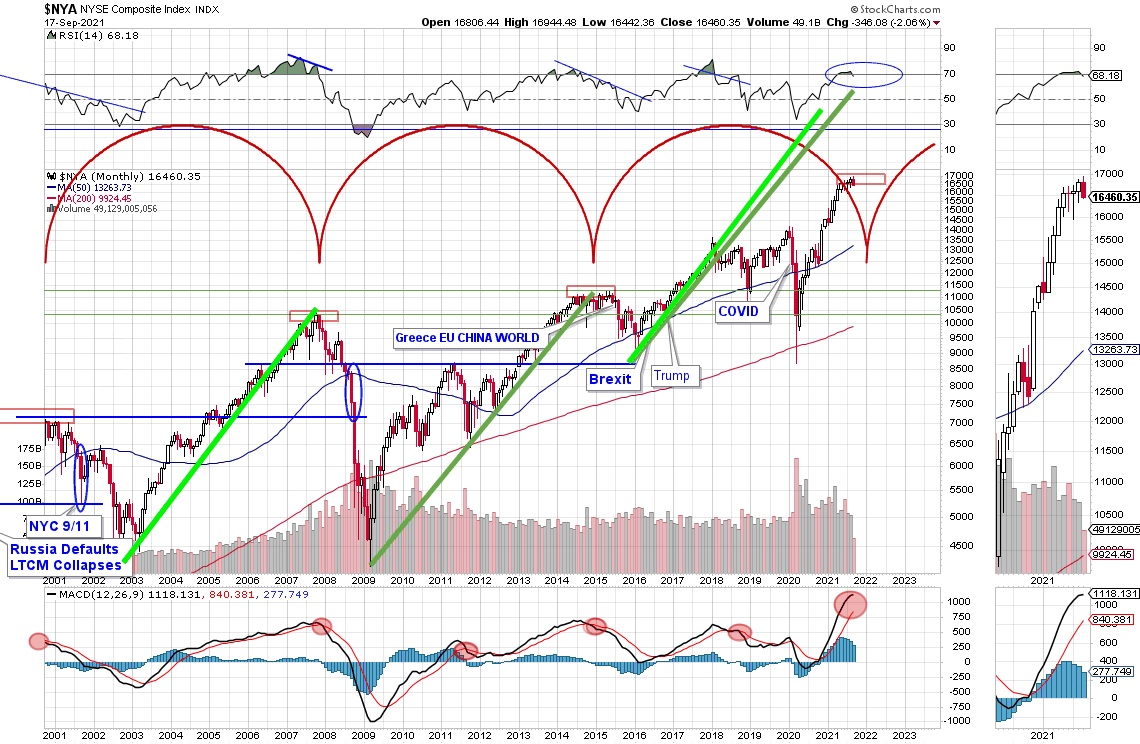

I find this monthly $NYA interesting. Looks toppy but could go on for sometime...or not.

I'm looking for a lower monthly low (we are close now) followed by a failed snap-back rally.

Monthly RSI has turned down and MACD is trying to turn down.

Also thinking about Martin Armstrong's call for a depression in 2022.

2014-15 top went on for a year!

2009 to 2015 rally angle and length equals where we are now.

The past does not repeat exactly, but often rhymes.

Edited by Rogerdodger, 18 September 2021 - 09:43 PM.

BIGGEST SCIENCE SCANDAL EVER...Official records systematically 'adjusted'.

#4

Posted 20 September 2021 - 05:32 AM

I still think it is all all about the Mega Caps.

Apple looking closer and closer to being fully cooked, with a long bear ahead of it.

If MSFT blows out both 300 and 295 today, it could be done as well.

Amazon back below 3400, and it is likely done as well.

If those 3 are done, likely Google and Facebook may roll similarly....

That is a TON of Market cap headwind to fight should they all roll here, and odds are high that they wont be they only ones to come under pressure.....

Big gap down coming today....see how it finishes out the day.

If it is big down, then bull may be done for now....

Edited by K Wave, 20 September 2021 - 05:33 AM.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

#5

Posted 20 September 2021 - 09:48 AM

Down 613, NYA ($NYSE) just made that lower low on the Monthly. There is "support" around 16000 and we are at 16172.

This could be the first roach in the cabinet.

Edited by Rogerdodger, 20 September 2021 - 09:49 AM.

BIGGEST SCIENCE SCANDAL EVER...Official records systematically 'adjusted'.

#6

Posted 20 September 2021 - 12:01 PM

I published this in July, and think the cycle could actually play out as in your chart:

#7

Posted 20 September 2021 - 12:34 PM

I prefer this count as I see the equity market as commoditized to a large extent, therefor the 5th wave has the final thrust action usually seen in commodities.

#8

Posted 20 September 2021 - 01:12 PM

I prefer this count as I see the equity market as commoditized to a large extent, therefor the 5th wave has the final thrust action usually seen in commodities.

And have a look at the current charts of Lumber, Rhodium, Palladium, Iron.....blowoffs, and total disasters now a few months later....

Point is, it can come undone..VERY fast.....

here is Iron Ore

And here is TQQQ that is trying to make the 3rd downside momo crossover that often leads to a death dive...(see Iron Ore)

Edited by K Wave, 20 September 2021 - 01:13 PM.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

#10

Posted 20 September 2021 - 01:48 PM

I prefer this count as I see the equity market as commoditized to a large extent, therefor the 5th wave has the final thrust action usually seen in commodities.

In context: