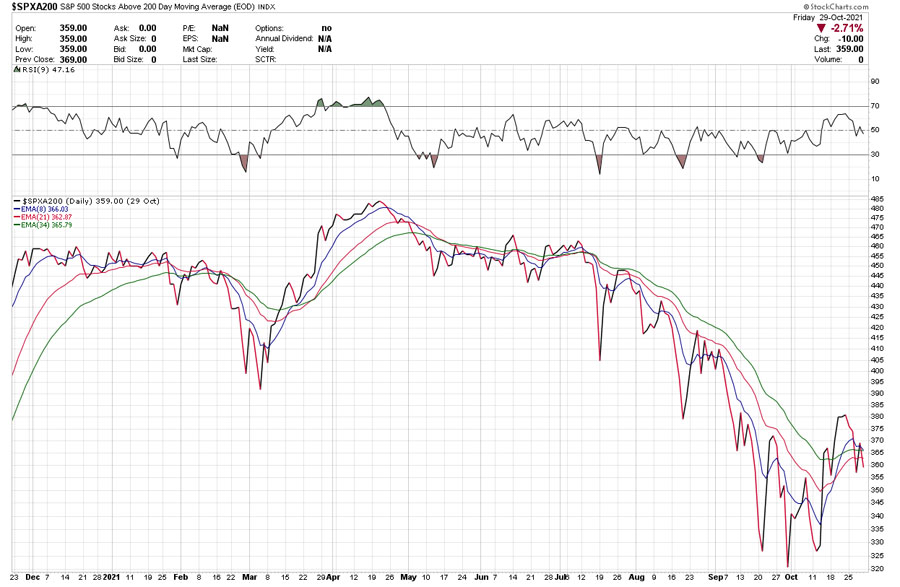

I was talking to Ike about this Monday. This indicator looks like Hell, and in ordinary times, it would be indicative of serious distribution and would be very bearish.

These days, however, I think not. At the margin, a big chunk of stock demand is from sophisticated funds seeking a low risk, net positive return through hedged equities and derivative programs. Money is cheap to borrow, but conversely, there is no place besides the stock market to get a net of inflation positive return, with liquidity. Which is driver of the anomaly. These "investors" need very good liquidity in both the stocks and their derivatives. They're going to keep putting money into the market until rates rise, likely. But they're not going to be interested in the less liquid issues.

M