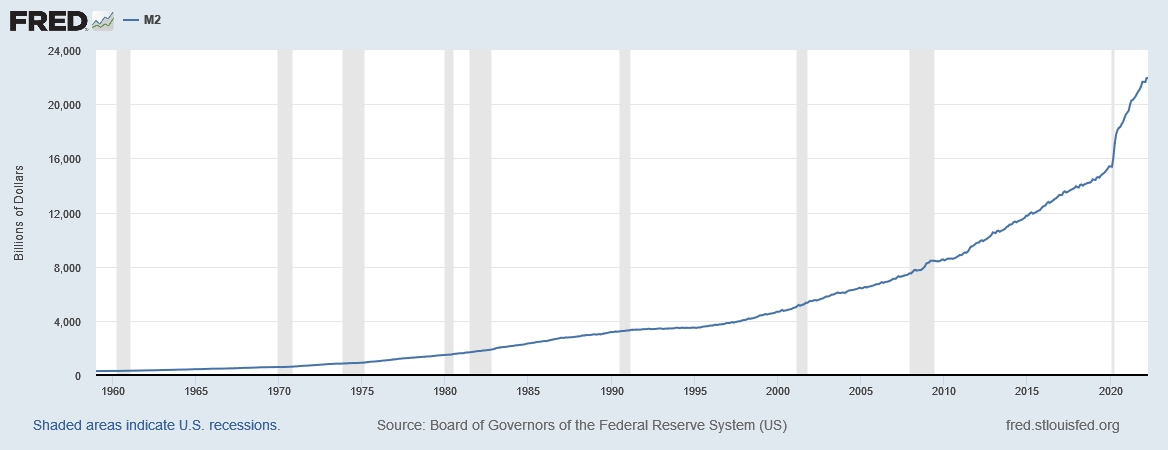

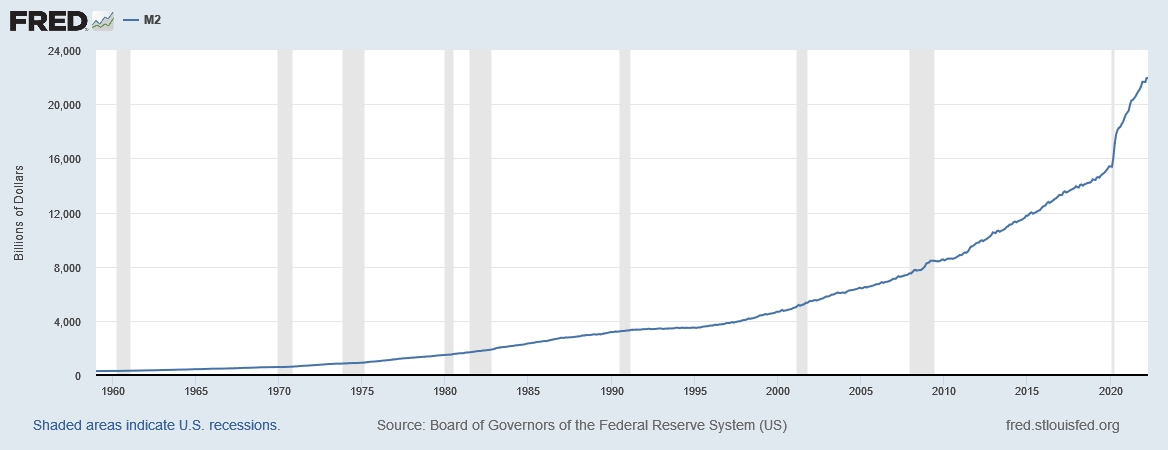

Why we have inflation? Look at that chart. Look at the $6 trillion increase in M2, that's almost 40% since 2020.

Edited by linrom1, 14 June 2022 - 03:54 PM.

Posted 14 June 2022 - 03:48 PM

Why we have inflation? Look at that chart. Look at the $6 trillion increase in M2, that's almost 40% since 2020.

Edited by linrom1, 14 June 2022 - 03:54 PM.

Posted 14 June 2022 - 04:55 PM

Why we have inflation? Look at that chart. Look at the $6 trillion increase in M2, that's almost 40% since

Worthless, you should be looking at velocity of money. Prining all that money did not cause this, ythe money ends up in the hands of fewer and fewer, next year we will be headed for deflation again. Velocity of M2 Money Stock (M2V) | FRED | St. Louis Fed (stlouisfed.org)

Posted 14 June 2022 - 10:59 PM

Why we have inflation? Look at that chart. Look at the $6 trillion increase in M2, that's almost 40% since

Worthless, you should be looking at velocity of money. Prining all that money did not cause this, ythe money ends up in the hands of fewer and fewer, next year we will be headed for deflation again. Velocity of M2 Money Stock (M2V) | FRED | St. Louis Fed (stlouisfed.org)

I'll stick with Milton Friedman's explanation of WHAT IS INFLATION. The chart above proves it and M2 is still growing at 8-12%/year so we'll have inflation for the next 40-years until it blows up.

Edited by linrom1, 14 June 2022 - 11:00 PM.

Posted 14 June 2022 - 11:14 PM

Hanke on Inflation

Posted 15 June 2022 - 05:51 AM

Why we have inflation? Look at that chart. Look at the $6 trillion increase in M2, that's almost 40% since

Worthless, you should be looking at velocity of money. Prining all that money did not cause this, ythe money ends up in the hands of fewer and fewer, next year we will be headed for deflation again. Velocity of M2 Money Stock (M2V) | FRED | St. Louis Fed (stlouisfed.org)

I'll stick with Milton Friedman's explanation of WHAT IS INFLATION. The chart above proves it and M2 is still growing at 8-12%/year so we'll have inflation for the next 40-years until it blows up.

Look at the graph and how much the velocity of money was in his day. Money passed through many hands then, after the bankes took over it passes through fewer and fewer hands. When the rich get money where does it go? Wall St. The middle class spends its money, Wall St was predicting the velocity of money would explode higher since thi time money wa given to ordinary people, and the economy absrbed it. Wall St's big lie! rickle down hurts the economy.

Posted 18 June 2022 - 11:23 AM

"It does not belong to man that walks to direct even his own step."

World's central banks now face uneasy crowd...

If their response to the economic crisis triggered by the pandemic seemed bold and forward-looking, with its laundry list of new programs and massive monetary stimulus, the last few months have been an erratic, even awkward phase of failed forecasts, embarrassing mea culpas, increased political scrutiny and some evidence of lost trust.

Managing inflation is core to a central bank's mission, and from major players like the U.S. Federal Reserve and the Bank of Japan to regional institutions like the Bank of Canada and the Reserve Bank of Australia, recent events have dealt a blow to their credibility as they play catch up with policy and, in the process, raise the likelihood of recession.

"They had horse blinders on. They didn't want to entertain any talk of stable or upside risk to inflation in response to massive stimulus around the world, government and monetary," said Derek Holt, head of capital markets economics at Scotiabank in Toronto. "I think they had that evidence even as 2020 unfolded," yet held onto emergency programs for another year, and discounted an initial rise in inflation as transitory.

The result: Over little more than a week the Fed has whipsawed financial markets with a 75-basis-point interest rate increase...

Edited by Rogerdodger, 18 June 2022 - 11:33 AM.