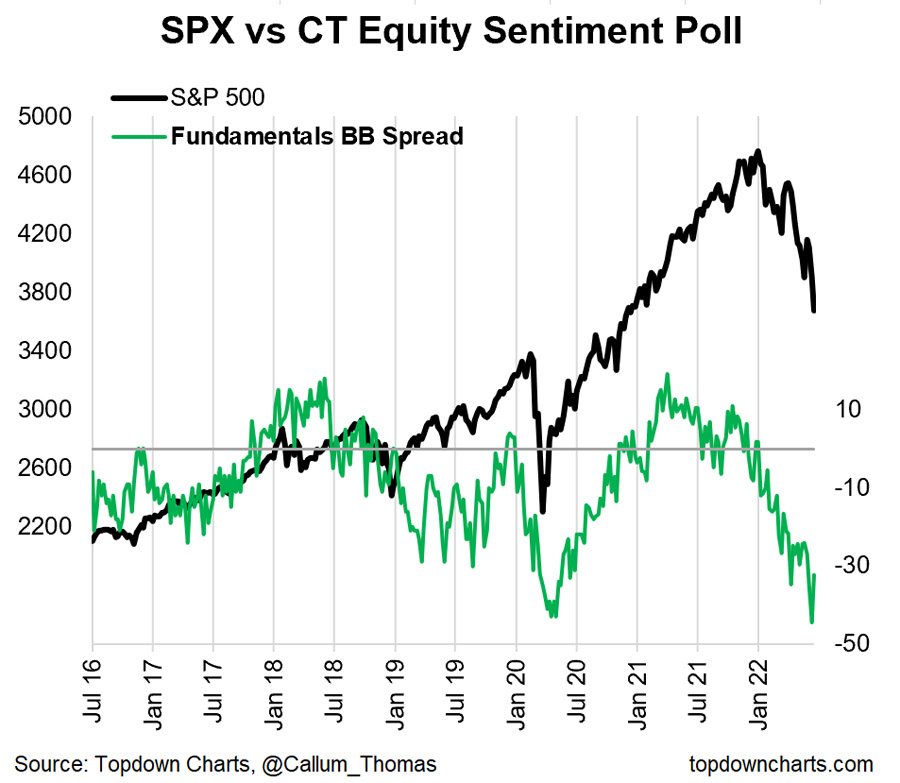

Fundamental Bearishness.

#1

Posted 23 June 2022 - 10:07 AM

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

#2

Posted 23 June 2022 - 10:45 AM

Yes...but do sentiment charts like this "work" under bear market conditions?

For example: 2007-2009?

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#3

Posted 23 June 2022 - 12:51 PM

#4

Posted 23 June 2022 - 01:30 PM

Yes...but do sentiment charts like this "work" under bear market conditions?

For example: 2007-2009?

Fib

Well, we don't have data from this from then. But it worked at the 2000 low! This, market, however, bears little resemblance to that market. My guess is that this one will look a bit more like 1969-1974, -ish.

Still, with that much fundamental pessimism, it's very possible that all the near-term bad news is in the market.

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

#5

Posted 23 June 2022 - 02:47 PM

Yes...but do sentiment charts like this "work" under bear market conditions?

For example: 2007-2009?

Fib

Well, we don't have data from this from then. But it worked at the 2000 low! This, market, however, bears little resemblance to that market. My guess is that this one will look a bit more like 1969-1974, -ish.

Still, with that much fundamental pessimism, it's very possible that all the near-term bad news is in the market.

Well...near term...2-3 days...OK

But on a short and intermediate term basis, which includes all of the upcoming 3rd quarter of 2022, businesses are going to get wrecked unnecessary by the FED and the Bolshevik's agenda, and that's going to keep a cap on any kind of countertrend technical move in prices to relieve any and all underlying "oversold" extremes.

Fib

Edited by fib_1618, 23 June 2022 - 02:51 PM.

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#6

Posted 23 June 2022 - 06:31 PM

If you are invested in the market, it will take 5 years to get your money back.

Even if FED reduces interest rates to zero at warp speed and releases record levels of QE in 2023?

https://www.zerohedg...-3-rate-cuts-qe

Edited by pdx5, 23 June 2022 - 06:32 PM.

#7

Posted 23 June 2022 - 07:54 PM

If you are invested in the market, it will take 5 years to get your money back.

Even if FED reduces interest rates to zero at warp speed and releases record levels of QE in 2023?

https://www.zerohedg...-3-rate-cuts-qe

Ok, say you are saying that they are going to stop inflation. Questions how high do rates go and how long will it take?

#8

Posted 23 June 2022 - 09:28 PM

Ok, say you are saying that they are going to stop inflation. Questions how high do rates go and how long will it take?

Central bank officials project the federal funds rate could be between 3% and 3.5% by the end of the year. That's it, no matter what the inflation rate will be at year end. FED will point to slowing of housing sales, drop in job openings, retail sales in downtrend etc as enough proof to not require any higher rates in 2022. In 2023 they will cut rates at warp speed and pump up QE. This is my opinion based on observing the FED since Volcker left the FED.

#9

Posted 24 June 2022 - 07:33 AM

This does not have a cyclical look to it.