It turned out to be a week of market digestion as the major market indexes finished on Friday with an average loss of -.76%, with the NASDAQ Composite Index continuing to lag (performance wise) with the rest of the market with a loss of -1.57%, and the Dow Industrials finishing nearly unchanged at -.01%.

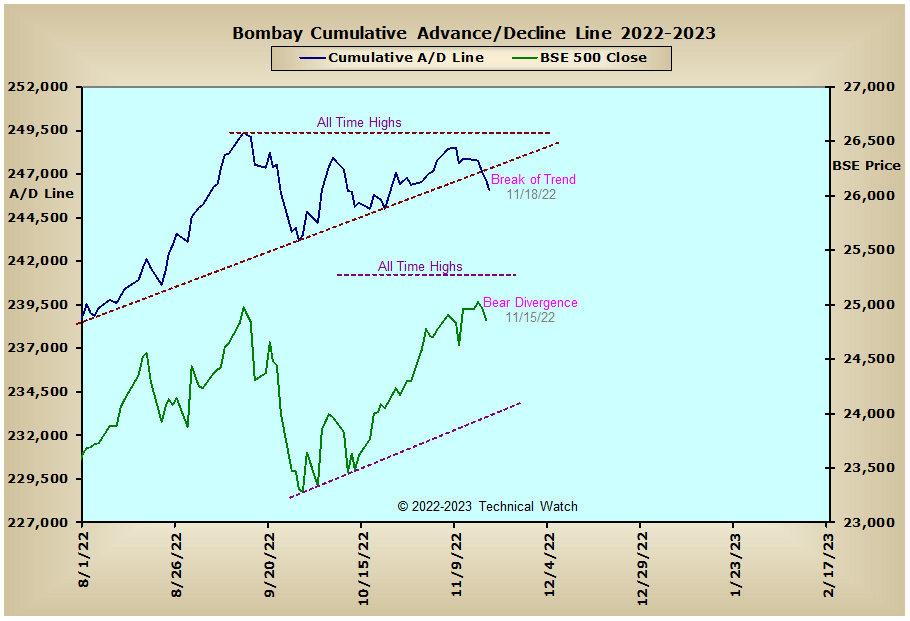

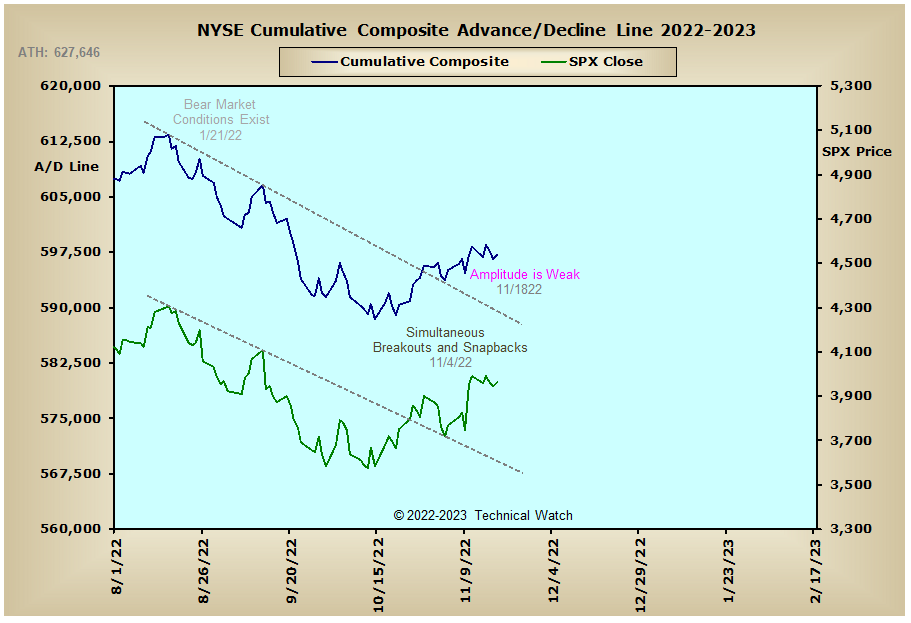

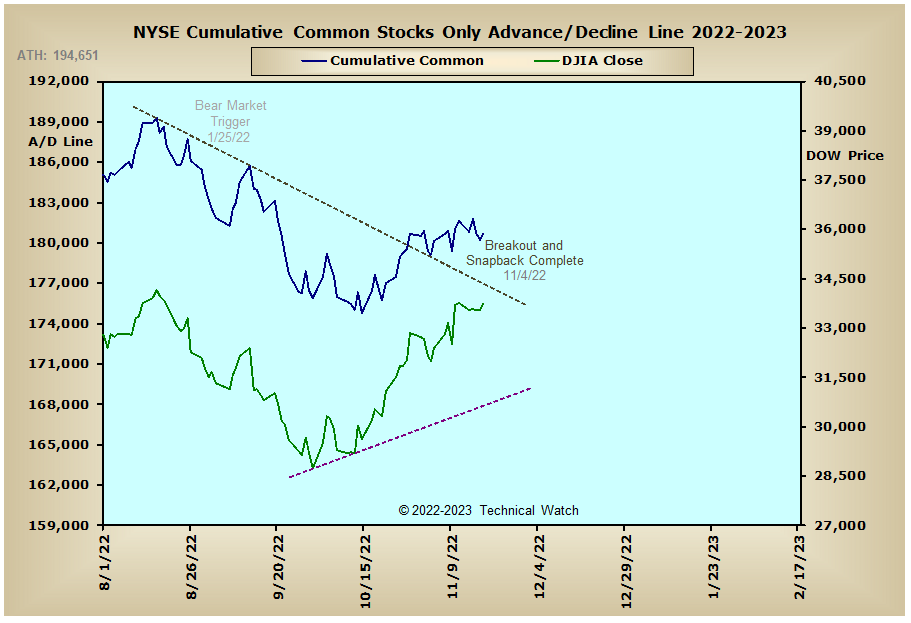

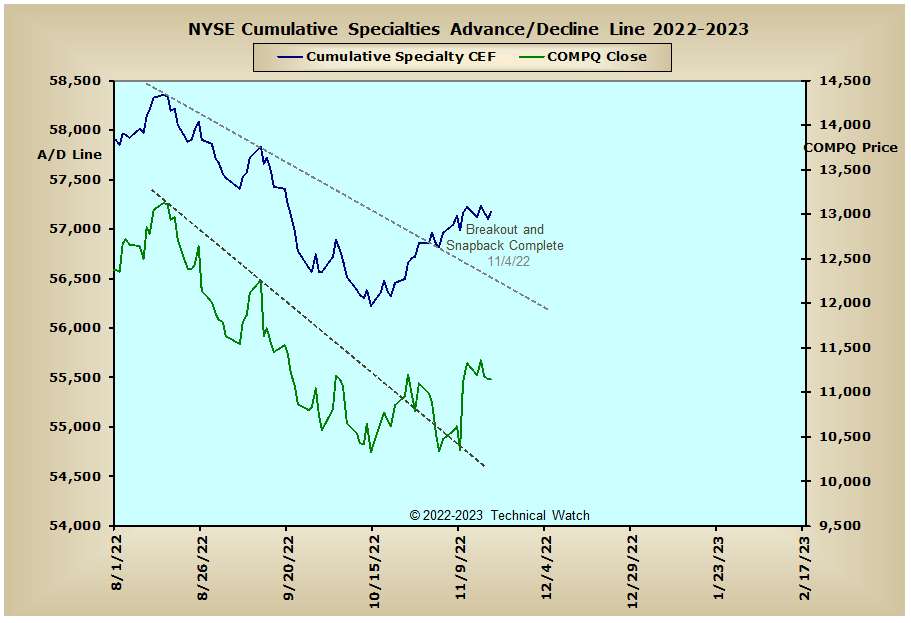

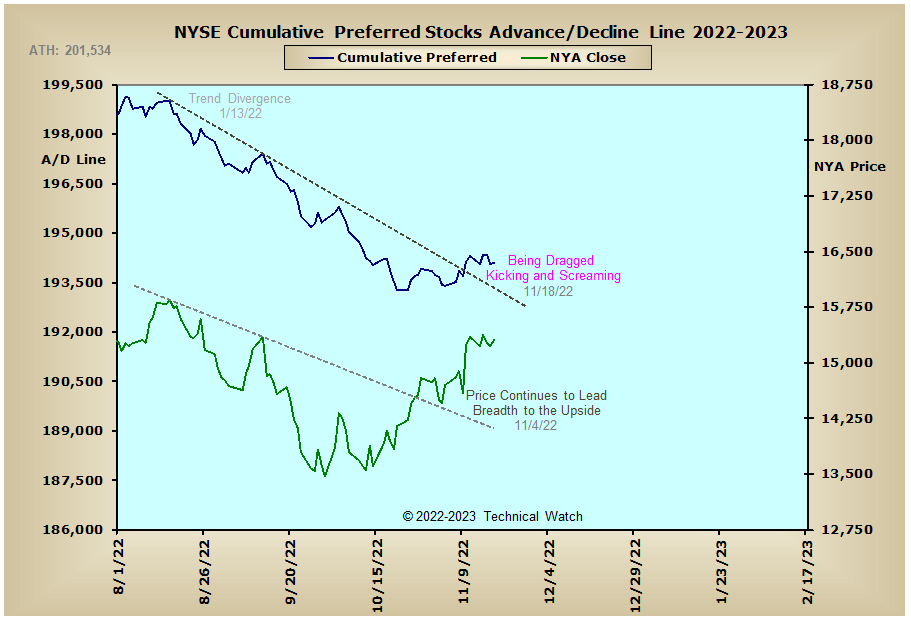

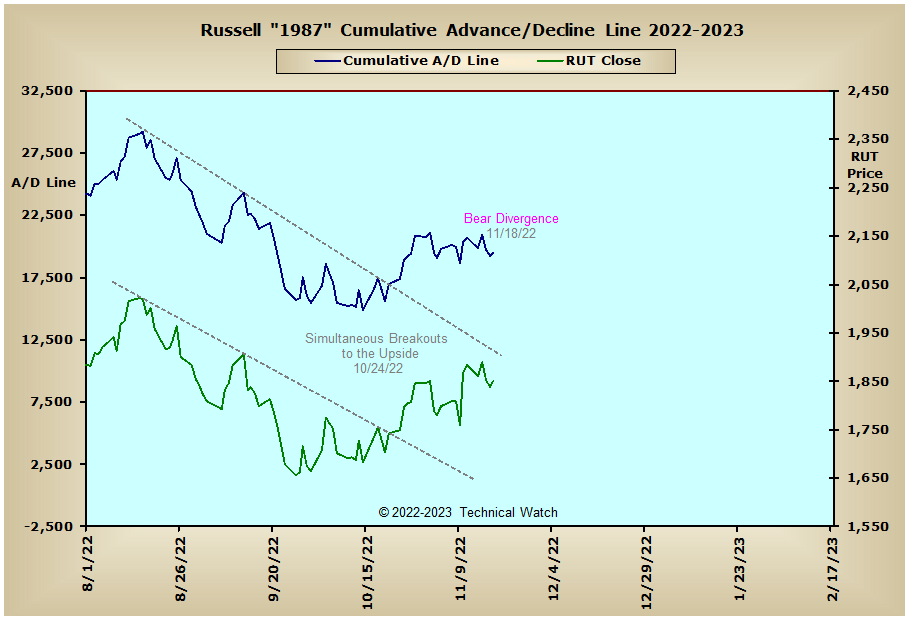

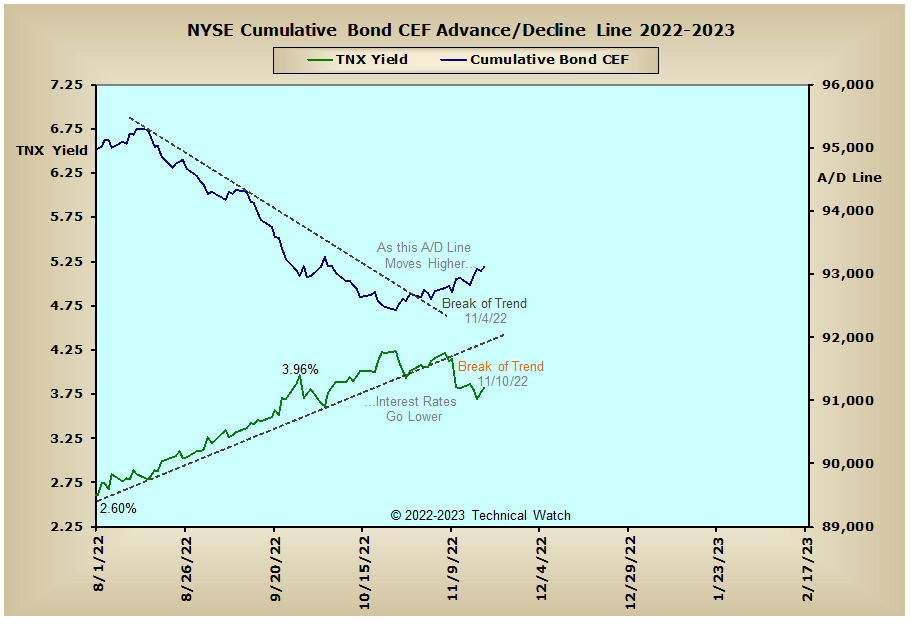

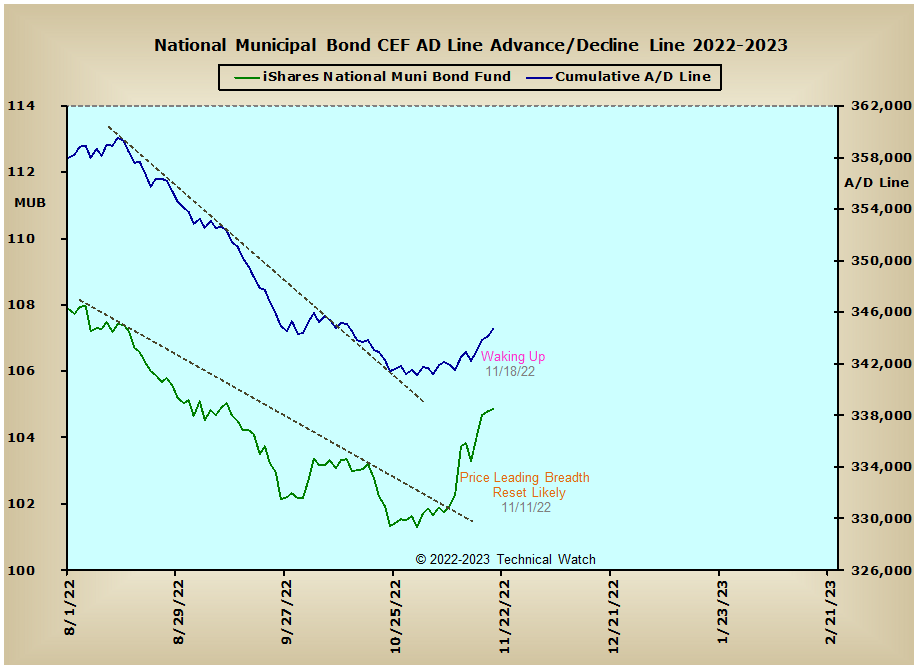

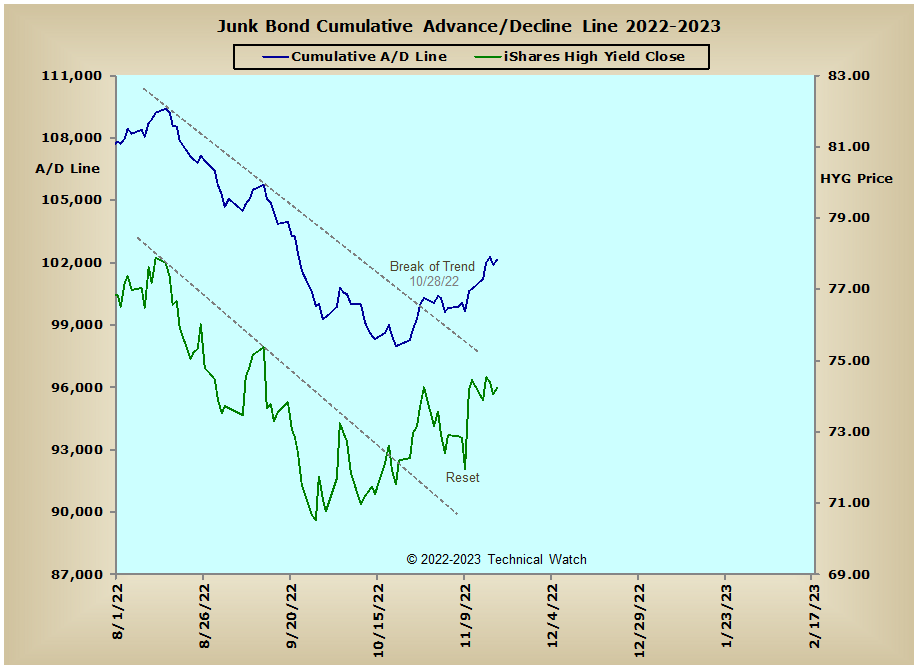

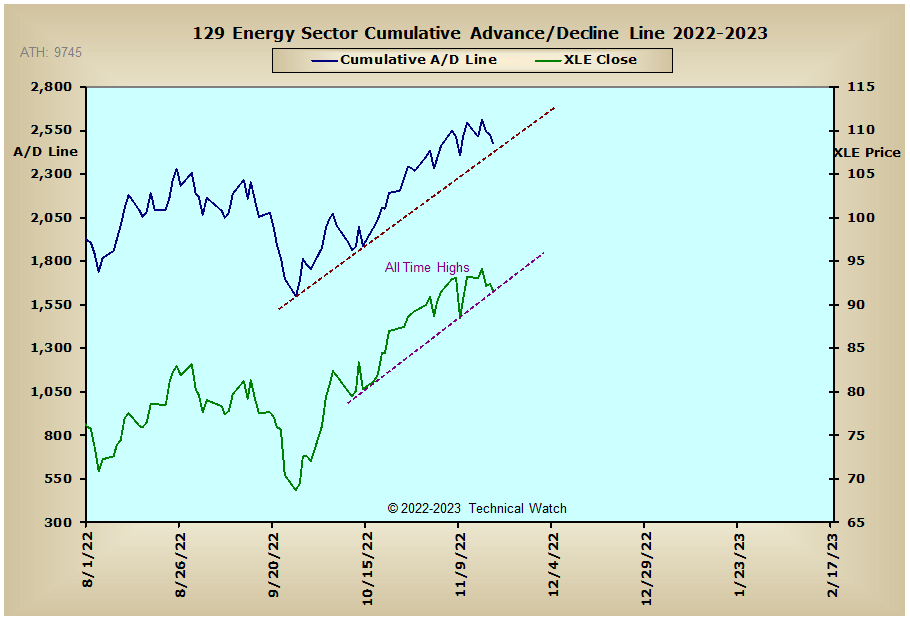

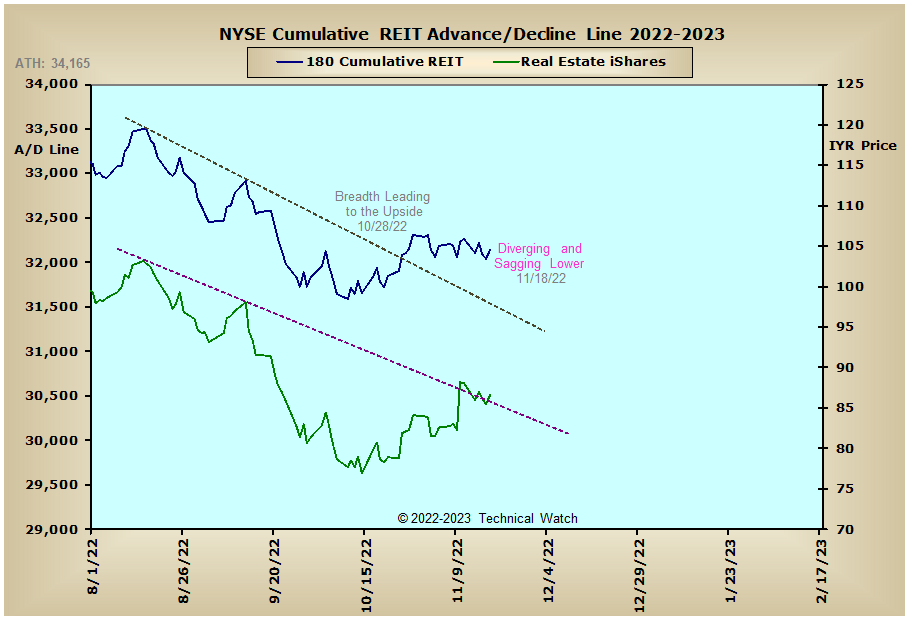

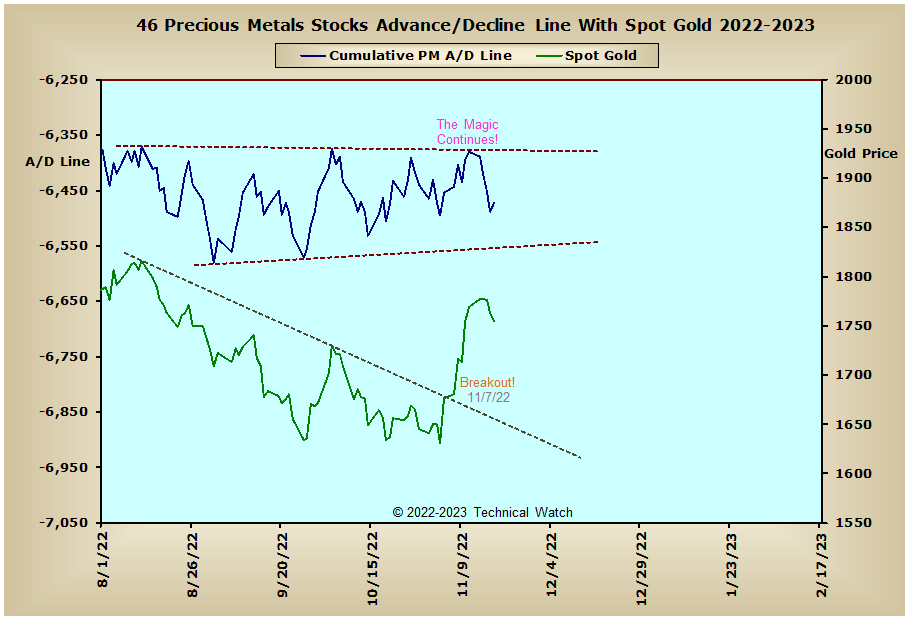

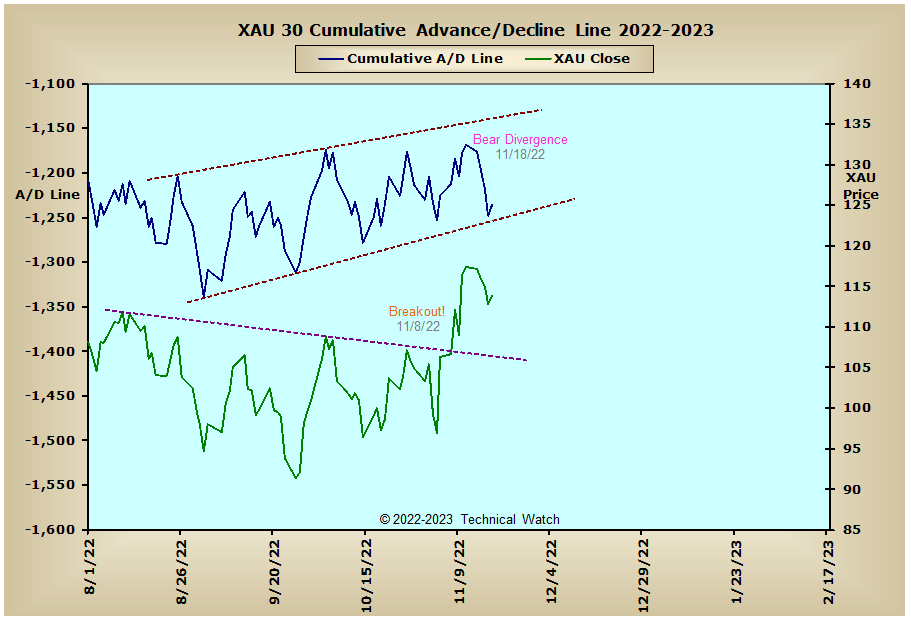

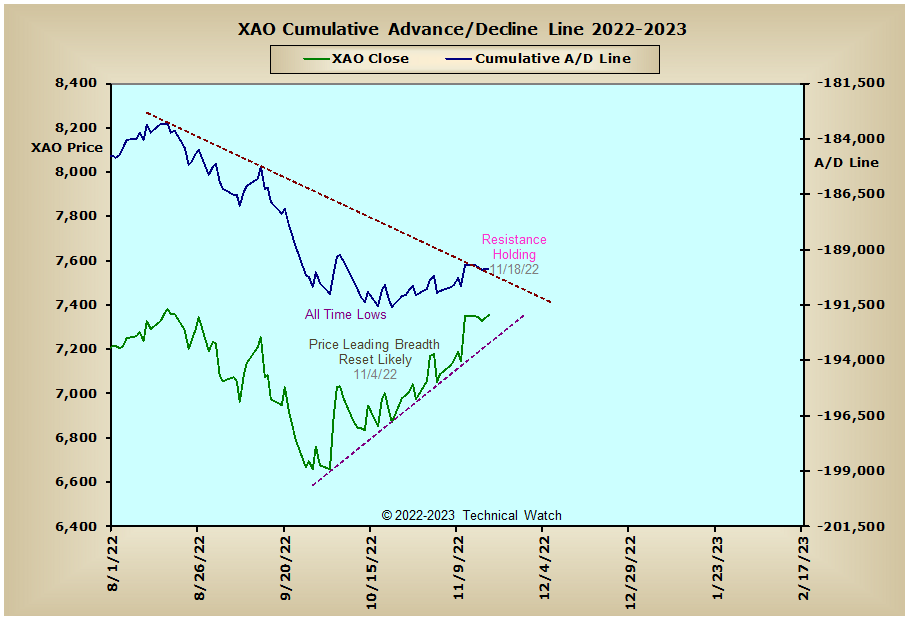

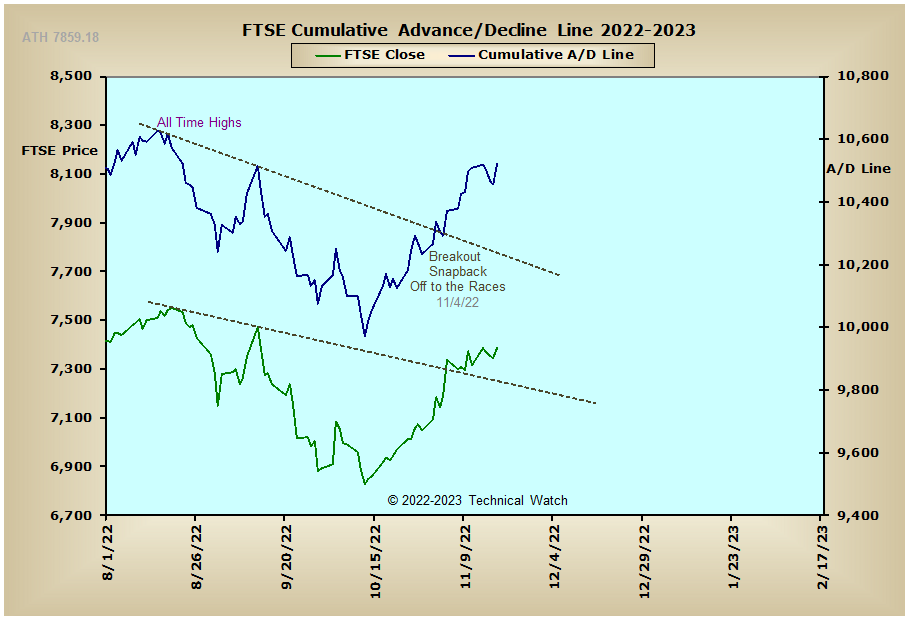

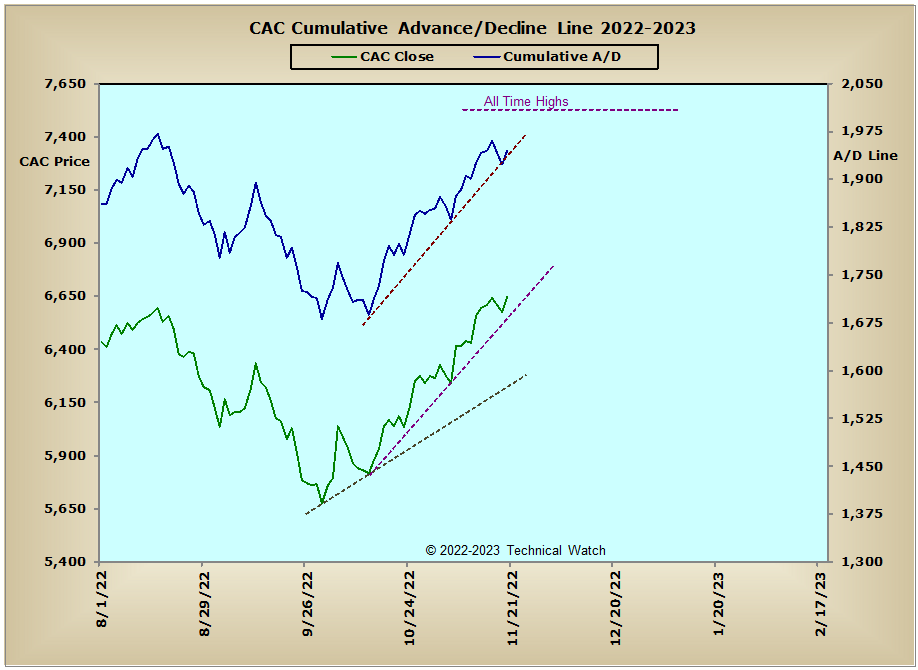

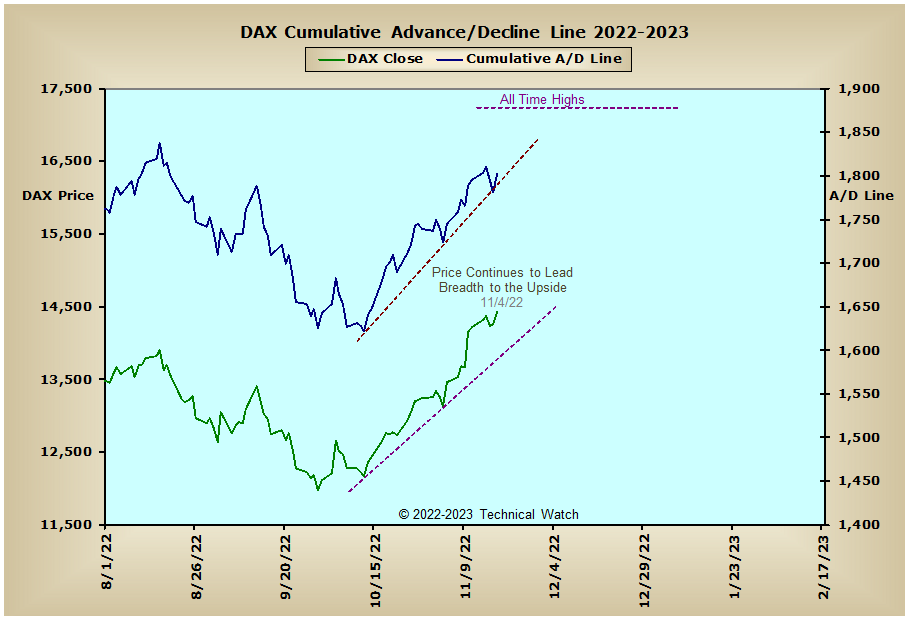

This weeks review of cumulative breadth charts shows that equity related areas moved net sideways for the week, while interest rate sensitive issues found a bit more acceptance by traders and investors with the exception of the NYSE REIT advance/decline line which finished at its lowest levels since its break above intermediate term resistance back on October 25th. The Energy Sector advance/decline line continues to trend to the upside at this time, while the Precious Metals and XAU advance/decline lines were capped by technical resistance. International issues are now mixed with the CAC, DAX and FTSE advance/decline lines continuing to charge higher, while the Aussie advance/decline line is up against longer term resistance, and the Bombay advance/decline line breaking down below trendline support.

So with the BETS moving sharply lower to a reading of -50, this has now left behind a strong case of "liquidity divergence" compared with price. With November OPEX now behind us, we find that the majority of breadth and volume McClellan Oscillators remain in positive territory, with several bouncing off zero line support on Friday. With our initial expectation from October of prices topping out around this time period, along with all of the MCO's remaining above their zero lines for the last 5 weeks, the odds are fairly high now that we'll see zero line violations to the downside as soon as Monday. From there, the momentum generated by this latest surge of investment capital moving into the market from the October 13th lows will do its best in keeping prices buoyant as we go into the beginning of December...possibly into the next release of PPI data for November on December 9th and CPI data on December 13th. Both the NYSE Open 10 (1.16) and NASDAQ Open 10 (1.04) TRIN's remain favorable for this expected market resiliency as we move into height of consumer holiday spending with "Black Friday" and "Cyber Monday" coming just after next Thursday's Thanksgiving holiday here in the states. We currently have a split decision on the 10 day average of put/call ratios with the Equity side showing more bets for prices to weaken, while the CBOE data is favoring further gains. Other than that, there's not a whole lot more analytically to report. With all this in mind then, let's look for another choppy, if not volatile week ahead, with traders and investors continuing to keep tabs on sector rotation and now concentrating on areas where market weakness is most prevalent.

Have a great trading week!

US Interest Rates:

US Sectors:

Precious Metals:

Australia:

England:

France:

Germany:

India: