Is this going to crash to revert to the mean now?

Edited by CLK, 09 July 2022 - 06:42 AM.

Posted 09 July 2022 - 06:42 AM

Edited by CLK, 09 July 2022 - 06:42 AM.

Posted 09 July 2022 - 09:00 AM

Is this going to crash to revert to the mean now?

Given that COVID shut downs and restrictions forced acute economic changes to the Capitalistic system in how we do business, I would say not. But, in reality, it's really too soon to know for sure until those currently in charge are replaced with leaders who have a more favorable opinion (core values) towards how things were before this unfortunate human event took place.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

Posted 09 July 2022 - 10:55 AM

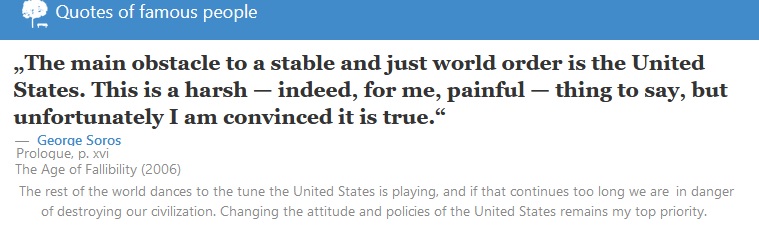

"those currently in charge" are not visible but are getting exactly what they have planed! Their list is long and unfinished.

Edited by Rogerdodger, 09 July 2022 - 11:02 AM.

Posted 12 July 2022 - 02:39 AM

Posted 12 July 2022 - 08:02 AM

Edited by CLK, 12 July 2022 - 08:05 AM.

Posted 12 July 2022 - 11:17 AM

Homebuyers canceling deals at highest rate since pandemic...

The share of sale agreements on existing homes canceled in June was just under 15% of all homes that went under contract, according to a new report from Redfin.

Homebuilders are also seeing higher cancellation rates.

Edited by Rogerdodger, 12 July 2022 - 11:17 AM.

Posted 12 July 2022 - 01:48 PM

Edited by CLK, 12 July 2022 - 01:49 PM.

Posted 12 July 2022 - 03:16 PM