After struggling on Monday and Tuesday, the major market indices rallied sharply for the rest of the week as the perception of possibly capping the rate of inflation was used as an excusable proxy. When all was said and done at Friday's close, we finished with an average weekly gain of +3.51% with the S&P 400 Mid Cap Index leading the charge as it added another +4.42% to its value. It should also be duly noted that we saw all of the major averages close above their 200 day EMA's of longer term resistance for the first time since early April.

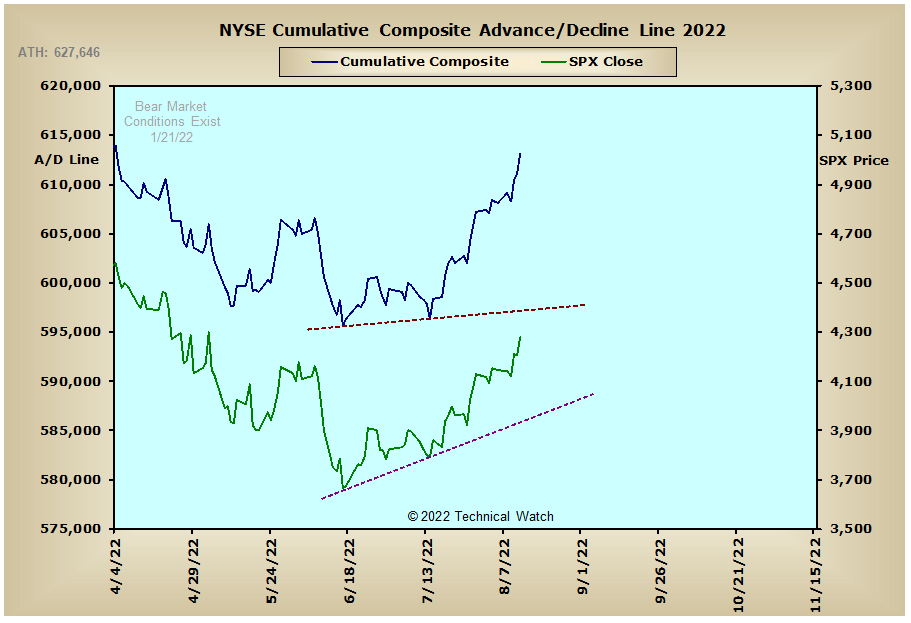

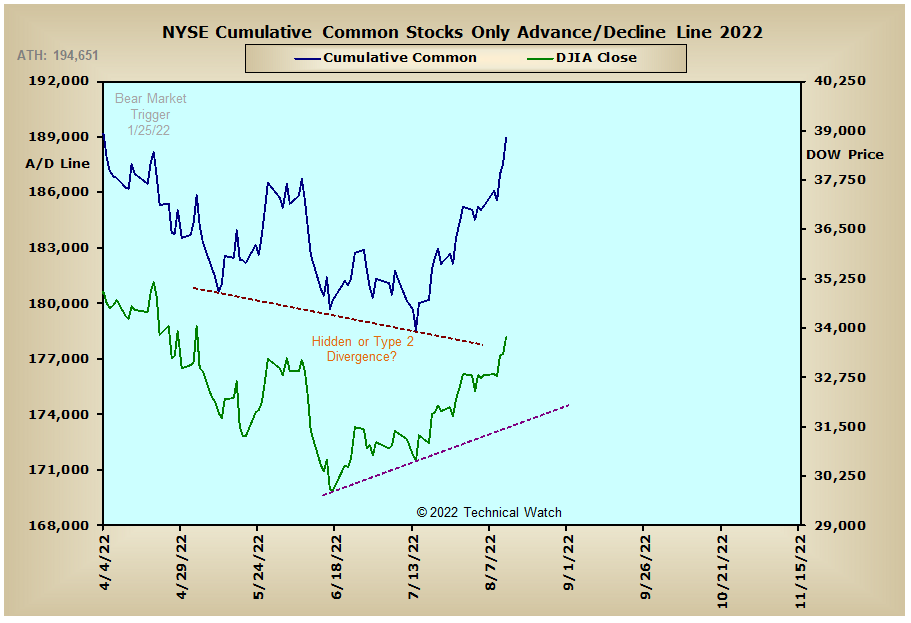

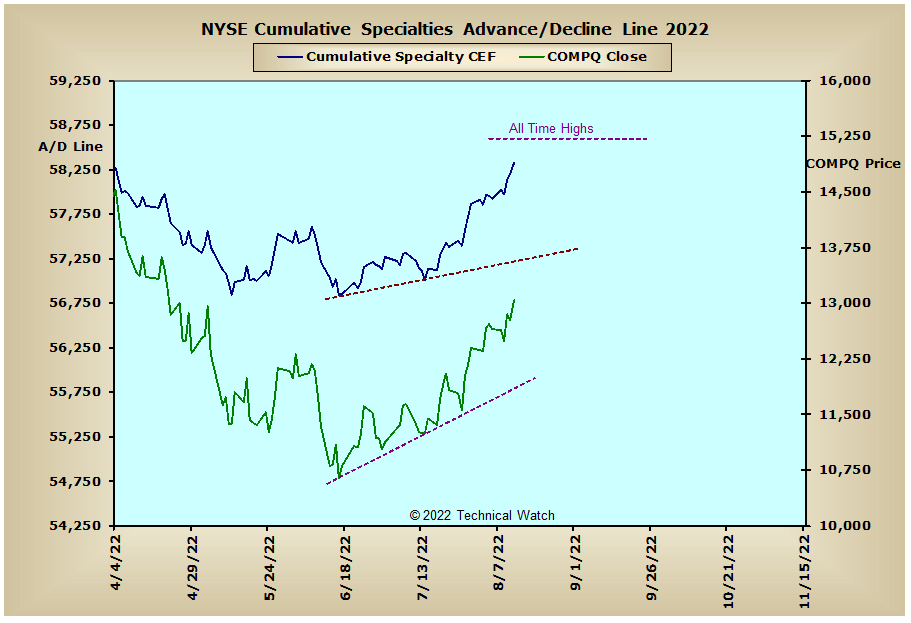

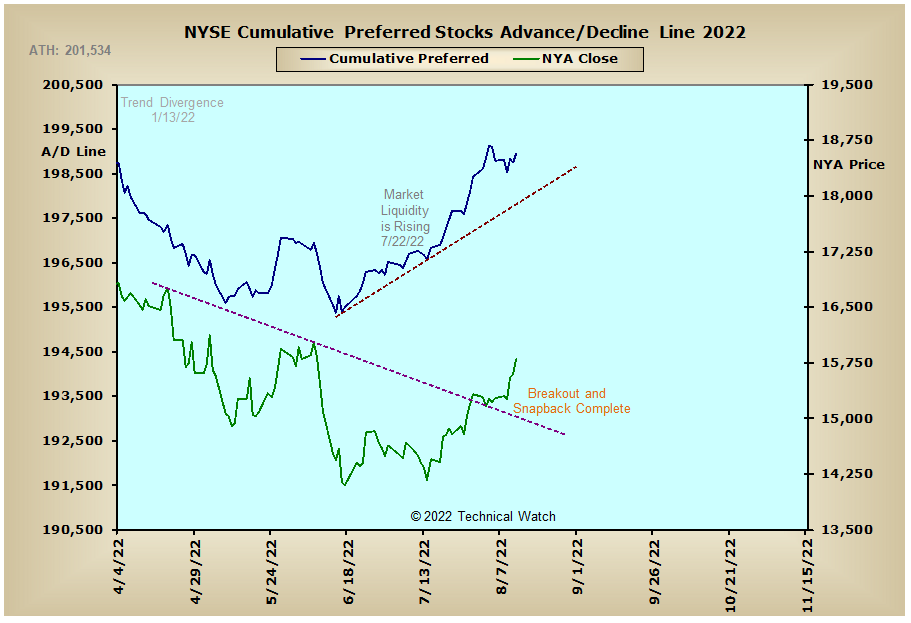

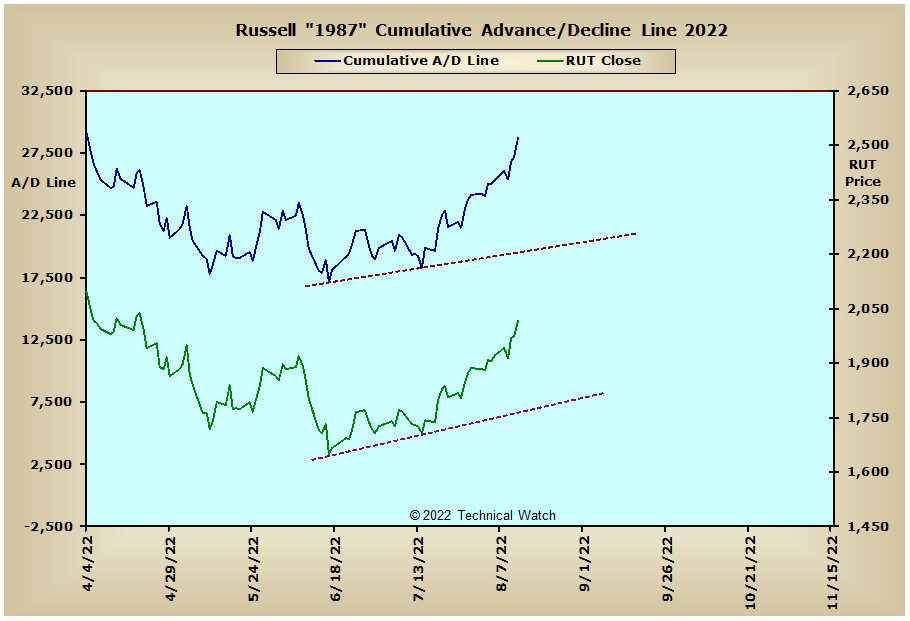

Looking at our standard array of cumulative breadth charts for this week shows that investment capital continues to move into equities at a brisk pace with some money flow lines even approaching their all time highs. In fact, the S&P 500 advance/decline line (not shown) did finish the week in record territory, while the S&P 100 advance/decline line is only 5 net advancing issues from doing the same. Other market indices are not so robust, however, and this now provides us with a split market of sorts with a leaning toward an overall bullish bias as cumulative growth stock U/D volume lines such as the NASDAQ, MID and SML are at or are currently in record territory. Because of this, we can now put our working under bear market conditions on the back burner for the time being. Nevertheless, unless the NYSE Common Only and NYSE Composite advance/decline lines don't show this same kind of positive amplitude by mid September, we might be working with a similar situation as we had with the 1998-2000 topping pattern sequence where money flow continued to show a bearish bias, while at the same time, equity prices consolidated sideways within a large, multi month trading range.

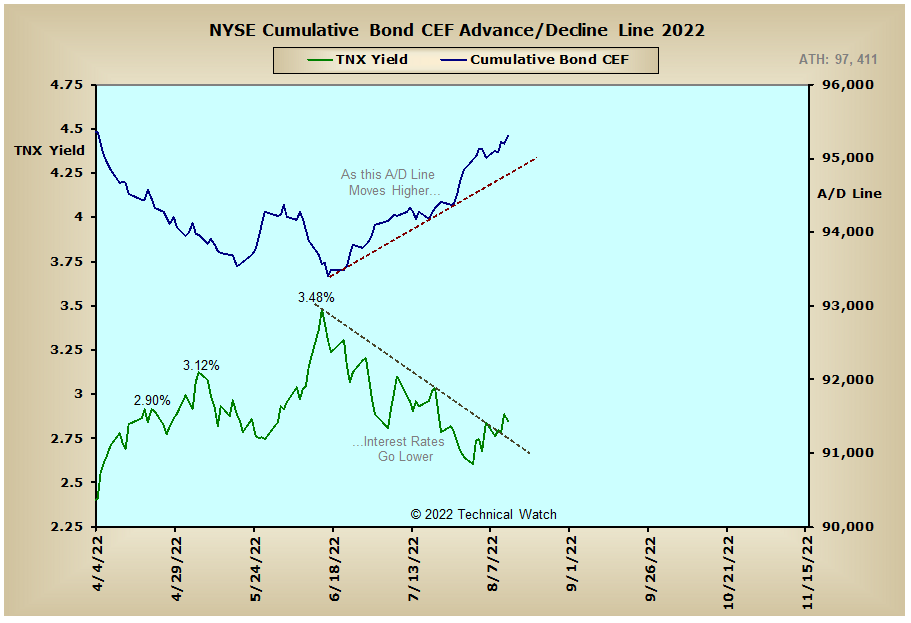

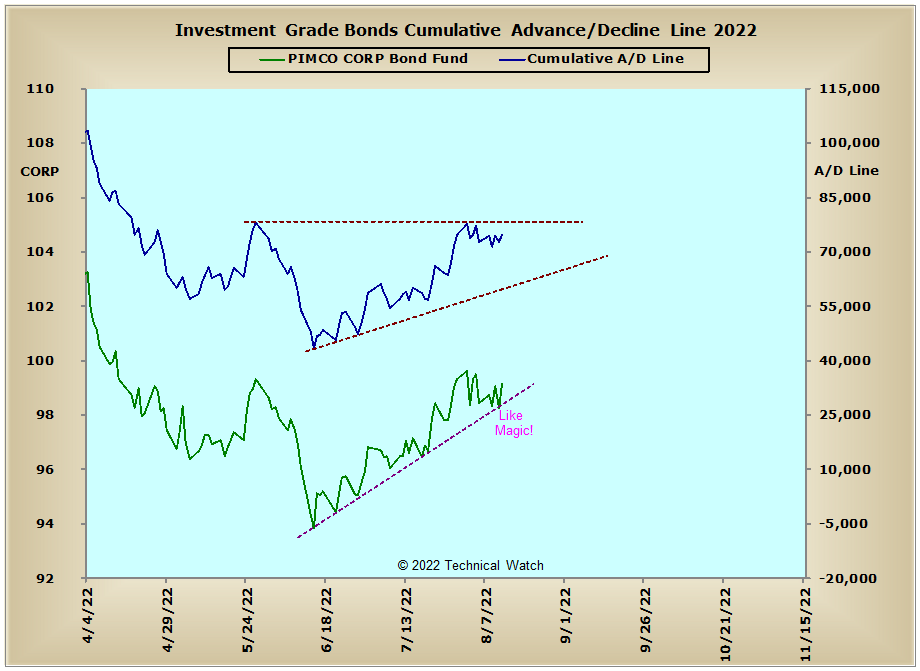

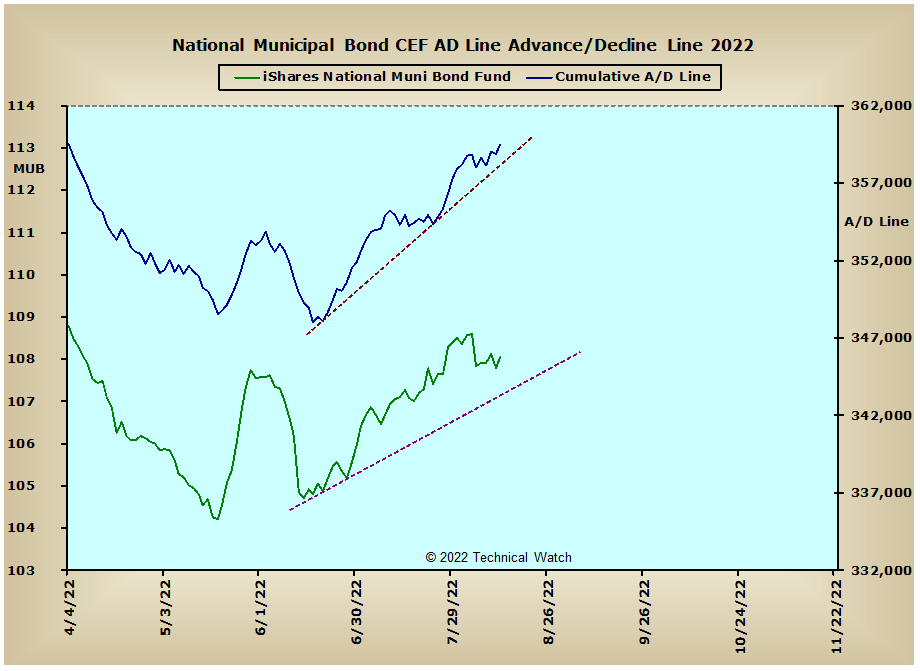

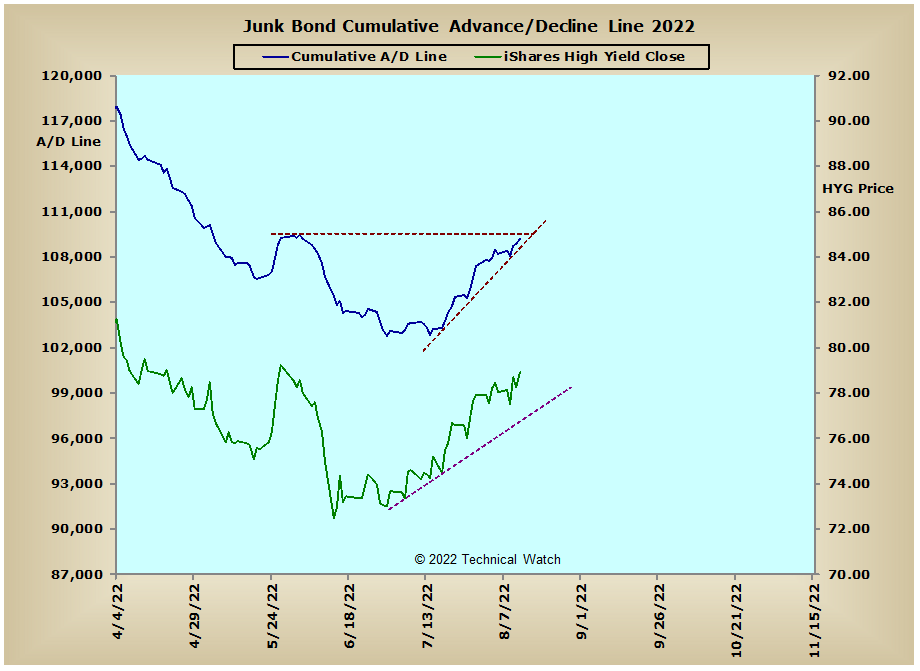

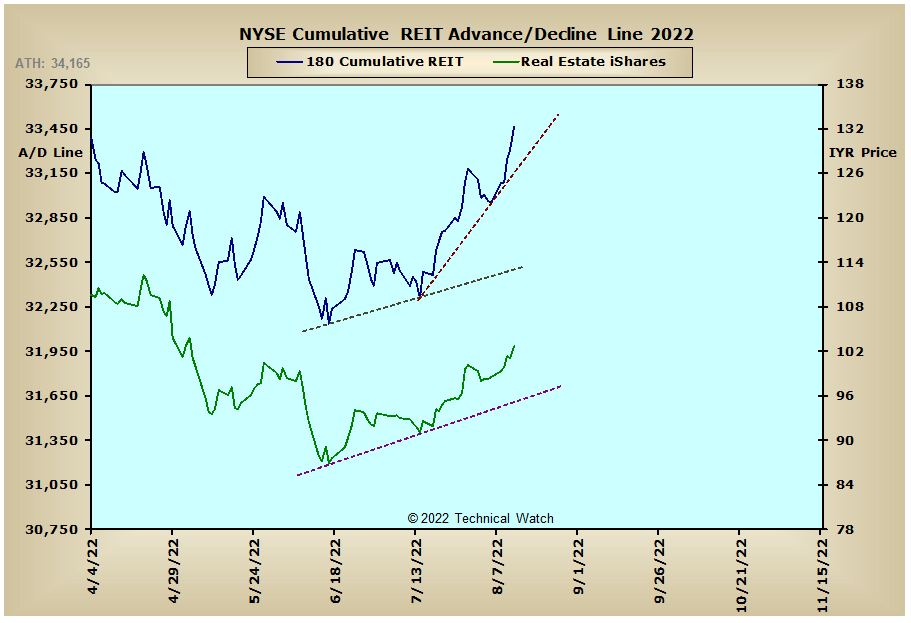

In other areas, interest rate sensitive issues continue to show buoyancy in their pattern structures with the Investment Grade and Junk Bond advance/decline lines now coming up on major horizontal resistance levels compared to their end of May peaks. Looking for a moment at the CME's FedWatch Tool and things are becoming more interesting as there is now a 54% chance of a Fed hike of only 1/4% to 1/2% at the September meeting, though there is a better chance of increases at or above 1/2% in late November. One would think that this kind of hawkish monetary policy will continue to put a cap on equity prices overall as we go into the end of the year as liquidity levels continue to recede. But, for now, as long as money flow remains at such high levels, we'll have to hold our nose and work with what the marketplace provides as guidance.

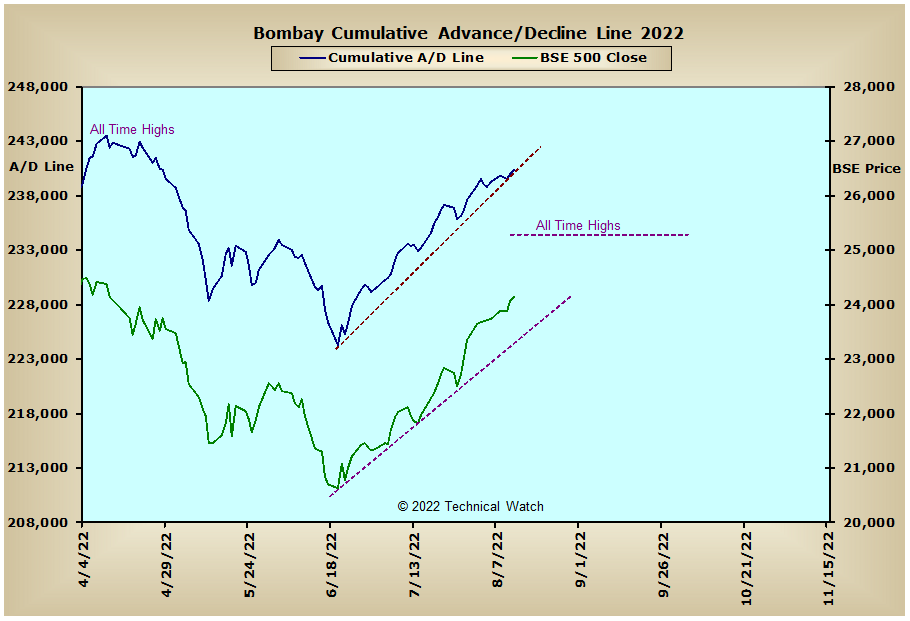

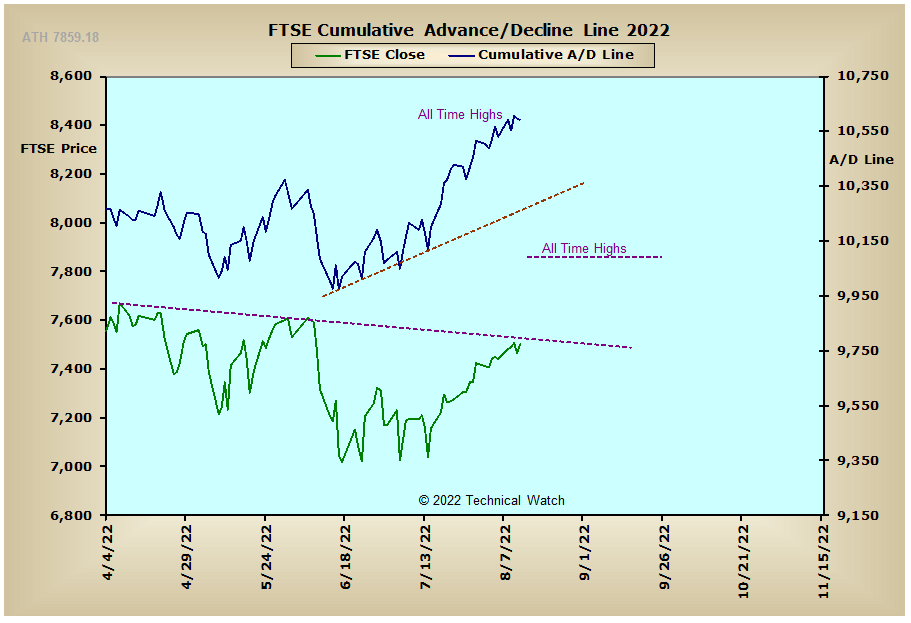

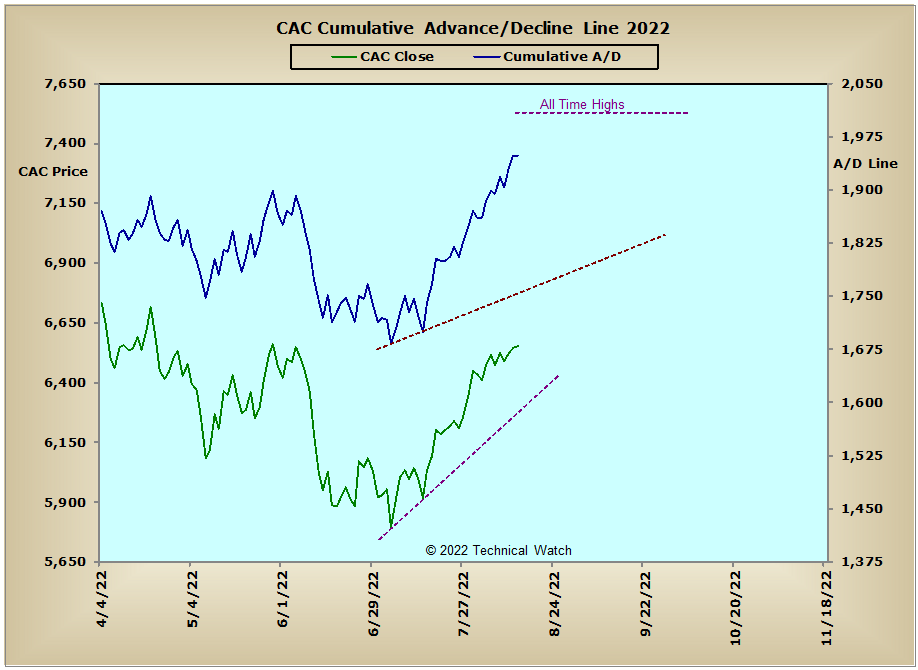

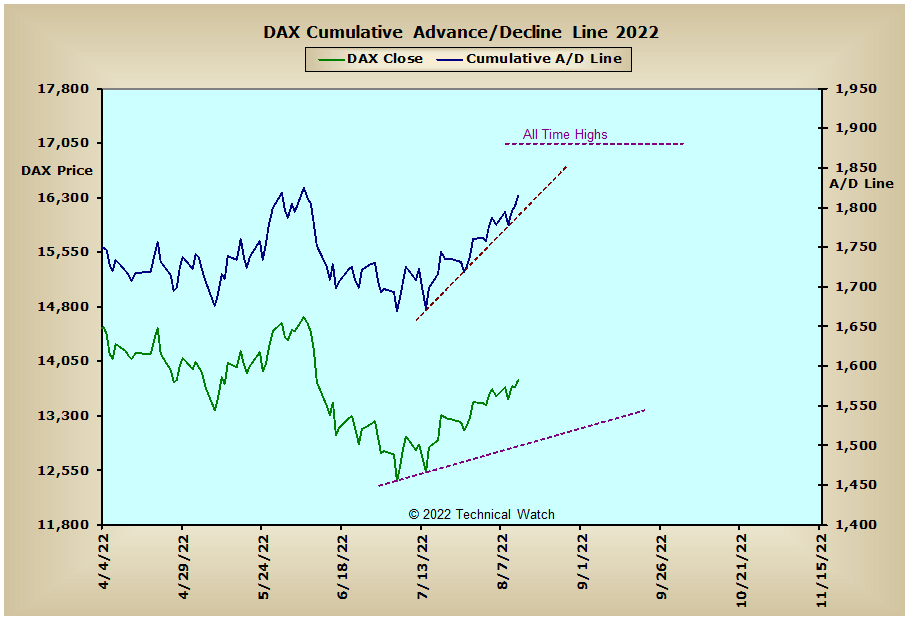

European markets continue to surprise with monetary policy starting to tighten and still having the forgotten conflict in the Ukraine as an economic backdrop. With the FTSE advance/decline line already in new all time high territory, and the CAC and DAX advance/decline lines now 59 and 64 net advancing issues from making it unanimous, there is little sign of any liquidity problems overseas at the moment. Even emerging markets such as the Bombay advance/decline line continue to show large amounts of investment capital chasing equity issues, and this has now put its A/D line within 1.25% of moving into new all time high territory as well.

So...with the BETS back to a neutral reading of -15, investors are now back to cash positions. As we start the week ahead, the late week rally in stock prices has now pushed several of the breadth and volume McClellan Oscillators to their highest levels since the June lows and this, in turn, continues to be good news for the intermediate term bulls as the large majority of breadth and volume McClellan Summation Indexes are close to or above their key "escape velocity" levels of +500. This would now suggest that we're likely to see equity prices continue to trend to the upside as we go into the September OPEX period on the 16th. For the near and short term, however, with the MCO 10% Trends now highly overextended with readings above +200, it's now time for a pause in the current price advance at and around their 200 day EMA's as we go into one of the slowest trading times of the year. The brisk late week advance has also pushed the NYSE Open 10 TRIN to near "overbought" now with Friday's reading at .82, while the NASDAQ Open 10 TRIN finished at .85. As one would expect, call buying picked up quite a bit last week, while implied price volatility premiums on put options continues to flirt with their April lows (or price highs in equities). With all this as a backdrop then, investors should continue to stand aside as the market goes about the task in working off their current "overbought" levels, while traders can continue to enjoy working with their highly successful "hit and run" trading strategies.

Have a great trading week!

US Interest Rates:

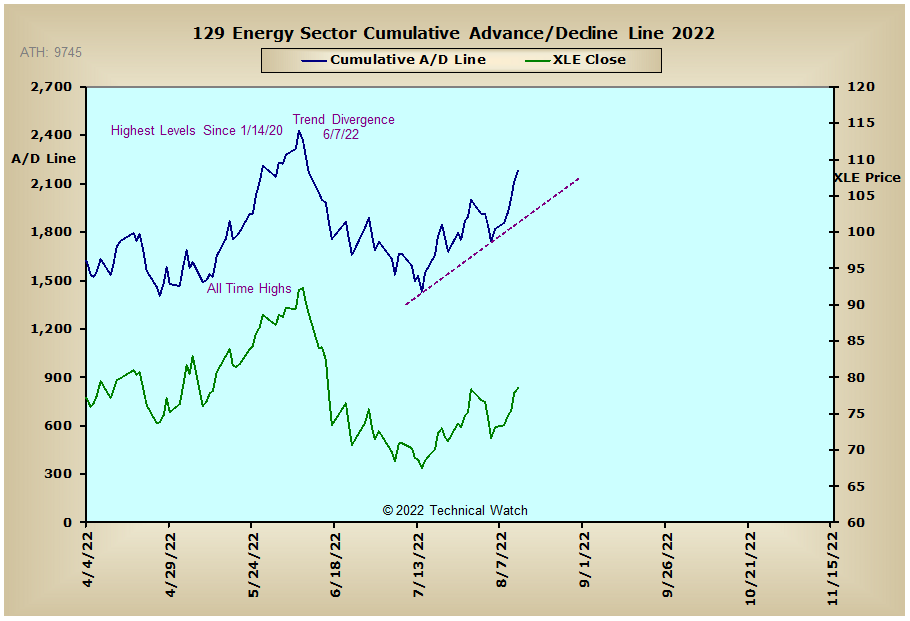

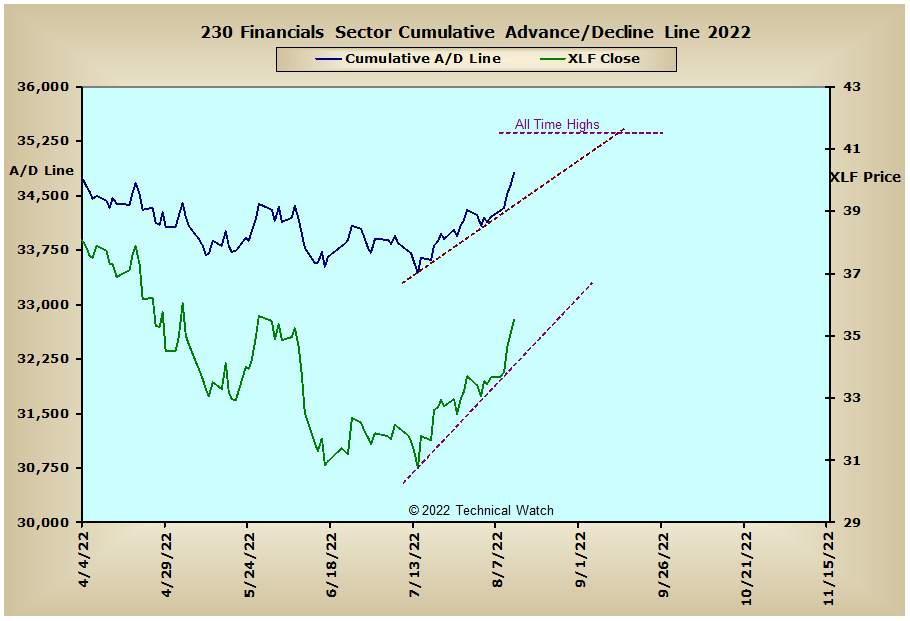

US Sectors:

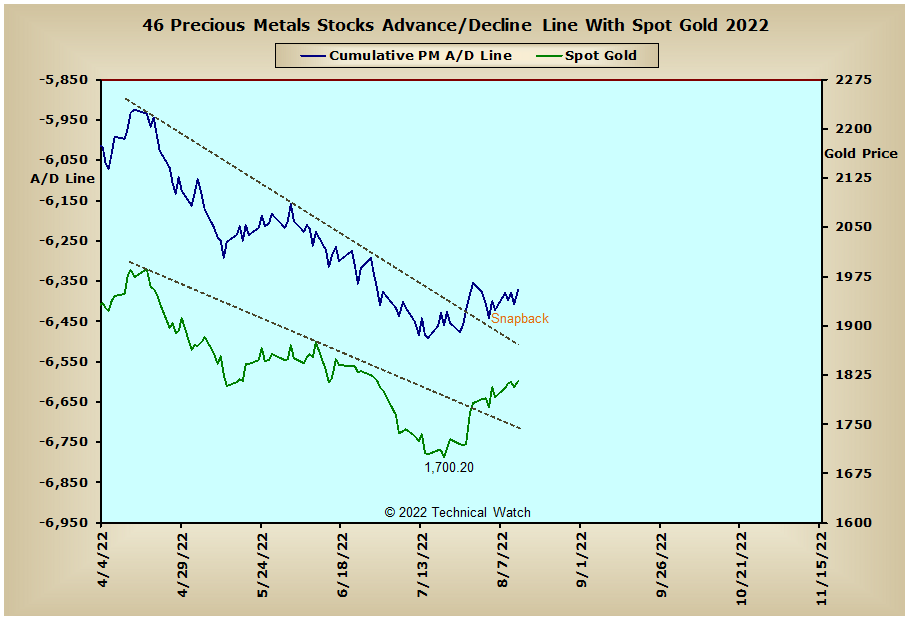

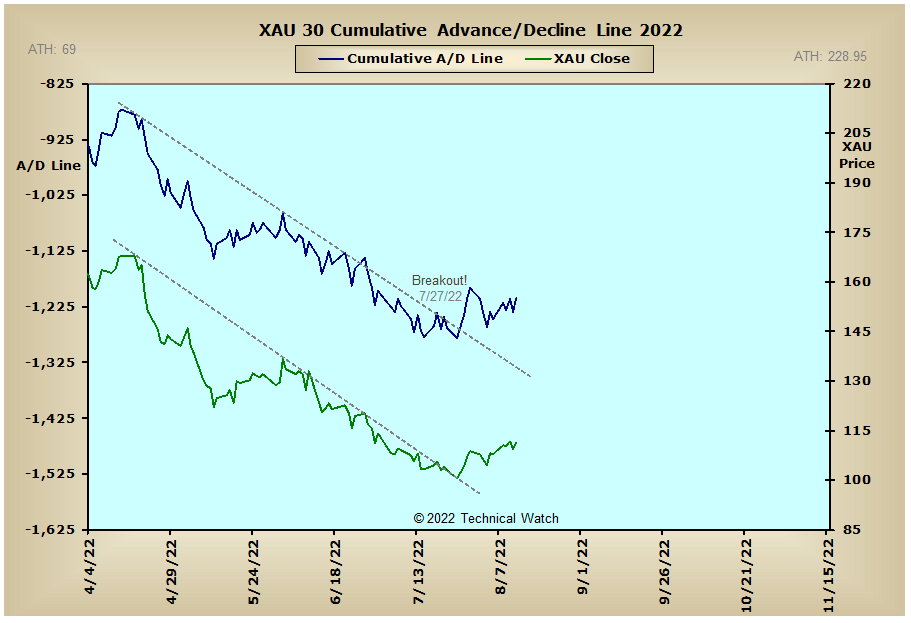

Precious Metals:

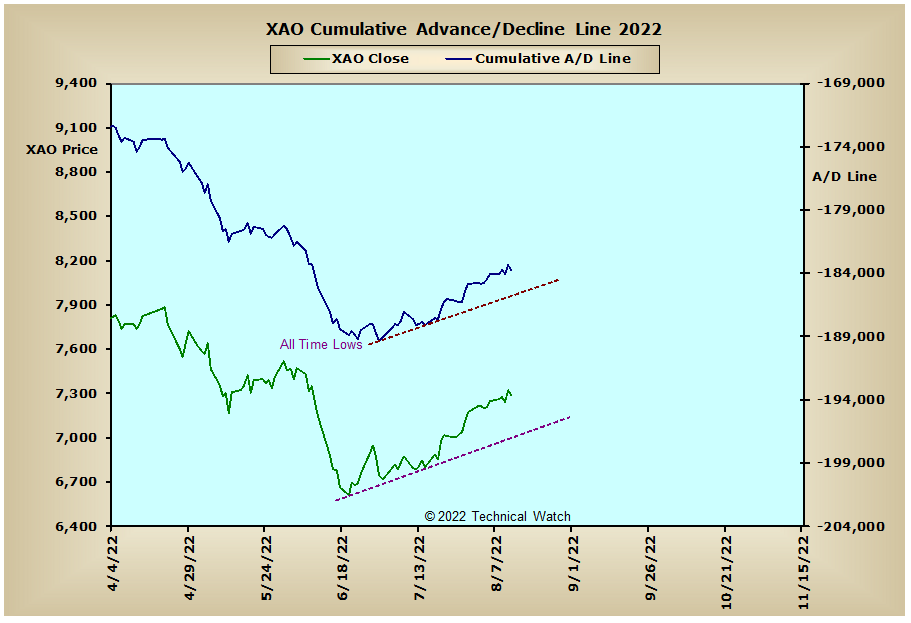

Australia:

England:

France:

Germany:

India: