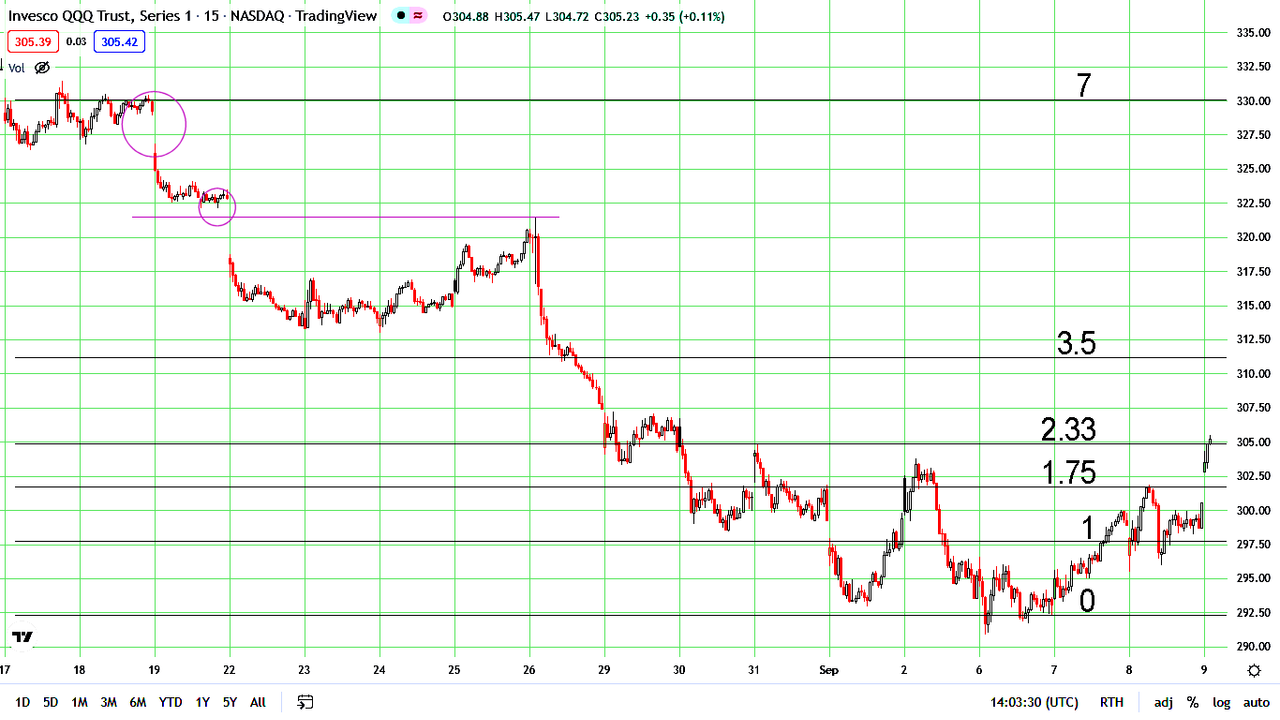

spx, nasdaq, dow respectively have 1.9% , 2.5% , 1.5% more upside left....then bounce over

Ok....the last ST rise

#1

Posted 08 September 2022 - 12:34 PM

forever and only a V-E-N-E-T-K-E-N - langbard

#2

Posted 08 September 2022 - 01:26 PM

the most we can get..........but however we have two options......we have already arrived or we need to rise as said

forever and only a V-E-N-E-T-K-E-N - langbard

#3

Posted 08 September 2022 - 04:31 PM

there' s also a possibility that tomorrow we are going to have a bar like that of last 21st of April.

forever and only a V-E-N-E-T-K-E-N - langbard

#4

Posted 08 September 2022 - 05:15 PM

spx 4025 is the 50 day moving average resistance, so basically we are there....we can also think to a fake break up of it, but even in that case we are not far from a reversal

If it breaks up the 50 day ma and stays above it for some days, something different is going on.....but sincerely hard to think

Edited by andr99, 08 September 2022 - 05:17 PM.

forever and only a V-E-N-E-T-K-E-N - langbard

#5

Posted 09 September 2022 - 06:59 AM

#6

Posted 09 September 2022 - 07:16 AM

What is going on is 10 year bond paying fully taxable yield 3.3% while cash is losing purchasing power at 9%.

You are driving in the rear view mirror...

Oil (-35%) Gasoline (-45%) Lumber (-60%) have all been crushed with a massive wave of deflation....

Russia Scare was peak peak inflation....at least for now...

Markets look ahead not behind....

And...last time Crude and Gas crashed like this was 2008 FWIW....

Edited by K Wave, 09 September 2022 - 07:18 AM.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

#7

Posted 09 September 2022 - 09:46 AM

Might still be early into this squeeze - too many leaning bearish. Could turn into more than a squeeze as it becomes clearer we are early into a deflationary period. Eventually something should break and bring the c-r-a-s-h that everyone is waiting for - but when?

.

.

#8

Posted 09 September 2022 - 11:13 AM

Strong rejection of the 50-day - but maybe a backtest coming?

#9

Posted 09 September 2022 - 12:47 PM

#10

Posted 09 September 2022 - 01:39 PM

x

Edited by pdx5, 09 September 2022 - 01:40 PM.