(This is an excerpt from last Friday's blog for Decision Point subscribers.)

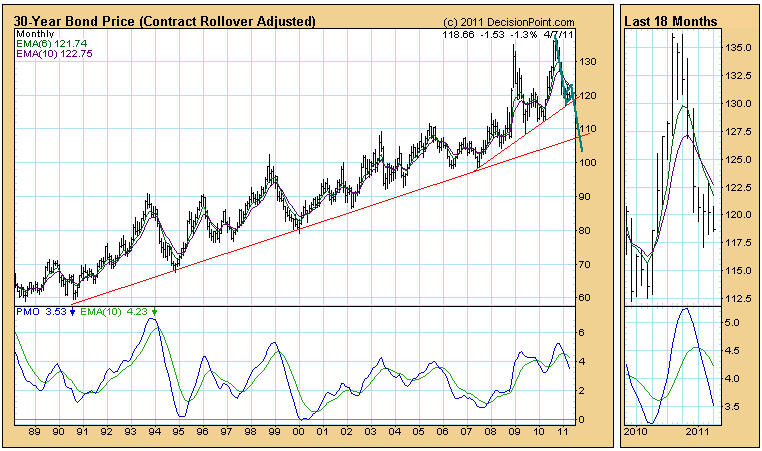

Bonds began a steep decline in October, bounced off a low in February, then began another decline after being stopped by declining trend line resistance. At this point the price index is approaching important long-term support, and the execution of a bearish technical pattern points toward much lower prices.

The support is a long-term rising trend line drawn across the March 2010 and February 2011 price lows. We shall see that that line has held many times in the last four years, but a bearish reverse flag formation has formed (emphasized by the teal lines), and this week it executed when prices broke down out of the flag. The normal downside projection is a decline about equal to the length of the flag pole that preceded the flag.

The weekly chart gives us a better look at the rising trend line support and the potential downside projection.

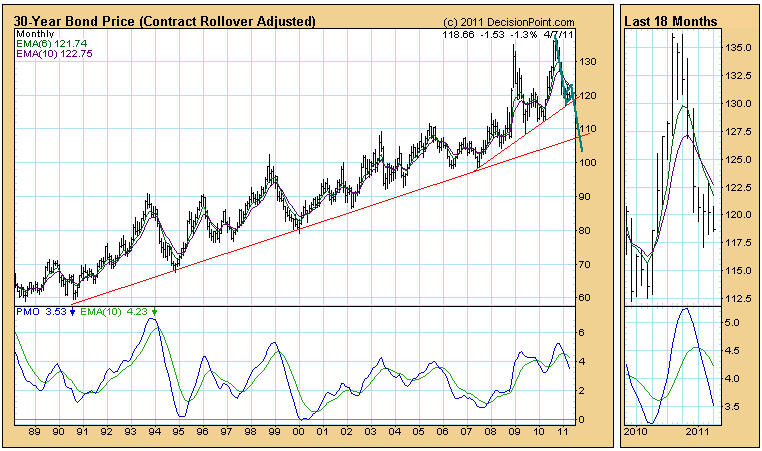

Zooming way back on the monthly chart we can see that our projection will take prices well below an even longer-term rising trend line that dates back to 1990.

Bottom Line: Bonds are in a bear market and have been on a Trend Model Neutral signal as of 11/10/2010. At this point a SELL signal would be more appropriate, but our Trend Model criteria have not been met, so we are satisfied simply not being exposed to the market. The best hope for the bulls is that the support immediately below will hold and cause the reverse flag projection to abort, but I see no fundamental reason to hold that hope.

* * * * * * * * * * * * * * * * * * * * *

Technical analysis is a windsock, not a crystal ball.

* * * * * * * * * * * * * * * * * * * * *

Carl BIO: Carl Swenlin is a self-taught technical analyst, who has been involved in market analysis since 1981. A pioneer in the creation of online technical resources, he is president and founder of DecisionPoint.com, a premier technical analysis website specializing in stock market indicators, charting, and focused research reports. Mr. Swenlin is a Member of the Market Technicians Association.

* * * * * * * * * * * * * * * * * * * * *

The weekly chart gives us a better look at the rising trend line support and the potential downside projection.

The weekly chart gives us a better look at the rising trend line support and the potential downside projection.

Zooming way back on the monthly chart we can see that our projection will take prices well below an even longer-term rising trend line that dates back to 1990.

Zooming way back on the monthly chart we can see that our projection will take prices well below an even longer-term rising trend line that dates back to 1990.

Bottom Line: Bonds are in a bear market and have been on a Trend Model Neutral signal as of 11/10/2010. At this point a SELL signal would be more appropriate, but our Trend Model criteria have not been met, so we are satisfied simply not being exposed to the market. The best hope for the bulls is that the support immediately below will hold and cause the reverse flag projection to abort, but I see no fundamental reason to hold that hope.

* * * * * * * * * * * * * * * * * * * * *

Technical analysis is a windsock, not a crystal ball.

* * * * * * * * * * * * * * * * * * * * *

Carl BIO: Carl Swenlin is a self-taught technical analyst, who has been involved in market analysis since 1981. A pioneer in the creation of online technical resources, he is president and founder of DecisionPoint.com, a premier technical analysis website specializing in stock market indicators, charting, and focused research reports. Mr. Swenlin is a Member of the Market Technicians Association.

* * * * * * * * * * * * * * * * * * * * *

Bottom Line: Bonds are in a bear market and have been on a Trend Model Neutral signal as of 11/10/2010. At this point a SELL signal would be more appropriate, but our Trend Model criteria have not been met, so we are satisfied simply not being exposed to the market. The best hope for the bulls is that the support immediately below will hold and cause the reverse flag projection to abort, but I see no fundamental reason to hold that hope.

* * * * * * * * * * * * * * * * * * * * *

Technical analysis is a windsock, not a crystal ball.

* * * * * * * * * * * * * * * * * * * * *

Carl BIO: Carl Swenlin is a self-taught technical analyst, who has been involved in market analysis since 1981. A pioneer in the creation of online technical resources, he is president and founder of DecisionPoint.com, a premier technical analysis website specializing in stock market indicators, charting, and focused research reports. Mr. Swenlin is a Member of the Market Technicians Association.

* * * * * * * * * * * * * * * * * * * * *