Our mechanical timing models completely ignore fundamentals, but that doesn't mean I don't think about them, and it is unlikely that my subjective analysis of the technicals is not influenced by fundamentals just a little bit from time to time.

A good example is what recently happened with bonds. I was certain that the failure of our politicians to make a credible effort to deal with our debt problem would cause bonds to crash. What happened was that bonds exploded to the upside. Not a problem for our timing -- we have been on a mechanical buy signal for bonds since April 26 -- but I expressed often that I thought that the rally that began at the end of August was irrational.

In response to my comments I received the following comments from a subscriber.

SUBSCRIBER: Carl, I've been a subscriber for just a few months but followed your monthly comments on Aegean Capital for several years. Your comments on bonds have compelled me to write. You MUST read the quarterly reports of Hoisington Management. They are an Austin based bond house and publish a free, quarterly report on the economy and long-term treasuries. Read back several quarters (more if you're so inclined - they are fascinating) and get a sense of what they're saying. You'll then readily see the reason 30 year bonds are breaking all time highs as our country's debt continues to mount.

We all agree the debt will explode in our face one day but that day is far off. In the meantime, you'll at least understand the "why" of the current increases in value.

ANSWER: Thank you for your comments and for the tip on the Hoisington. They have some of the most clearly written commentary on the economy I have seen. Their quarterly reports are a "must read." (http://www.hoisingto...c_overview.html)

This recent experience with bonds has reminded me of the dangers of of projecting prices using perception of fundamentals. I'm sure by now that nearly everyone "knows" why bonds took off, but not many knew before the event. It is likely that a good part of the rally was caused by frantic short-covering, but the fundamental events were behind the move in a direction that was largely unexpected.

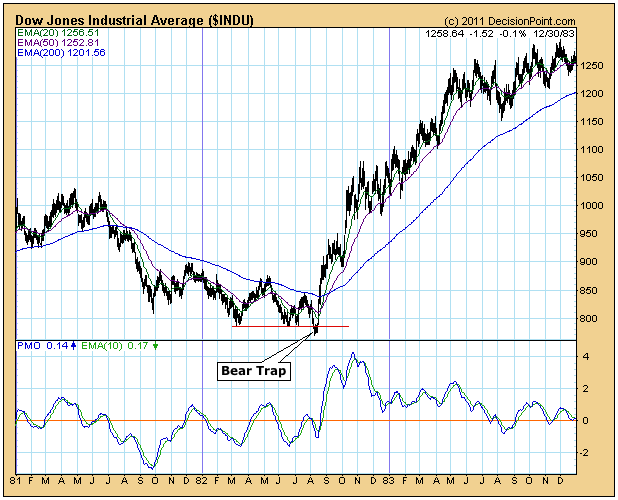

I started my market studies about 1980, and I remember the dismal outlook for the economy and stocks as the bear market ground on through 1981 and 1982. When the Dow broke support in August 1982, that was IT. The world was ending. Then the Dow broke upward, beginning the greatest bull market in history. There were reasons for this that were explained thoroughly after the fact. I don't remember what they were, but I was a "babe in the woods", and I still remember clearly the feeling of disorientation as I tried to comprend what was happening.

To paraphrase Joe Granville from his 1960 book, "If it's obvious to everyone, it's obviously wrong." Of course that doesn't always apply, but the more obvious something is, the more nervous I get. Our conclusion about the imminent negative outcome of the global debt crisis is an example. Hoisington points out that Japan has been stalling the piper for 20 years. I don't think we have that long, but I don't know how long we do have.

Bottom Line: The most important lesson learned from the bond rally is that it is best to follow mechanical timing models based upon price movement. At the end of August we were on a buy signal for bonds, which I regretted because it looked technically and fundamentally as if bonds were about to tank. We are still on that bond buy signal and happy that we let the timing models do our thinking for us.

* * * * * * * * * * * * * * * * * * * * *

Technical analysis is a windsock, not a crystal ball.

* * * * * * * * * * * * * * * * * * * * *

Decision Point's Timer Digest Rankings

TimerDigestCover

* * * * * * * * * * * * * * * * * * * * *

Carl BIO: Carl Swenlin is a self-taught technical analyst, who has been involved in market analysis since 1981. A pioneer in the creation of online technical resources, he is president and founder of DecisionPoint.com, a premier technical analysis website specializing in stock market indicators, charting, and focused research reports. Mr. Swenlin is a Member of the Market Technicians Association.