http://www.capitalst...st&id=50453.gif

Chart borrowed from a Stoolie.

cheers,

john

Edited by SilentOne, 31 August 2005 - 04:51 PM.

Posted 31 August 2005 - 04:47 PM

Edited by SilentOne, 31 August 2005 - 04:51 PM.

Posted 04 September 2005 - 04:47 PM

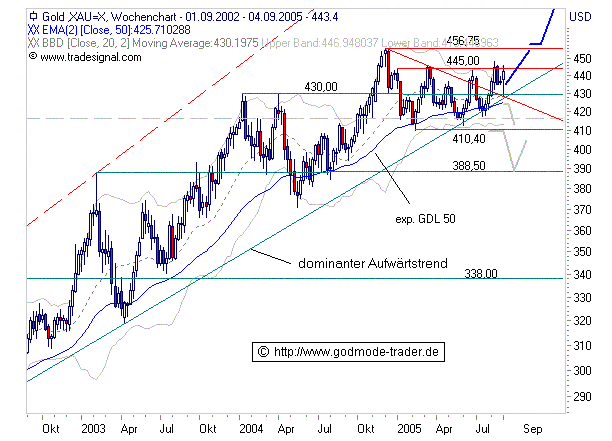

just watch this chart. It could be explosive from here.

http://www.capitalst...st&id=50453.gif

Chart borrowed from a Stoolie.

cheers,

john

Posted 04 September 2005 - 05:08 PM

Posted 05 September 2005 - 01:36 PM

Edited by PorkLoin, 05 September 2005 - 01:41 PM.

Posted 05 September 2005 - 09:54 PM

Well, who knows -- maybe silver doesn't have to lead gold. Or, since it did gain a little on gold in the last week, maybe things have changed. The COT certainly isn't infallible, and the Commercials can cover. It's still a very good question, IMO.

[attachment=3563:attachment]

Could be very bullish here -- could be a big 3rd wave coming up. I think that eventually we'll get a continuation of the considerable move into the late 2003 high (as the Dollar bear market resumes in earnest). The weekly RSI has stayed decently strong, over all -- consistent with an ongoing bull market. My question is if the next big wave up is soon, as the above count implies, or later, if we're making a triangle where'd we'd have to complete a fairly big "E" wave or even a "D" wave from the May 2005 low followed by "E." So, what does the move up from May really look like?

[attachment=3564:attachment]

Overall, I think the move from May looks better as three waves, as the light purple line. Same for the XAU, and this makes me reluctant to fully embrace the bull case. But it also can be counted as a decent five waves up, as the red numbers. If we're indeed bullish from the May low, then we should rally impulsively, and decline correctively, so let's look at the action in the last month.

[attachment=3565:attachment]

We should know more pretty soon, since the launch up lately was only a little more than two days' duration. Any correction should be short-lived. Nothing is without doubt or without risk here -- one could count a small "A" and "B" on Sept. 30 followed by a five-wave "C" up, but that looks low probability to me. The decline from the August top can also be counted as a five-wave impulsive move, but that would have to be reconciled with the apparent five-wave rally last week and whatever comes next in the short-term.

If we're bullish and we get a corrective move sideways or down from last week's peak, it should be followed by another good move up, almost surely taking out the August peak. Then the question is if we're just finishing up the rally from May or if we're heading for the 2004 and 2003 highs.

Best,

Doug

Posted 06 September 2005 - 06:18 AM

I am trying to reconcile the bullish count to new highs with a scenario that THEN sees a serious sell-off for a month or two. Gold to silver ratio is to be watched....