Saturday, July 21, 2007

HOTS Weekly Options Commentary

by Peter Stolcers

Two weeks ago the market staged a convincing rally to new all-time highs. The buying continued right in the close Friday and it looked like the table was set for an awesome option expiration week. Throughout the course of this last week the market had some large intraday swings but it was unable to add to the breakout. Going into the week I expected solid earnings from financial stocks to spark that sector and fuel the market.

Merrill Lynch and State Street Bank both posted big numbers that handily beat expectations. To my surprise, both stocks sold off even though their exposure to subprime lending is limited. Clearly, higher interest rates are the larger concern. They have the potential to impact consumer spending, corporate financing, and private equity deals. Without the help of the financial sector, a sustained rally is unlikely. These stocks comprise 20% of the S&P 500. Tuesday, Bear Stearns dropped the second shoe on subprime lending woes when it announced its hedge funds in that area were going belly up. The magnitude of this problem has yet to be identified. In the second day of his testimony before Congress, the Fed Chairman said that subprime lending issues will get worse before they get better. Years ago, home buyers opted for 3-year and 5-year ARMS and those adjustable rate mortgages are just starting to kick in. As long as the unemployment level stays below 5%, I believe homeowners will be able to adjust their spending patterns and avoid catastrophe.

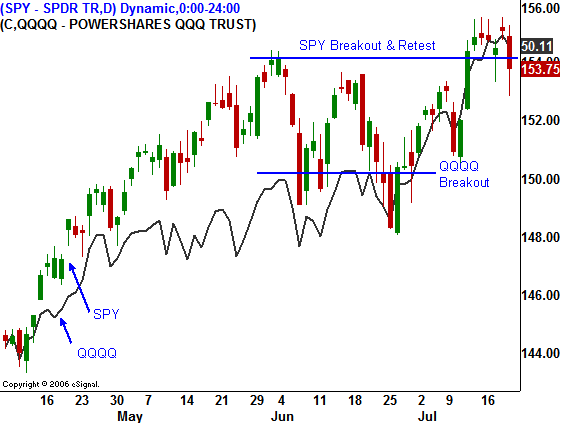

In the chart you can see the QQQQ/SPY overlay. Tech stocks have been strong relative to the SPY. They broke out and they have continued to make advances while the SPY has stalled. Tech stocks are still 50% below their peak from 2000 and they have lagged the rest of the market. I have not bought in to the recent tech rally because guidance has not been raised. Only 13 stocks account for the recent NASDAQ 100 rally and the move lacks depth. Last week, two tech leaders (Intel and Google) failed to meet expectations. Cyclical stocks were even more disappointing. They released solid earnings and in many cases beat expectations, yet the stocks sold off after the news. Friday, Caterpillar announced earnings and missed expectations. This overall price action tells me that stocks in general are ďfully pricedĒ. Unless we get an extraordinary round of earnings next week, I fear that the market might be putting in a temporary top.

I donít believe that the economic numbers next week will drive prices. On deck we have new home sales, durable goods, GDP and consumer sentiment. Interest rates will stay put for the rest of the year and that places greater importance on earnings.

I canít possibly name all the companies that are announcing this week, but here is a list of some that Iím interested in: ACI, ALTR, AXP, CNI, RE, HAL, LNCR, MRK, NFLX, TXN, STLD, AKS, AMZN, T, BTU, BP, BNI, CDWC, DD, LLY, ENR, LM, LMT, NOC, PCAR, PNRA, PEP, PCP, SII, UPS, VRTX, AKAM, AAPL, CL, DADE, FFIV, FMC, FCX, GD, OSG, SLAB, TSCO, ZBRA, ZMH, WLP, MMM, AET, AMGN, BZH, BWA, BDK, BG, CLF, CRS, F, KLAC, NTGR, ODP, POT, SI, SPAR, DOW, WEN, WDC, BHI, CVX, IR, LZ, SEPR.

As I look at the list, I canít visualize where the strength is going to come from. Energy, mining and heavy equipment are all priced for performance. The tech stocks on the list have performed well and they are trading at lofty P/E ratios. The chemical stocks have the potential to outperform and they are just showing signs of strength. Unfortunately, they wonít be able to carry the market. Iím expecting a choppy week of earnings and the market will do well just to hold its current level. If it falters and it falls below SPY150, it could retest the relative lows we made in June. I would be suspicious of any rally that does not include financials stocks.