There's more volume up there than you think.

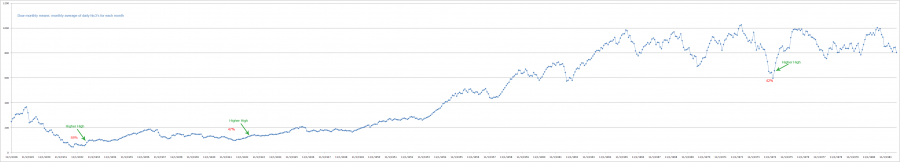

Going back a bit too far for to be useful imo, but to each their own. Using that many years and expecting it to work for support and resistance is presuming that most of the holders from years past are still holding or interested in defending those levels, imo. I think it's safe to say that the volume profile from last year or 2 reflects well enough where vested interest is, don't feel as confident that 4+ years back is relevant to s/r.

Either way those 5 year profiles you posted look bullish to me as well, just not as bullish. The capital P on the Nasdaq is a particularly bullish profile.

Edited by MoneyFriend, 06 June 2009 - 01:19 PM.