fast cars, vegas, women, picture of a woman for an avatar. you're just a horny lil bastage.my favorite indicator is my own personal BS indicator.

I can spot fraud, liars, and majority of just plain bs. Its become a refined sixth sense for me. In my career in sales and engineering, its allowed me to post consistently high close ratios, walk away from incredibly bad deals, bad customers, and keep things like my home, my investment portfolio, my finances, my family, growing and out of a lot of trouble. Coupled with a very high literacy comprehension rate, testing out of all required college english classes while sophomore in HS,and a comprehensive background in linguistics, its fairly easy for me now to spot patterns in word use, and detect people who are basic fraudsters and liars or just plain bs artists. How people spell, type, their word choices, inconsistency, grammar, coined terms and phrases all lead to a very reliable indicator of how truthful people are, or being, and who can be trusted or not. Having dealt with literally thousands of people in business, thousands of business transactions, I have proven it out time and again. I use it to determine which web-sites, posters, bloggers, are credible, and what companies to choose to do business with.

I also use body language and patterns in speech and tonal changes to detect what is true or not true in conversations. Over the years, What I find amazing is how many people tell so many lies day in and day out, and then themselves actually begin to believe what they are saying is true, or find they can get away with telling so many so called "white lies" where they feel noone will ever detect it or prove them wrong. People who tend to learn how I am, especially in business tend to say much less and are a lot more careful. They become uncomfortable, as they should be, as they often figure out that I am on to them. They will even try to resort to verbal communications, avoid written communications, thinking I can't catch them in their inconsistencies, won't remember what they say, or can't possibly hold them to something later if its not in writing. They couldn't be more wrong which generally ends up in their undoing.

So just sayin' - Be careful of some posters out there. And choose your indicators wisely.

wow...what do you think of me?

This is not a bear market rally

#21

Posted 18 June 2009 - 10:53 PM

#22

Posted 18 June 2009 - 11:23 PM

Both. Degreed mechanical engineer. Use engineering analysis all the time.In my career in sales and engineering

are you in sales? or are you an Engineer?

And just for kicks here is a long answer to your question. My clients love my work, and they trust me, because I don't act like the typical saleman who doesn't know ********, and simply blows hot air to try to sell them something. And when they see how all my work saves them money, over and over again, they keep referring me to other new customers. I still have to filter out the riff raff and some get upset when I turn them down, or don't cut them any deal, but I simply tell them I have more than enough business, and so if they lie to me or aren't being straight, I just walk. Too busy for bs. I work long hours and am up late at night. Two computers - one for work, and one for this ********. When you see me post it means I'm taking a break from my work or my family or hobbies or charity work. I usually have 10 things going at once, so this allows me to have a mental break from the analysis work. Its also why I don't do charts here. Have no time for that, and last thing I need is more analysis. I scram the net looking at specific sites only for my daily dose of news. I can do it very quickly and efficiently with some search methods I use, to make the most of my not so spare time. Some months I crank out 30 proposals, the next maybe zero or just a few. I go long stretches in massive bursts of energy to close business, then I just shut it down for a few days or even a few weeks, work on hobbies, investments, charity, community, then back at it again. I hate routine. The variety keeps me fresh. I can rip out a hundred emails in no time to accomplish or a delegate what I need. I still remain the #2 sales guy in the company out of 55 people now, and I guess if I wanted to work non-stop in a trudgingly boring 5 day routine like the number one guy who cranks out the same number week in and week out like a boring robot, I could maybe be number 1. But I'd rather stay number 2, have a ton of fun, not be bored, but work a lot on things I want to work on, not just this "day yob" and probably devote only half the hours to this day yob that the #1 guy does. Im 11 years his senior and he will no doubt be burn't out before he gets to my age.

So there you have it:

Father

Husband

Salesman

Engineer

Writer

Technician

Investor

Builder

Analyst

Energy specialist

Mechanical Design & process Trouble shooter

Go kart racer

R/C plane modeler and racer

Soccer player

Coach

Eaglescout

Troop leader

Cyclist

Community volunteer

Good samaritan

Electrician

Home designer

Solar advocate

Energy efficiency specialist

Industrial process expert

Treasurer

Artist

Gardener

Cook

Woodworker

Linguistics studier

Photographer

#23

Posted 19 June 2009 - 12:04 AM

u sound just like a guy i knew on CB forum.....zedor

Well, if you can't distinguish the gargantuan differences in government policy between now and 1982 and how it will affect future growth, and they are legion, it's perfectly understandable why one would repeatedly post the NYT article written at the absolute bottom because the NYT writer was too stupid to understand what the 180 degree turn in policy would do, even in the face of totally bleak news.

This time around, we have a 180 degree turn in policy in the opposite direction of 1982, now in the face of "good" news spun out of nothing by media in the service of their hero in the White House. Neither he nor they have any idea of how to grow an economy and even the incredible resourcefulness of this economy isn't going to overcome the never-ending stream of huge obstacles to growth being set up and slowly but surely implemented as we speak.

Makes for bad earnings and a bad market barring the hyperinflation scenario, which I've never seen you advocate.

BTW, I ain't "zedor," ask Mark or the mods who have access to IP addresses.

#24

Posted 19 June 2009 - 05:06 AM

u sound just like a guy i knew on CB forum.....zedor

Well, if you can't distinguish the gargantuan differences in government policy between now and 1982 and how it will affect future growth, and they are legion, it's perfectly understandable why one would repeatedly post the NYT article written at the absolute bottom because the NYT writer was too stupid to understand what the 180 degree turn in policy would do, even in the face of totally bleak news.

This time around, we have a 180 degree turn in policy in the opposite direction of 1982, now in the face of "good" news spun out of nothing by media in the service of their hero in the White House. Neither he nor they have any idea of how to grow an economy and even the incredible resourcefulness of this economy isn't going to overcome the never-ending stream of huge obstacles to growth being set up and slowly but surely implemented as we speak.

Makes for bad earnings and a bad market barring the hyperinflation scenario, which I've never seen you advocate.

BTW, I ain't "zedor," ask Mark or the mods who have access to IP addresses.

for that matter the economy has not 'grown' since 2000 in terms of real wage growth or real high quality jobs..gg (political overtones in these posts..wonder where the admins are..so i will counter just for balance though i do not care about either side)

1982 and 2009 situations are way different so policies can not be the same

the bush bottom will be hard to match (know some may say we ain't seen nothing yet)...

#25

Posted 19 June 2009 - 06:41 AM

Anyone that thinks that, I believe will be disappointed.

There won't be any meltdowns.

That said, forget about any notions of parabolic moves to the upside,

those days are over, it's grind from here on out, classic bull market action.

It will be very hard to make money on index calls. Cash, futures and stock pickers

market.

RSI is almost oversold already.

The advance from 666 is a bear market rally due to the overlapping waves pattern. Every high except the 875 high has been overlapped by the next highs correction. That idicates the advance from 666 to 875 was not a bull market wave, bull markets do not wave overlap, only bear markets overlap. You may recall I forecast in advance the super cycle top would occur in summer/fall of 2007 between 1550 and 1610 based on the 235 new moon cycle. I also forecast well in advance to be a buyer in the mid 600s. I gave you three wave (4) flat wave targets for the bear market rally high. The 956 high has hit the middle target in the 940s and getting close to confirming 956 was the high. Shorted the 940s looking for the 890s Just need to not trade above 923 and achieve 890s for this wave down from 956 to confirm that. Higher wave (4) targets at 1020-1050 so we have a technical wave stop below the entry for protection. It might require three tries to get short for the next big move down. This is my second try after being long from 670s to 840s. The rally from 826 to 956 could be just the wave C of the ABCDE wave so we are set if 956 was E and protected if it was just C.

The next 235 new moon high is due in 2026 with the lowest low in 2016. You are right about the grind, just wrong on direction.

Best,

Larry

#26

Posted 19 June 2009 - 07:00 AM

Both. Degreed mechanical engineer. Use engineering analysis all the time.In my career in sales and engineering

are you in sales? or are you an Engineer?

And just for kicks here is a long answer to your question. My clients love my work, and they trust me, because I don't act like the typical saleman who doesn't know ********, and simply blows hot air to try to sell them something. And when they see how all my work saves them money, over and over again, they keep referring me to other new customers. I still have to filter out the riff raff and some get upset when I turn them down, or don't cut them any deal, but I simply tell them I have more than enough business, and so if they lie to me or aren't being straight, I just walk. Too busy for bs. I work long hours and am up late at night. Two computers - one for work, and one for this ********. When you see me post it means I'm taking a break from my work or my family or hobbies or charity work. I usually have 10 things going at once, so this allows me to have a mental break from the analysis work. Its also why I don't do charts here. Have no time for that, and last thing I need is more analysis. I scram the net looking at specific sites only for my daily dose of news. I can do it very quickly and efficiently with some search methods I use, to make the most of my not so spare time. Some months I crank out 30 proposals, the next maybe zero or just a few. I go long stretches in massive bursts of energy to close business, then I just shut it down for a few days or even a few weeks, work on hobbies, investments, charity, community, then back at it again. I hate routine. The variety keeps me fresh. I can rip out a hundred emails in no time to accomplish or a delegate what I need. I still remain the #2 sales guy in the company out of 55 people now, and I guess if I wanted to work non-stop in a trudgingly boring 5 day routine like the number one guy who cranks out the same number week in and week out like a boring robot, I could maybe be number 1. But I'd rather stay number 2, have a ton of fun, not be bored, but work a lot on things I want to work on, not just this "day yob" and probably devote only half the hours to this day yob that the #1 guy does. Im 11 years his senior and he will no doubt be burn't out before he gets to my age.

So there you have it:

Father

Husband

Salesman

Engineer

Writer

Technician

Investor

Builder

Analyst

Energy specialist

Mechanical Design & process Trouble shooter

Go kart racer

R/C plane modeler and racer

Soccer player

Coach

Eaglescout

Troop leader

Cyclist

Community volunteer

Good samaritan

Electrician

Home designer

Solar advocate

Energy efficiency specialist

Industrial process expert

Treasurer

Artist

Gardener

Cook

Woodworker

Linguistics studier

Photographer

a jack of all trades anda.....da da dah di da da da

#27

Posted 19 June 2009 - 07:02 AM

LT.s next big move down.........ill file that along with the rest

You file that and while you are at it file the fact I called the 2000 top, the 2007 high the mid 660s low and this bounce. Also file you missed the 2000 and 2007 highs that dropped 50%, file that while you are at filing. I missed the 2003 low, yes I did, you can keep that file.

#28

Posted 19 June 2009 - 07:05 AM

It's nothing near a bull. My 34 years of trading for a living tells me the disappointment will be all yours, my friend. But I've always said the best lessons are learned when you lose money, so I'm sure it will help you somewhere down the road.

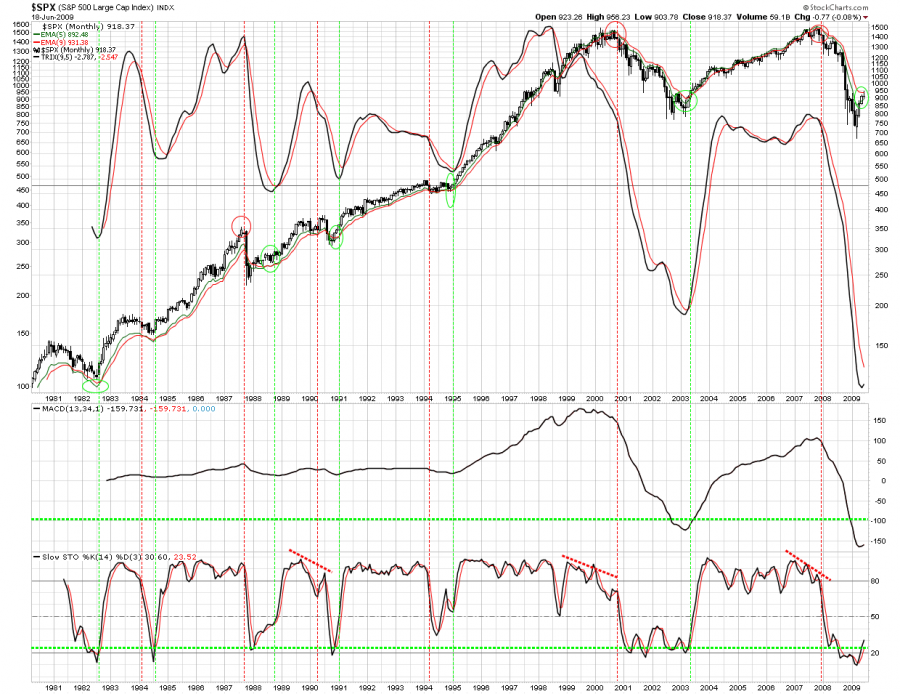

what does this chart say to you?

#29

Posted 19 June 2009 - 07:09 AM

LT.s next big move down.........ill file that along with the rest

You file that and while you are at it file the fact I called the 2000 top, the 2007 high the mid 660s low and this bounce. Also file you missed the 2000 and 2007 highs that dropped 50%, file that while you are at filing. I missed the 2003 low, yes I did, you can keep that file.

spin this

http://www.traders-t...showtopic=65044

#30

Posted 19 June 2009 - 07:50 AM

It's nothing near a bull. My 34 years of trading for a living tells me the disappointment will be all yours, my friend. But I've always said the best lessons are learned when you lose money, so I'm sure it will help you somewhere down the road.

what does this chart say to you?

lol, it means exactly what you want it to mean apparently. The chart says this is just another bear market rally?