For better archiving purpose, I post the swing type outlooks in this thread. The scope aims on trend speculation longer than a week, some ambiguity is unavoidable. To delve intraday speculation, I also post intraday outlook (in indexcalls.com) to synchronize the market movements. Since I am not a day trader, posting intraday outlook is on a irregular basis.

-----------------------------------------------------------------------------------------------

Posted on: Jul 5 2010, 08:35 PM

Intraday speculation:

http://indexcalls.co...o...st&p=585691

Resistance zone 1039-1048, 1071. supports 1008-998, 976.

Posted on: Jul 6 2010, 08:49 AM

http://indexcalls.co...o...st&p=585763

intraday high 1042.50 [projected zone 1039-1048]

drop to 1017-1019 & bounce off 1017-1019 to see 1068-1071.

[07/06 intraday low 1,018.35 high 1,042.50]

Posted on: Jul 7 2010, 11:10 AM

http://indexcalls.co...o...st&p=586011

Day's Range: 1,028.54 - 1,050.48 @this writing

The "congested nut" (1039-1048) has been "digested". By holding 1039, next target is 1068-1071 (gap)

[07/07 open 1,028.54 closing 1,060.27]

Posted on: Jul 8 2010, 11:45 AM

http://indexcalls.co...o...st&p=586218

Crafting the rhythms series 07/08/10

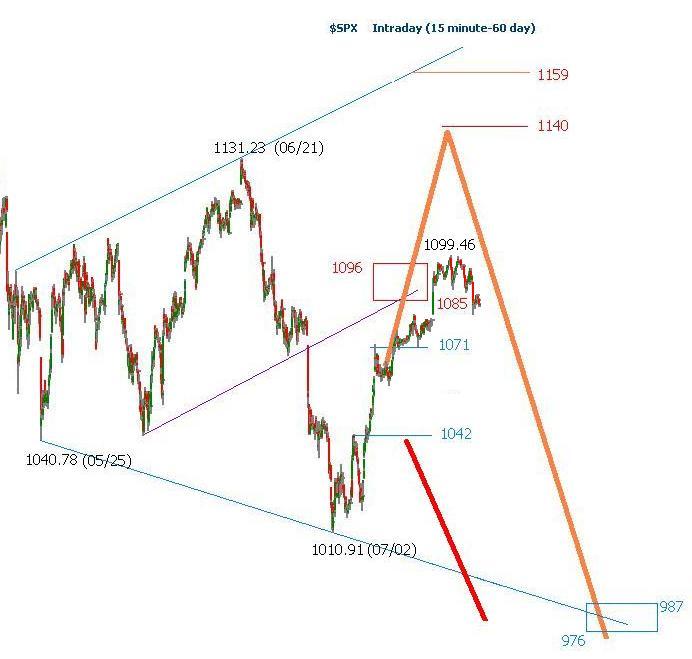

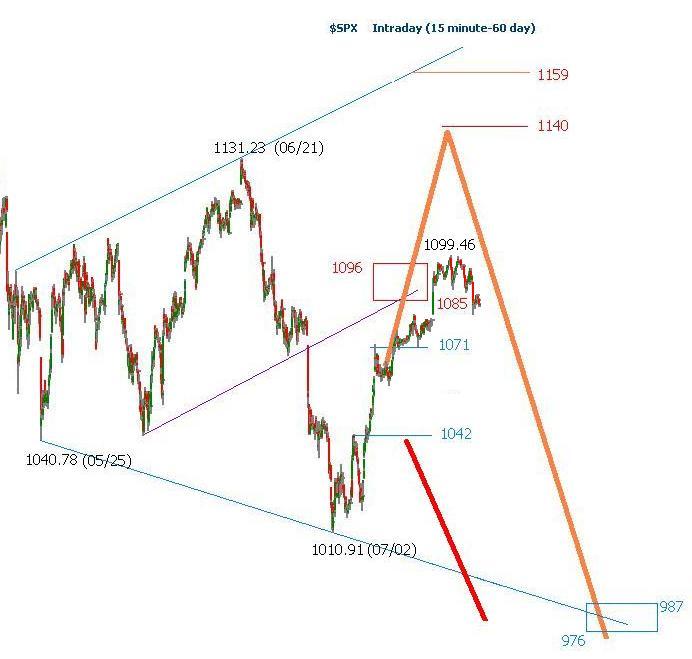

On 07/08, session high is 1071.25 @ this writing. A 0.5 retracement is neutral, 1071.07 = [0.5|1010.91:1131.23]), gap 1071.10-1071.45. The critical pivots to gauge the direction is 1096 [up] and 1042 [down].

[07/08 intraday high 1,071.25 low 1,058.24]

Posted on: Jul 9 2010, 11:47 AM

http://indexcalls.co...o...st&p=586411

1078 is the mean between 1071 & 1085

chart: http://indexcalls.co...01250_thumb.jpg

[07/09 intraday high 1,078.16]

Posted on: Jul 9 2010, 02:11 PM

http://indexcalls.co...o...st&p=586458

closing remark: Earnings & outlooks sets the tone

0.382 1090.70 [1219.80:1010.91] frame 04/26-07/01

0.500 1071.07 [1131.23:1010.91] frame 06/21-07/01

0.618 1085.27

0.707 1095.98 > 1090.70

-----------------------------------------------------------------------------------------------

comments:

The critical pivots to gauge the direction is 1096 [up] and 1042 [down].

The half power point 0.707 for short term frame 06/21-07/01 is 1095.98, about 6 points higher than 0.382 retracement for intermediate frame 06/21-07/01 @ 1090.70. So, I pick 1096 as a gauge for bullish scenario. The middle term wave structure remains unclear. So far the pullback from 1219 (04/26) is considered a correction of a longer term bullish wave structure, with an unrealized middle term second target 944-948. The first target (around 1008) had been met on 07/01 (1010.91)

Crafting the rhythms

Started by

stanley

, Apr 13 2010 12:58 PM

140 replies to this topic

#21

Posted 11 July 2010 - 07:38 PM

#22

Posted 13 July 2010 - 02:28 PM

Crafting the rhythms series 07/13/10

On 07/13 indraday, Index takes out 1096.

[1] status in quo, locus in quo

Index takes out 1096 marginally.

Big IF Intel deliver positive earning & positive outlook, The next obvious zone is 1107-1123.

------------------------------------------------------------------------

Jul 9 2010, 02:11 PM

closing remark: Earnings & outlooks sets the tone

The critical pivots to gauge the direction is 1096 [up] and 1042 [down].

Jul 8 2010, 11:44 AM

------------------------------------------------------------------------

[2] near term

Index is approaching to a (secondary?) rolling point, 07/26 - 08/10 [07/30?]

------------------------------------------------------------------------

Jul 8 2010, 11:44 AM

the index status on 07/26 is becoming exciting.

High

03/06/09 BASE

06/11/09 67TD 0939.04

10/21/09 91TD 1101.36

01/19/10 59TD 1150.45

04/26/10 66TD 1219.80

07/26/10 63TD ????

Low

03/06/09 BASE

07/08/09 85TD 0869.32

11/02/09 82TD 1019.95

02/05/10 64TD 1044.50

07/01/10 101D 1010.91

07/27/10 117?

Fibonacci Time Zone (ratio 1.00) due 07/30/10[-08/10/10].

------------------------------------------------------------------------

[3] quo vadis?

check point 1176 & 785.

------------------------------------------------------------------------

Jun 5 2010, 06:22 PM

At this moment, the wave structure in the large scale time frame remains bullish. the intermediate frame wave structure does not manifest itself

Jun 27 2010, 06:27 PM

chart: http://traders-talk....-1277686575.jpg

Jun 30 2010, 08:42 PM

785 is a pretty tough gauge. to be elaborated

Jul 5 2010, 06:36 PM

Large frame

1220-0667 0.382 1008

1220-0667 0.500 0944

1220-0667 0.786 0785 travels down to this level marks the end of the rally since March 09.

0667-1576 0.786 0861

------------------------------------------------------------------------

On 07/13 indraday, Index takes out 1096.

[1] status in quo, locus in quo

Index takes out 1096 marginally.

Big IF Intel deliver positive earning & positive outlook, The next obvious zone is 1107-1123.

------------------------------------------------------------------------

Jul 9 2010, 02:11 PM

closing remark: Earnings & outlooks sets the tone

The critical pivots to gauge the direction is 1096 [up] and 1042 [down].

Jul 8 2010, 11:44 AM

------------------------------------------------------------------------

[2] near term

Index is approaching to a (secondary?) rolling point, 07/26 - 08/10 [07/30?]

------------------------------------------------------------------------

Jul 8 2010, 11:44 AM

the index status on 07/26 is becoming exciting.

High

03/06/09 BASE

06/11/09 67TD 0939.04

10/21/09 91TD 1101.36

01/19/10 59TD 1150.45

04/26/10 66TD 1219.80

07/26/10 63TD ????

Low

03/06/09 BASE

07/08/09 85TD 0869.32

11/02/09 82TD 1019.95

02/05/10 64TD 1044.50

07/01/10 101D 1010.91

07/27/10 117?

Fibonacci Time Zone (ratio 1.00) due 07/30/10[-08/10/10].

------------------------------------------------------------------------

[3] quo vadis?

check point 1176 & 785.

------------------------------------------------------------------------

Jun 5 2010, 06:22 PM

At this moment, the wave structure in the large scale time frame remains bullish. the intermediate frame wave structure does not manifest itself

Jun 27 2010, 06:27 PM

chart: http://traders-talk....-1277686575.jpg

Jun 30 2010, 08:42 PM

785 is a pretty tough gauge. to be elaborated

Jul 5 2010, 06:36 PM

Large frame

1220-0667 0.382 1008

1220-0667 0.500 0944

1220-0667 0.786 0785 travels down to this level marks the end of the rally since March 09.

0667-1576 0.786 0861

------------------------------------------------------------------------

#23

Posted 13 July 2010 - 11:17 PM

chart in prior post is ambiguous. here is the "correct" one

archive

-------------------------------------------------

Apr 13 2010, 10:58 AM Post #1 in this thread

When index exceeds 1256.98 (refer to the chart shown below) the wave status since March 09 may “separate” from the prior one (1576-->667) and become an individual segment. When the wave is becoming a separate segment, it is capable of reaching 1300 level. The half power point 0.707 from 667 to 1576 is 1310, very close to the High 1313.15 marked on 08/11/08.

-------------------------------------------------

archive

-------------------------------------------------

Apr 13 2010, 10:58 AM Post #1 in this thread

When index exceeds 1256.98 (refer to the chart shown below) the wave status since March 09 may “separate” from the prior one (1576-->667) and become an individual segment. When the wave is becoming a separate segment, it is capable of reaching 1300 level. The half power point 0.707 from 667 to 1576 is 1310, very close to the High 1313.15 marked on 08/11/08.

-------------------------------------------------

#24

Posted 14 July 2010 - 09:50 AM

AP Business Writer, On Wednesday July 14, 2010, 9:59 am

"Stocks mostly fell Wednesday after a disappointing retail sales report chilled optimism from Intel's strong earnings and outlook."

archive

----------------------------

Jun 5 2010, 06:22 PM

This poster believes it is the market underlying intrinsic value determines the wave structure.

Jul 5 2010, 06:36 PM

wave theory only provides a thought process, Market index obeys its own law; Time is a magnificent machine working out these overhang saga; Whether an event will transpire can be “perceived” by a gauge or pivot. The usage is not only works in the movement polarity but also for the displacement.

Jul 9 2010, 02:11 PM

The critical pivots to gauge the direction is 1096 [up] and 1042 [down].

Time gauge given in post #20

"Stocks mostly fell Wednesday after a disappointing retail sales report chilled optimism from Intel's strong earnings and outlook."

archive

----------------------------

Jun 5 2010, 06:22 PM

This poster believes it is the market underlying intrinsic value determines the wave structure.

Jul 5 2010, 06:36 PM

wave theory only provides a thought process, Market index obeys its own law; Time is a magnificent machine working out these overhang saga; Whether an event will transpire can be “perceived” by a gauge or pivot. The usage is not only works in the movement polarity but also for the displacement.

Jul 9 2010, 02:11 PM

The critical pivots to gauge the direction is 1096 [up] and 1042 [down].

Time gauge given in post #20

#25

Posted 15 July 2010 - 01:15 PM

Crafting the rhythms series 07/15

refer to chart Jul 8 2010, 11:44 AM. I put new traces into the old chart, shown below.

the resistance zone 1085-1096 served as a damper, index pricked 1099.46 on 07/13 then reversed. It is a rough 0.707 [actual 0.735] retracement of the segment from 1131.23 (06/21) to 1010.91 (07/01) . Count from 1099.46, an equal movement to the down side will put index at 979.14. If you think it is not lower enough, just use wave extensions to get your "preferred" number. However, index need to crack 1042-1044 for better confirmation.

Wave 3 of 4 of 7 ??? ....

wave theory only provides a thought process, Market index obeys its own law.

Jul 9 2010, 02:11 PM

The critical pivots to gauge the direction is 1096 [up] and 1042 [down].

refer to chart Jul 8 2010, 11:44 AM. I put new traces into the old chart, shown below.

the resistance zone 1085-1096 served as a damper, index pricked 1099.46 on 07/13 then reversed. It is a rough 0.707 [actual 0.735] retracement of the segment from 1131.23 (06/21) to 1010.91 (07/01) . Count from 1099.46, an equal movement to the down side will put index at 979.14. If you think it is not lower enough, just use wave extensions to get your "preferred" number. However, index need to crack 1042-1044 for better confirmation.

Wave 3 of 4 of 7 ??? ....

wave theory only provides a thought process, Market index obeys its own law.

Jul 9 2010, 02:11 PM

The critical pivots to gauge the direction is 1096 [up] and 1042 [down].

#26

Posted 22 July 2010 - 11:53 AM

SPX 07/22/10

intraday high 1096.55 @ this writing.

I did minor adjustments on support & resistance, refer to the chart shown below.

archives

-----------------------------------------------

Posted on: Jul 20 2010, 01:08 PM

link

Index bounced off the FIB ratio 0.5 1055 [actual 1056.88] but enounters the resistance 1085 [actual 1083.94].

The sentiment to have the second attempt on 1096 (a pivot to the upper side) is obvious.

Posted on: Jul 8 2010, 11:44 AM

link

The critical pivots to gauge the direction is 1096 [up] and 1042 [down].

-----------------------------------------------

chart 07/15

intraday high 1096.55 @ this writing.

I did minor adjustments on support & resistance, refer to the chart shown below.

archives

-----------------------------------------------

Posted on: Jul 20 2010, 01:08 PM

link

Index bounced off the FIB ratio 0.5 1055 [actual 1056.88] but enounters the resistance 1085 [actual 1083.94].

The sentiment to have the second attempt on 1096 (a pivot to the upper side) is obvious.

Posted on: Jul 8 2010, 11:44 AM

link

The critical pivots to gauge the direction is 1096 [up] and 1042 [down].

-----------------------------------------------

chart 07/15

#27

Posted 23 July 2010 - 05:26 PM

Crafting the rhythms series 07/23/10

In session 07/23, intraday low 1087.88, high 1103.73.

For bullish scenario: To see 1140-1144, the resistance zone 1105.48 -1108.24 in this chart is the first hurdle needs to be removed. The target projection encounters some uncertainty because the waves with different time frame overlaps in the zone 1137-1159.

By surmounting (closing above) the gauge 1096 (d), this action is a caveat for

Here is the Thought process: Even If Index reverses down before hitting the aforementioned resistance zone, the Fibonacci time zone ratio 1.0 suggests the actions in the time window 07/26-08/10, ( b ), could be a secondary event. This secondary event will be a good guide to perceive the wave structure in October, ( a ).

For longer term speculation, the index trajectory gives faint hint. refer to the chart in ( c )[3], So far, the first middle term target (1014-1001, speculated on 12/31/09) has been met on 07/01, 948-962 ( revised as 944-948) is an unrealized middle term target.

( a ) Jul 5 2010, 08:35 PM Post #19

Crafting the rhythms series 07/05/10

The second target is around 944-948.

Long PI

04/15/10 actual 04/26, error 2.2PI. index deployed a middle term High

09/17/10 realigned to 10/19 [+/- 4PI]

( b ) Jul 8 2010, 11:44 AM

the index status on 07/26 is becoming exciting

Fibonacci Time Zone (ratio 1.00) due 07/30/10[-08/10/10].

( c ) Jul 13 2010, 11:54 AM, post #22

link

[2] near term

Index is approaching to a (secondary?) rolling point, 07/26 - 08/10 [07/30?]

[3] quo vadis?

chart: http://traders-talk....-1279080617.jpg

( d ) Jul 8 2010, 11:44 AM

The critical pivots to gauge the direction is 1096 [up] and 1042 [down].

Jun 27 2010, 06:27 PM

Second half may be full of surprises & volatilities, .... let me reiterate one more time that we need some entertainments in this fascinating market. “Technical analysis is a windsock, not a crystal ball” [Carl Swenlin]

Year of the Tiger

But, ... "Tail" Down or Up? which one?

In session 07/23, intraday low 1087.88, high 1103.73.

For bullish scenario: To see 1140-1144, the resistance zone 1105.48 -1108.24 in this chart is the first hurdle needs to be removed. The target projection encounters some uncertainty because the waves with different time frame overlaps in the zone 1137-1159.

By surmounting (closing above) the gauge 1096 (d), this action is a caveat for

Here is the Thought process: Even If Index reverses down before hitting the aforementioned resistance zone, the Fibonacci time zone ratio 1.0 suggests the actions in the time window 07/26-08/10, ( b ), could be a secondary event. This secondary event will be a good guide to perceive the wave structure in October, ( a ).

For longer term speculation, the index trajectory gives faint hint. refer to the chart in ( c )[3], So far, the first middle term target (1014-1001, speculated on 12/31/09) has been met on 07/01, 948-962 ( revised as 944-948) is an unrealized middle term target.

( a ) Jul 5 2010, 08:35 PM Post #19

Crafting the rhythms series 07/05/10

The second target is around 944-948.

Long PI

04/15/10 actual 04/26, error 2.2PI. index deployed a middle term High

09/17/10 realigned to 10/19 [+/- 4PI]

( b ) Jul 8 2010, 11:44 AM

the index status on 07/26 is becoming exciting

Fibonacci Time Zone (ratio 1.00) due 07/30/10[-08/10/10].

( c ) Jul 13 2010, 11:54 AM, post #22

link

[2] near term

Index is approaching to a (secondary?) rolling point, 07/26 - 08/10 [07/30?]

[3] quo vadis?

chart: http://traders-talk....-1279080617.jpg

( d ) Jul 8 2010, 11:44 AM

The critical pivots to gauge the direction is 1096 [up] and 1042 [down].

Jun 27 2010, 06:27 PM

Second half may be full of surprises & volatilities, .... let me reiterate one more time that we need some entertainments in this fascinating market. “Technical analysis is a windsock, not a crystal ball” [Carl Swenlin]

Year of the Tiger

But, ... "Tail" Down or Up? which one?

#28

Posted 28 July 2010 - 10:57 AM

Crafting the rhythms series – 07/28/10

It is the market underlying intrinsic value determines the wave structure, After another disappointing economic report, the June Durable Goods [0], the index has likely topped on 07/27. The (seconday top) time window is up to 08/10, [1][2][3]. The follow-through actions could be consolidations with resistance zone 1137-1159, initial trend reversal gauge 1079, and lower consolidation zone 1066 – 1035. This secondary event will be a good guide to perceive the wave structure in October, [4].

[0]

US Department of Commerce - WEDNESDAY, JULY 28, 2010, AT 8:30 A.M. EDT

Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders

June 2010

http://www.census.go...v/pdf/durgd.pdf

New Orders

New orders for manufactured durable goods in June decreased $2.0 billion or 1.0 percent to $190.5 billion, ... This was the second consecutive monthly decrease and followed a 0.8 percent May decrease. Excluding transportation, new orders decreased 0.6 percent. Excluding defense, new orders decreased 0.7 percent.

Inventories

Inventories of manufactured durable goods in June, up six consecutive months, increased $2.8 billion or 0.9 percent to $308.2 billion. This followed a 1.1 percent May increase.

Transportation equipment, up six consecutive months, had the largest increase, $0.8 billion or 1.1 percent to $80.0 billion.

[1]

King Wen’s Sequence

Jul 8 2010, 11:44 AM

High

03/06/09 BASE

06/11/09 67TD 0939.04

10/21/09 91TD 1101.36

01/19/10 59TD 1150.45

04/26/10 66TD 1219.80

07/26/10 63TD ???? [to be confirmed]

Low

03/06/09 BASE

07/08/09 85TD 0869.32

11/02/09 82TD 1019.95

02/05/10 64TD 1044.50

07/01/10 101D 1010.91 This low is confirmed as of 07/27

07/27/10 117? this case is Out,

[2]

Fibonacci Time Zone (ratio 1.00) due 07/30/10 [07/21 - 08/10].

[3]

Fibonacci retracements & waves

Jul 8

http://traders-talk....14590_thumb.jpg

Jul 22

http://indexcalls.co...17951_thumb.jpg

1099.46 – 1010.91 + 1056.88 = 1145.43

(1219.80 – 1040.78) * 0.707 + 1010.91 = 1137.48

(1219.80 – 1040.78) * 0.618 + 1010.91 = 1121.54 [07/27 intraday high 1120.95]

1173.57 – 1040.78 + 1010.91 = 1143.7

(1219.9 – 1010.91) * 0.707 + 1010.91 = 1158.67

(1219.9 – 1010.91) * 0.618 + 1010.91 = 1140.06

[4]

Long PI

04/15/10 actual 04/26, error 2.2PI. index deployed a middle term High

09/17/10 realigned to 10/19 [+/- 4PI]

Archives

Jul 23 2010, 03:26 PM

For bullish scenario: To see 1140-1144, the resistance zone 1105.48 -1108.24 in this chart is the first hurdle needs to be removed. The target projection encounters some uncertainty because the waves with different time frame overlaps in the zone 1137-1159.

Here is the Thought process: Even If Index reverses down before hitting the aforementioned resistance zone, the Fibonacci time zone ratio 1.0 suggests the actions in the time window 07/26-08/10, could be a secondary event.

Jul 11 2010, 05:38 PM

So far the pullback from 1219 (04/26) is considered a correction of a longer term bullish wave structure, with an unrealized middle term second target 944-948. The first target (around 1008) had been met on 07/01 (1010.91)

It is the market underlying intrinsic value determines the wave structure, After another disappointing economic report, the June Durable Goods [0], the index has likely topped on 07/27. The (seconday top) time window is up to 08/10, [1][2][3]. The follow-through actions could be consolidations with resistance zone 1137-1159, initial trend reversal gauge 1079, and lower consolidation zone 1066 – 1035. This secondary event will be a good guide to perceive the wave structure in October, [4].

[0]

US Department of Commerce - WEDNESDAY, JULY 28, 2010, AT 8:30 A.M. EDT

Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders

June 2010

http://www.census.go...v/pdf/durgd.pdf

New Orders

New orders for manufactured durable goods in June decreased $2.0 billion or 1.0 percent to $190.5 billion, ... This was the second consecutive monthly decrease and followed a 0.8 percent May decrease. Excluding transportation, new orders decreased 0.6 percent. Excluding defense, new orders decreased 0.7 percent.

Inventories

Inventories of manufactured durable goods in June, up six consecutive months, increased $2.8 billion or 0.9 percent to $308.2 billion. This followed a 1.1 percent May increase.

Transportation equipment, up six consecutive months, had the largest increase, $0.8 billion or 1.1 percent to $80.0 billion.

[1]

King Wen’s Sequence

Jul 8 2010, 11:44 AM

High

03/06/09 BASE

06/11/09 67TD 0939.04

10/21/09 91TD 1101.36

01/19/10 59TD 1150.45

04/26/10 66TD 1219.80

07/26/10 63TD ???? [to be confirmed]

Low

03/06/09 BASE

07/08/09 85TD 0869.32

11/02/09 82TD 1019.95

02/05/10 64TD 1044.50

07/01/10 101D 1010.91 This low is confirmed as of 07/27

07/27/10 117? this case is Out,

[2]

Fibonacci Time Zone (ratio 1.00) due 07/30/10 [07/21 - 08/10].

[3]

Fibonacci retracements & waves

Jul 8

http://traders-talk....14590_thumb.jpg

Jul 22

http://indexcalls.co...17951_thumb.jpg

1099.46 – 1010.91 + 1056.88 = 1145.43

(1219.80 – 1040.78) * 0.707 + 1010.91 = 1137.48

(1219.80 – 1040.78) * 0.618 + 1010.91 = 1121.54 [07/27 intraday high 1120.95]

1173.57 – 1040.78 + 1010.91 = 1143.7

(1219.9 – 1010.91) * 0.707 + 1010.91 = 1158.67

(1219.9 – 1010.91) * 0.618 + 1010.91 = 1140.06

[4]

Long PI

04/15/10 actual 04/26, error 2.2PI. index deployed a middle term High

09/17/10 realigned to 10/19 [+/- 4PI]

Archives

Jul 23 2010, 03:26 PM

For bullish scenario: To see 1140-1144, the resistance zone 1105.48 -1108.24 in this chart is the first hurdle needs to be removed. The target projection encounters some uncertainty because the waves with different time frame overlaps in the zone 1137-1159.

Here is the Thought process: Even If Index reverses down before hitting the aforementioned resistance zone, the Fibonacci time zone ratio 1.0 suggests the actions in the time window 07/26-08/10, could be a secondary event.

Jul 11 2010, 05:38 PM

So far the pullback from 1219 (04/26) is considered a correction of a longer term bullish wave structure, with an unrealized middle term second target 944-948. The first target (around 1008) had been met on 07/01 (1010.91)

#29

Posted 02 August 2010 - 12:01 AM

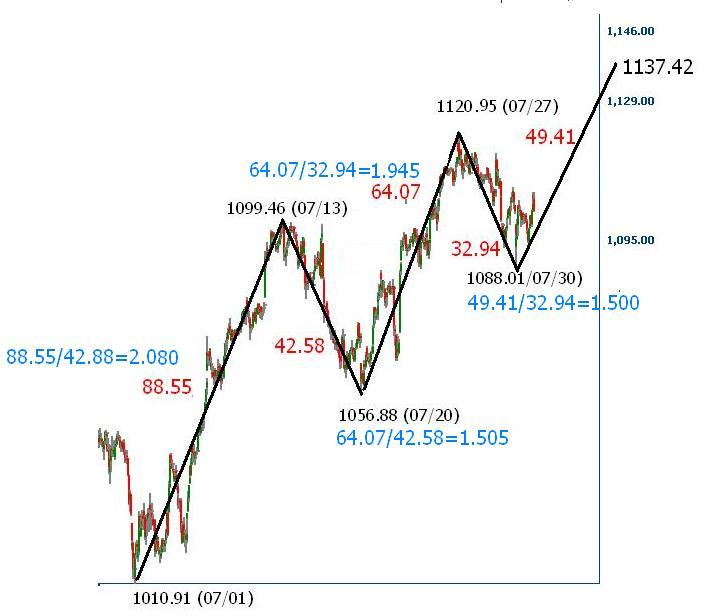

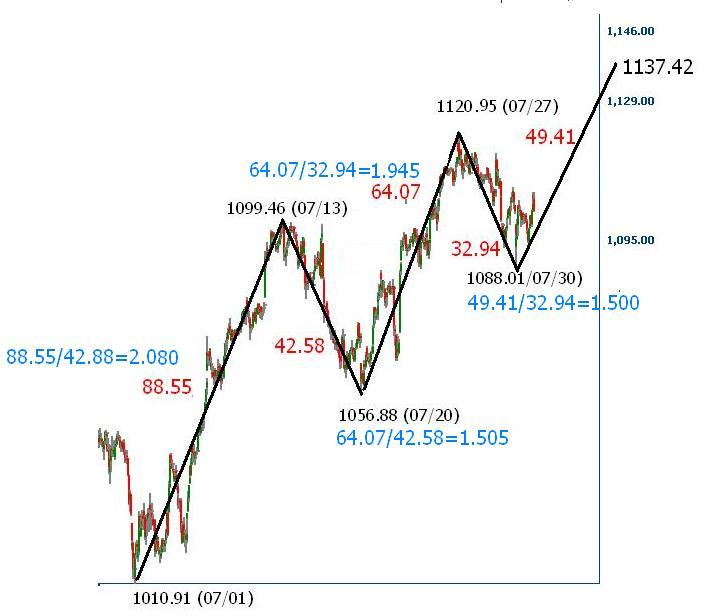

Crafting the rhythms series – 08/01/10

On 07/30, index marked an intraday low 1,088.01, it is about 9 points higher than the reversal gauge 1079.

Since the time window to expect a secondary high is up to 08/10, (2.2PI, 7 trading days from 07/30), the actions in the next few sessions becomes critical, IF index cannot dive below 1079, there is a good chance index may spring up to 1137 due to the following two technical reasons:

(1) 1219.80 – 1040.78) * 0.707 + 1010.91 = 1137.48 [refer to archive Jul 28]

(2) Sometimes the time movement let each segment’s vertical length deploy a simple magic ratios

The following chart depicts a nearly perfect wave ratios (1.5 & 2.0). if ratio 1.5 repeats one more time it will put index at 1137.42.

chart courtesy of www.elliottwavesignals.com

Archives:

Posted on: Jul 31, 10:57 PM

http://indexcalls.co...o...st&p=590394

Races with the Ascending Trend Line.

The (seconday top) time window is up to 08/10, initial trend reversal gauge 1079.

Jul 30, 2010 intraday High 1,106.44 low 1,088.01

Posted on: Jul 29 2010, 09:49 AM

http://indexcalls.co...o...st&p=590043

One important hint is the wave bounced off 1010.91 on 07/01 is still part of the down wave since 04/26. The rally off the 07/01's low travled 0.618 out of [1219.80 – 1040.78] is the evidence that there is no separation yet. However, there is no confirmation the rally since 07/01 is complete.

short term/Intraday support given in the following chart:

chart: http://indexcalls.co...22553_thumb.jpg

Jul 28 2010, 08:57 AM

http://www.traders-t...?...st&p=536701

the index has likely topped on 07/27. The (seconday top) time window is up to 08/10, [1][2][3]. The follow-through actions could be consolidations with resistance zone 1137-1159, initial trend reversal gauge 1079,

chart Jul 8

Fibonacci retracements & waves

1219.80 – 1040.78) * 0.707 + 1010.91 = 1137.48

(1219.80 – 1040.78) * 0.618 + 1010.91 = 1121.54 [07/27 intraday high 1120.95]

On 07/30, index marked an intraday low 1,088.01, it is about 9 points higher than the reversal gauge 1079.

Since the time window to expect a secondary high is up to 08/10, (2.2PI, 7 trading days from 07/30), the actions in the next few sessions becomes critical, IF index cannot dive below 1079, there is a good chance index may spring up to 1137 due to the following two technical reasons:

(1) 1219.80 – 1040.78) * 0.707 + 1010.91 = 1137.48 [refer to archive Jul 28]

(2) Sometimes the time movement let each segment’s vertical length deploy a simple magic ratios

The following chart depicts a nearly perfect wave ratios (1.5 & 2.0). if ratio 1.5 repeats one more time it will put index at 1137.42.

chart courtesy of www.elliottwavesignals.com

Archives:

Posted on: Jul 31, 10:57 PM

http://indexcalls.co...o...st&p=590394

Races with the Ascending Trend Line.

The (seconday top) time window is up to 08/10, initial trend reversal gauge 1079.

Jul 30, 2010 intraday High 1,106.44 low 1,088.01

Posted on: Jul 29 2010, 09:49 AM

http://indexcalls.co...o...st&p=590043

One important hint is the wave bounced off 1010.91 on 07/01 is still part of the down wave since 04/26. The rally off the 07/01's low travled 0.618 out of [1219.80 – 1040.78] is the evidence that there is no separation yet. However, there is no confirmation the rally since 07/01 is complete.

short term/Intraday support given in the following chart:

chart: http://indexcalls.co...22553_thumb.jpg

Jul 28 2010, 08:57 AM

http://www.traders-t...?...st&p=536701

the index has likely topped on 07/27. The (seconday top) time window is up to 08/10, [1][2][3]. The follow-through actions could be consolidations with resistance zone 1137-1159, initial trend reversal gauge 1079,

chart Jul 8

Fibonacci retracements & waves

1219.80 – 1040.78) * 0.707 + 1010.91 = 1137.48

(1219.80 – 1040.78) * 0.618 + 1010.91 = 1121.54 [07/27 intraday high 1120.95]

#30

Posted 02 August 2010 - 01:27 PM

As of 08/02, It is 68 TDs (trading days) from the 4/26 high @ 1219.80. The time window for this secondary high is up to 08/10.Wait just a few more sessions for confirmation. I guess something ties with - 135° August 7, start of autumn ( ZEN: the The Beginning of Autumn, http://indexcalls.co...o...st&p=590358 ).

If the rhythm repeats, the secondary low is at least 54 TDs from 07/01....

High

03/06/09 BASE 0666.79

06/11/09 67TD 0939.04

10/21/09 91TD 1101.36

01/19/10 59TD 1150.45

04/26/10 66TD 1219.80

08/02/10 68?? ???? [to be confirmed]

Low

03/06/09 BASE

07/08/09 85TD 0869.32

11/02/09 82TD 1019.95

02/05/10 64TD 1044.50

07/01/10 101D 1010.91 This low is confirmed as of 07/27

07/27/10 117? this case is Out,

King Wen’s Sequence link

archives:

Sep 7 2009, 01:46 PM

the wave structure since March’s low (09) looks bullish

Jun 5 2010, 06:22 PM

the wave structure in the large scale time frame remains bullish.

the intermediate frame wave structure does not manifest itself

If the rhythm repeats, the secondary low is at least 54 TDs from 07/01....

High

03/06/09 BASE 0666.79

06/11/09 67TD 0939.04

10/21/09 91TD 1101.36

01/19/10 59TD 1150.45

04/26/10 66TD 1219.80

08/02/10 68?? ???? [to be confirmed]

Low

03/06/09 BASE

07/08/09 85TD 0869.32

11/02/09 82TD 1019.95

02/05/10 64TD 1044.50

07/01/10 101D 1010.91 This low is confirmed as of 07/27

07/27/10 117? this case is Out,

King Wen’s Sequence link

archives:

Sep 7 2009, 01:46 PM

the wave structure since March’s low (09) looks bullish

Jun 5 2010, 06:22 PM

the wave structure in the large scale time frame remains bullish.

the intermediate frame wave structure does not manifest itself