Just wondering what you all think

#21

Posted 27 December 2013 - 03:11 PM

Love, be kind to one another, seek the truth, walk the narrow path between the ying and the yang.

#22

Posted 27 December 2013 - 03:17 PM

Hey Z,speaking of value crude is probably the most overvalued com out there.

Oh yeah coffee is cheap hit the levels I told my coffee friends here to watch 1-1.15

Do you have a view on corn? Fundamental wise has a lot going against higher price, however chart looks like we are painint a bottom.

I'm expecting higher prices into this summer on Es after a very fast and furious 15% drop soon. What you don't typically see at a

top is CNBC ratings falling off the charts, lack of mom & pop stock chasers, and low volume on ES/YM...; I think the volume can

be partially explained with the rise and fall of HFT algo driven shops. Quote stuffing rule changes (and selective enforcement) at the

exchanges are putting most out of bussiness.

thks

#23

Posted 27 December 2013 - 03:36 PM

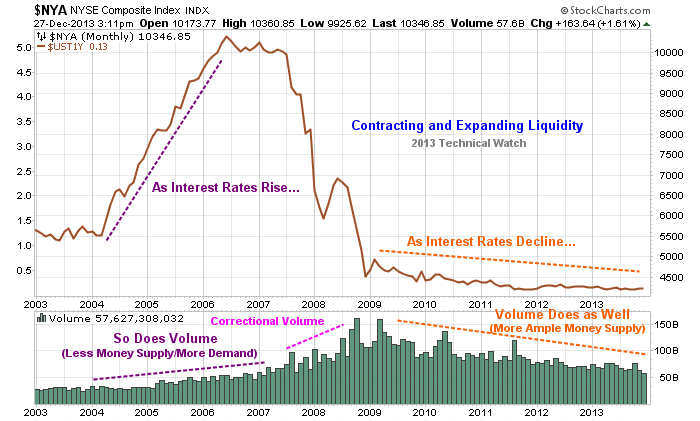

Not at all...much of what you're referring has to do with the liquidity dynamic that's brought on by monetary policies....look at total volume for the run to 2000 and the one to 2007 increasing volume ever year but the top years. You do not think this one is a bit more fishy?

Simple and quick example presented below using the 1 year T-Bill rate in comparison to daily volume on the NYA (which closed at new all time highs on Thursday). As the cost of money becomes more expensive, to wit less available, it takes more volume to keep the advancing price trend moving higher against the weight of the bear market default. As less and less money is available, stocks within an index begin to lose their sponsorship one by one to the point in which the weight is just to heavy to fight the default and prices collapse. So as long as interest rates remain at historic low levels, there is enough liquidity to keep prices rising without the same (volume) effort it would take if this same liquidity flow was taken away.

Think of the space shuttle already in orbit above the Earth. The further away from the gravitational pull of the planet, the less the burst of energy needed to climb to a higher orbit. Take away the fuel (or constrict it), and you begin to decay to the point to where it would take more and more fuel, for longer bursts, to keep a comfortable orbit and re-entering the atmosphere. When the fuel runs out, the decay eventually allows gravity to take over fully, and down you go (that's what happened in 1998 and 2000).

And, yes, it's a process...and it's this same process of which that drives the direction of volatility measures as well.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#24

Posted 27 December 2013 - 03:42 PM

Richard Wyckoff - "Whenever you find hope or fear warping judgment, close out your position"

Volume is the only vote that matters... the ultimate sentiment poll.

http://twitter.com/VolumeDynamics http://parler.com/Volumedynamics

#25

Posted 27 December 2013 - 03:53 PM

Quote stuffing rule changes (and selective enforcement)The problem as I have mentioned is that 70% of the volume in the market is PRICE FIXING.

See Supplemental Liquidity Providers

http://usequities.ny...-equities/types

#26

Posted 27 December 2013 - 04:29 PM

Edited by zoropb, 27 December 2013 - 04:37 PM.

Love, be kind to one another, seek the truth, walk the narrow path between the ying and the yang.

#27

Posted 27 December 2013 - 05:02 PM

Not at all...much of what you're referring has to do with the liquidity dynamic that's brought on by monetary policies....look at total volume for the run to 2000 and the one to 2007 increasing volume ever year but the top years. You do not think this one is a bit more fishy?

Simple and quick example presented below using the 1 year T-Bill rate in comparison to daily volume on the NYA (which closed at new all time highs on Thursday). As the cost of money becomes more expensive, to wit less available, it takes more volume to keep the advancing price trend moving higher against the weight of the bear market default. As less and less money is available, stocks within an index begin to lose their sponsorship one by one to the point in which the weight is just to heavy to fight the default and prices collapse. So as long as interest rates remain at historic low levels, there is enough liquidity to keep prices rising without the same (volume) effort it would take if this same liquidity flow was taken away.

Think of the space shuttle already in orbit above the Earth. The further away from the gravitational pull of the planet, the less the burst of energy needed to climb to a higher orbit. Take away the fuel (or constrict it), and you begin to decay to the point to where it would take more and more fuel, for longer bursts, to keep a comfortable orbit and re-entering the atmosphere. When the fuel runs out, the decay eventually allows gravity to take over fully, and down you go (that's what happened in 1998 and 2000).

And, yes, it's a process...and it's this same process of which that drives the direction of volatility measures as well.

Fib

we are at ZIRP more or less//so at least if a desperate attempt is needed to justify low volume, the fed balance sheet/stock market correlation chart should come to rescue...

this market moved in a quantum mode..that is sudden big spurt and then no price movement....essentially defining an inorganic and weak system that will atrophy when time comes...the means and methods of how it was achieved may be known few yrs from now as matters become public knowledge...

Right now I have posted about the contours of what is likely to happen...and massive assets busts are ahead in the future....(around 2017 +/-)...

#28

Posted 27 December 2013 - 05:09 PM

sure would like to go skiing but i broke my foot last year and I probably should take up golf - but it is toooo boring and demanding in a technical way for my idea of recreational fun!

have fun all and thanks for your thoughts.

klh

That is how I used to think before I took up golf full time after retiring at age 57..

As I got better at the game, it became more and more interesting.

Some of the most beautiful chunks of land I have ever walked on are

the gorgeous golf courses in states like Ohio, South Carolina, Illinois and here in Northwest.

There is a golf course in Cook county, Illinois named Forest preserve National. It is carved

out of a forest preserve, with lots of ponds and trees. It is amazing to play there just

as sun is coming up, the birds are singing and the greens are virgin without trampling.

Every one of the 18 holes are separated from others by trees. You do not see other fairways!

Another amazing course is Cog Hill #4 where pro's play tournament every year. It is public!

Here in NW, I belonged to a high end golf course Royal Oaks for many years and played

every private course in Portland area due to reciprocal playing privileges. All are great!

I am so absorbed for 4+ hours on golf course, I don't even think of anything else!

There is absolutely nothing, I repeat nothing that can hold my interest for 4+ hours.

I am shocked at how great shape I am in 70's because I walk all 18 holes = 6 to 7 miles.

I was pre-diabetic just before retirement, and had mild hypertension. Plus aches and pains.

Now all that is history! Nothing beats walking 7 miles 3 to 4 times a week.

But first you have to break 90 to make golf interesting. It is not the easiest game to

learn and get good at. The best way to get better is to find a companion who is a good golfer

and willing to help. Lessons from pro's is a waste of time and money if you can't break 100.

By the way I did a lot of down hill skiing in my younger years, but don't like cold weather

anymore. I still remember skiing at age 40 on sugar loaf ski area in Michigan when it was

20 below and 25 mph wind! I was a bit crazy then

Edited by pdx5, 27 December 2013 - 05:19 PM.

#29

Posted 27 December 2013 - 06:03 PM

Edited by pedro, 27 December 2013 - 06:06 PM.

#30

Posted 27 December 2013 - 06:17 PM