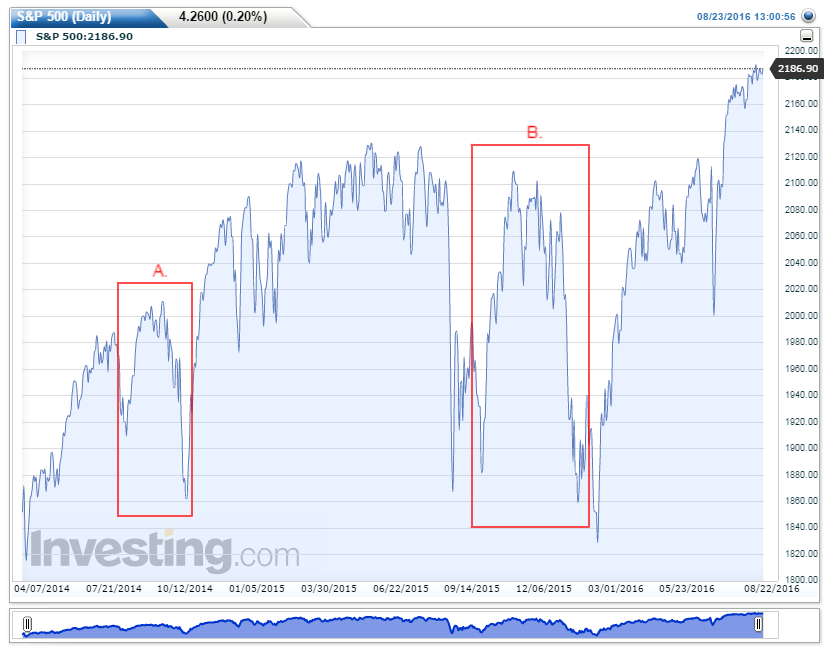

A or B?

dash line in both chart is today's close

A:

B:

Posted 22 January 2016 - 06:26 PM

A or B?

dash line in both chart is today's close

A:

B:

Posted 22 January 2016 - 07:15 PM

why only one?

Posted 22 January 2016 - 07:50 PM

Because only one of them we all know is NOT,

so I can also rephrase it as:

Which one is not the dead cat bounce?

(btw, in A, the lower dash line is my cursor caught in screen shot, the upper dash line in A is today's close)

Edited by iloliway, 22 January 2016 - 07:52 PM.

Posted 22 January 2016 - 08:42 PM

Posted 22 January 2016 - 08:52 PM

Because only one of them we all know is NOT,

so I can also rephrase it as:

Which one is not the dead cat bounce?

(btw, in A, the lower dash line is my cursor caught in screen shot, the upper dash line in A is today's close)

Posted 22 January 2016 - 09:04 PM

looks like he is comparing Oct 2014 to now by the look of those 2 charts.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

Posted 23 January 2016 - 12:04 AM

It has a few unique things going for it. Record option volume on the turnaround day. Pretty darn low sentiment, including AAII although not as highly regarded as before, lots of things. One thing that is interesting about this puzzle is that if oil goes up to like $60, a sh*t ton of the variables are no longer bearish and all of a sudden banks are raking in the dough. Not saying oil will rapidly get to those levels or anything, but oil and the commodities have been in a bear for a while, some commodities even years and years. How long do those bear cycles last? Will commodities starting to rip and enter a bull be a separate move from equities? Will they move in sync?

Posted 23 January 2016 - 01:19 AM

Oil going to 60 here and now portends war between Saudis and Iran.

Doubt that would be bullish

Posted 23 August 2016 - 04:29 PM

looks like he is comparing Oct 2014 to now by the look of those 2 charts.

sorry almost forgot this one, K you have kin eyes too, the point is NEVER JUDGE TOO QUICK, ALWAYS CONSULT WITH HISTORY, even in the thick of and deep of a bear or bull territory.

It's POSSIBLE to predict 7 months down the road using TA LOL !