Sure there will be bounces ...........

This could get worse....

#11

Posted 26 June 2018 - 10:42 AM

#12

Posted 26 June 2018 - 10:55 AM

Sure there will be bounces, but SPX 2750 should be a strong resistance.

#13

Posted 26 June 2018 - 11:57 AM

There will be lots of bear traps...

Yesterday was the bears day...

We are only having a very ANEMIC TURNAROUND TUESDAY here..

Nasdaq Comp needs 7600 to get a paltry .382R

Taking forever.

Meanwhile, back and fill, suck in more shorts all the way up.

Richard Wyckoff - "Whenever you find hope or fear warping judgment, close out your position"

Volume is the only vote that matters... the ultimate sentiment poll.

http://twitter.com/VolumeDynamics http://parler.com/Volumedynamics

#14

Posted 26 June 2018 - 12:13 PM

Initially, I had extreme doubts about the prevalence of BOTS in trading rooms, brokers, investment banks etc but mounting evidence has convinced me that the BOTS have tremendous control on the market direction. Not totally, but I try to keep close to the general trend of the marker as I day-trade, even if that goes against my analysis and intuition. Many times, I don't trade if I am not in agreement with the market direction, sometimes you miss out but that's part of the deal.

The BOTS are now programmed to buy (or defend, same thing) the 50ma and the 2700 SPX level. There are too many BOT buy-the-dip programs but I am not complaining since I follow the trend and don't care who is determining how the market goes.

When the BOTS's stops are hit, be careful!

My longer-term Options trades are partly buy/sell volatility plays and partly to take advantage of extreme moves in the markets, especially QQQ

I also trade VXX to buy/sell volatility but it's difficult to focus on too many trading instruments.

Edited by dTraderB, 26 June 2018 - 12:17 PM.

#15

Posted 26 June 2018 - 12:45 PM

Robots? You must be kidding...![]()

Why look at this perfectly natural action....![]()

Richard Wyckoff - "Whenever you find hope or fear warping judgment, close out your position"

Volume is the only vote that matters... the ultimate sentiment poll.

http://twitter.com/VolumeDynamics http://parler.com/Volumedynamics

#16

Posted 26 June 2018 - 01:17 PM

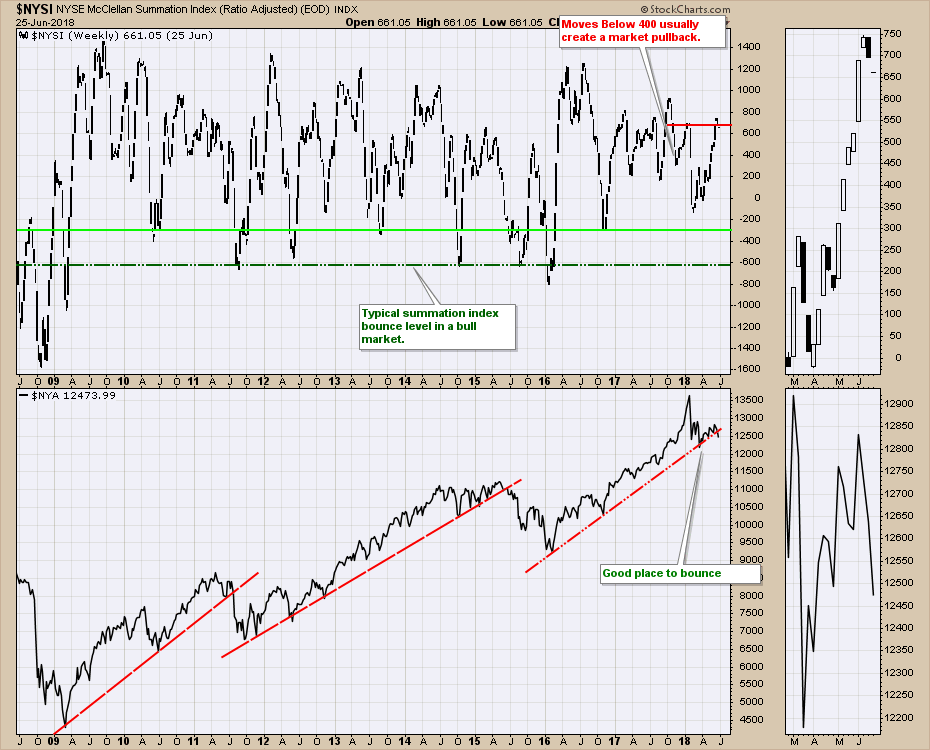

A mere crack or portents of deep fissures ....

$NYA Chart Cracks To Start The Week

Everyone still believes this bull market has a lot more legs. While the large-cap technology stocks dominate the weighting in the big indexes, the $NYA chart has been an important chart for timeliness for the overall picture in recent history. Even more important perhaps is the last two trend lines broke around the end of June.

More at link below chart:

http://stockcharts.c...t-the-week.html

#17

Posted 26 June 2018 - 04:31 PM

Rather weak close but still holding above SPX 2720