Bearish close on Friday in a relatively volatile OPEX session

ST turned short, IT still LONG.

Crash window still open

Very busy.... this could be UGLY later, for either bulls or bears

IT long stop exit @ SPX 2924

ST short exit stop @ SPX 2931.8

Posted 24 September 2018 - 09:21 AM

Bearish close on Friday in a relatively volatile OPEX session

ST turned short, IT still LONG.

Crash window still open

Very busy.... this could be UGLY later, for either bulls or bears

IT long stop exit @ SPX 2924

ST short exit stop @ SPX 2931.8

Posted 24 September 2018 - 09:28 AM

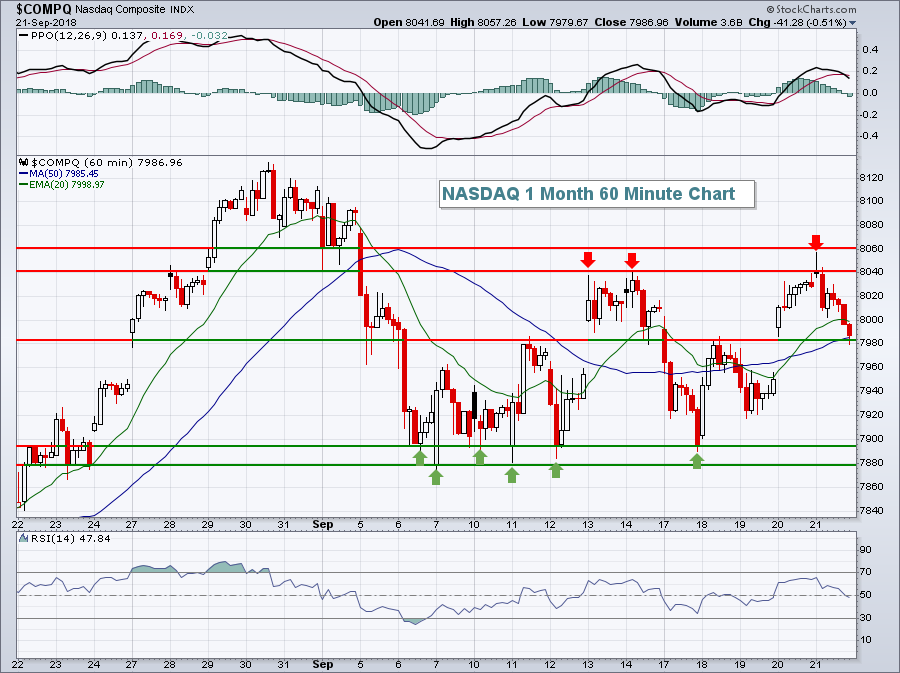

I wouldn't look for money to significantly rotate towards the tech-laden NASDAQ until the 8060 price resistance level breaks. In the meantime, watch short-term price support in the 7880-7900 zone. I fully expect to see NASDAQ stocks have a run higher into Q4 earnings, which start in a few weeks. One more test of the support zone, however, cannot be ruled out.

Keep in mind that the 50 day SMA is currently at 7892 (not shown on hourly chart above). But it's important to realize that if support on this hourly chart is lost, the NASDAQ will also be losing its 50 day SMA support as well. The NASDAQ barely closed beneath that key moving average on July 30th and that was the only time we've seen that since early May. I believe we'll hold this support zone, but I'll definitely need to re-evaluate if I'm wrong.

https://stockcharts....ds-to-hold.html

Posted 24 September 2018 - 09:44 AM

My "Bellweather" for NDX is the infamous AMAT,

If the market takes off, then the "AMAT Train" will be leaving the station, as mentioned repeatedly by Dan "The Greaseman" Niles back in 1999 - 2000 era.

Posted 24 September 2018 - 09:49 AM

Rosenstein rally?

Posted 24 September 2018 - 10:33 AM

JP Morgan's DIMON signals end of buyback policy

Wonder why and who is his REAL audience?

Posted 24 September 2018 - 10:35 AM

basically, I am daytrading QQQ options, NQ, and VXX, today, and last week.

Posted 24 September 2018 - 11:31 AM

The market (represented by SPY) has nearly reached the top of a rising wedge formation, and the VIX has reached the top Bollinger Band on our reverse scale display. There is no guarantee, but there is a pretty good chance that a short-term top is very near. There is also the technical expectation that price will eventually break down from the rising wedge, but not necessarily on the next pullback.

The DecisionPoint Weekly Wrap presents an end-of-week assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds.

https://stockcharts....t-term-top.html

Posted 24 September 2018 - 12:02 PM

Expect more selling in the last hour.............

Posted 24 September 2018 - 01:51 PM

I think they may take it higher today & tomorrow and then dump late tomorrow.

But, that's merely a thought, based primarily on the NQ strength and Trump's kicking the Rosenstein can down the road until Thursday then Friday then .... far far away until after the mid-term

Posted 24 September 2018 - 03:20 PM

A mildly bullish close that does not necessarily guarantee a higher open tomorrow but there is a good probability market opens higher