Maybe, but it will help the bear case if the market rallies another 1 or 2% and then retest last week's lows.

On Friday afternoon, the recognized authority on these matters, JPMorgan's Marko Kolanovic, weighed in on the selloff, and in the absence of a compelling reason to think otherwise, his take should probably be viewed as the definitive assessment. Here is a quick excerpt from Marko's note that explains what happened:

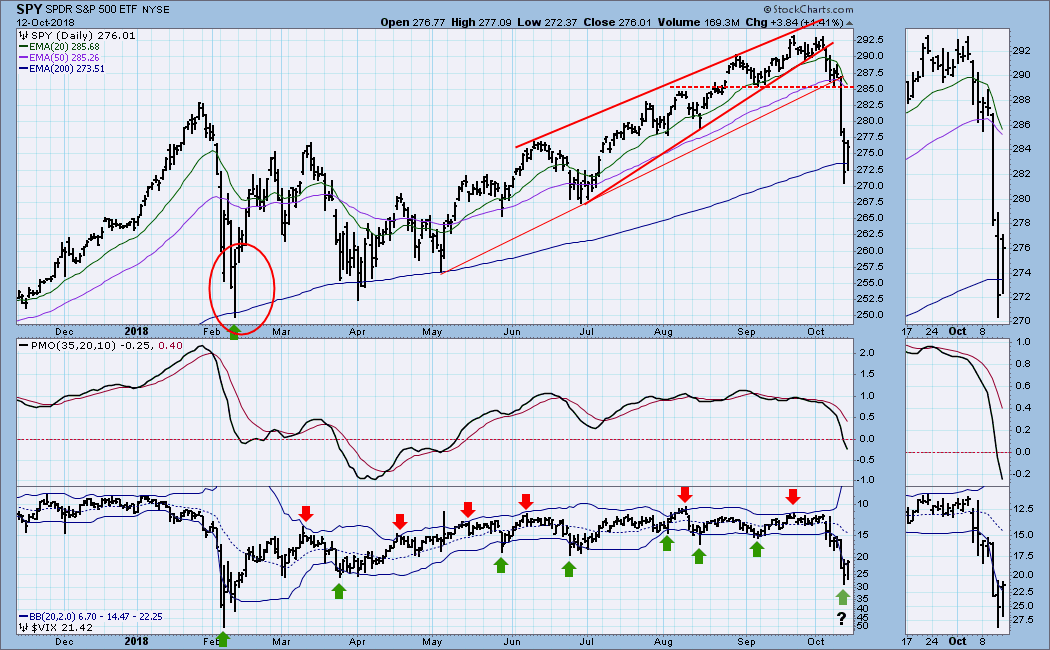

Wednesday’s selloff was largely technical in nature, with systematic strategies following the same selling template as in the Feb 5th selloff. Fundamental fears this time were about rising yields and the Fed’s more hawkish stance. In terms of systematic strategies that drove the selloff – by far the biggest selling pressure was from option gamma hedging on Wednesday.

What you should note about this is that some of it isn't debatable. There's math behind these assessments of systematic selling pressure, so while smart people can argue about "how much" and "who" (where "who" just means which systematic strats were primarily responsible for accelerating the declines), explanations that don't reference these flows are incomplete. Period.

There's some debate about the scope of CTA selling on Wednesday. In a post published here on Thursday, I cited an estimate from Nomura that put the figure at $88 billion. Since then, at least two reputable sources have told me that's not plausible. I don't know the answer, and I'm not going to pretend like I do.

What I do know, though, is that CTAs move quickly, so in the absence of another sharp move to the downside, that source of deleveraging has likely run its course. "[CTA selling] is likely largely behind us given the already low CTA equity beta, and the fact that 12M momentum on S&P 500 will most likely hold positive (>2550)", the above-mentioned Kolanovic wrote, in the same cited note.

So that takes care of option gamma hedging and the trend followers. But that still leaves the vol.-targeting crowd, and as you're probably aware, they are slower moving. This group includes risk parity, a strategy that leans heavily on leveraged bond positions and depends, at least in part, on the preservation of a negative stock-bond return correlation (positive equity-rates correlation). Do recall that a flip in the sign of that correlation was one of the key worries headed into this week.

Long story short, selling from that crowd may continue over the next week (give or take). Kolanovic's assessment is that 70% of the systematic selling is out of the way, with the remainder likely to come from vol.-targeting funds.

On that point, some commentary from Barclays' Maneesh Deshpande began making the rounds on Friday and I want to address it for readers here in a fashion that is devoid of any attempts to overplay things (i.e., in a way that doesn't paint his analysis in a needlessly bearish way).

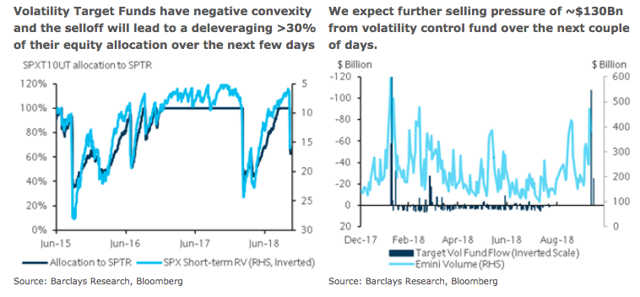

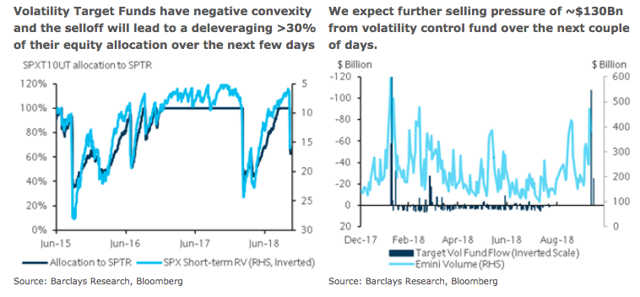

Deshpande, like Kolanovic, notes that the selling on Wednesday and Thursday followed the same template as February. That in part informs Deshpande's contention that another $130 billion in selling pressure from vol.-targeting funds may be in the cards.

Obviously, vol.-sensitive strats will deleverage during a volatility spike (in order to keep overall portfolio volatility steady). As expected volatility rises, they de-risk and while it's not possible to know, across funds, how everyone calculates expected volatility, Deshpande approximates things this way (from a note dated Thursday):

We estimate that the AUM in the Volatility control/Targeting strategies is ~$355Bn. We use the S&P Daily Risk Control 10% index as a benchmark strategy. This index rebalances between S&P exposure and cash to maintain a 10% volatility target. Until the past week the allocation according to the bench mark strategy was 100% to equities. With the sell-off the allocation has been reduced to ~65%.We expect further systematic selling to the tune of ~$130Bn from these funds to reduce allocation to equities over the next couple of days.

In the same note, Deshpande also says some $40 billion in ETF selling could materialize over the same period.

Even if that does materialize, it's important to understand that, as mentioned above, selling from vol.-control funds is slower and takes place over longer windows. In other words, there's time for other flows to offset the selling pressure - flows like buying from discretionary investors and folks hunting for "bargains" amid the drawdown.

That doesn't mean further systematic deleveraging won't lead to a "second leg lower" (as Deshpande suggested in the Thursday note cited above). But it does mean the market may be able to absorb those flows.

In a Friday morning post for this platform, I mentioned that we're in "peak buyback blackout" right now. I thought I was being charitable with that characterization to the extent it offered a ray of sunshine for bulls (i.e., a way to rationalize the Wednesday/Thursday selling and a positive read-through for equities once the blackout rolls off).

Invariably, some readers pointed out that buybacks aren't absent altogether during blackout periods. That's something I mentioned over on my site this week on at least two occasions, but I didn't want to raise it on this platform primarily because had I mentioned it, it would have taken the form of "well, even buybacks weren't enough to save you on Wednesday". But since it's since come up, I'll go ahead and address it.

In his Friday note, Kolanovic writes that going forward, buybacks might be one of the sources of equity demand that helps offset any further deleveraging from vol.-targeting funds. "ASR programs [are] not subject to blackouts", Marko wrote.

Well, on Wednesday, Goldman's buyback desk saw its largest flow since the February rout:

(Goldman)

(Goldman)

This is both good and bad. On the positive side, it means the buyback "safety net" is not completely absent. On the negative side, the fact that it "wasn't enough" (if you will) on Wednesday and Thursday suggests that in the face of rapid systematic deleveraging, there's little that can be done.

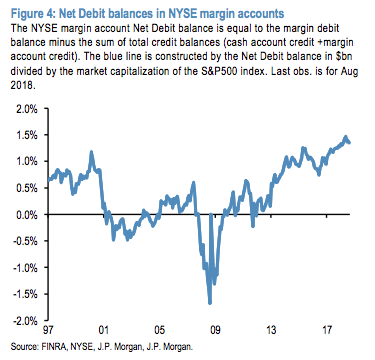

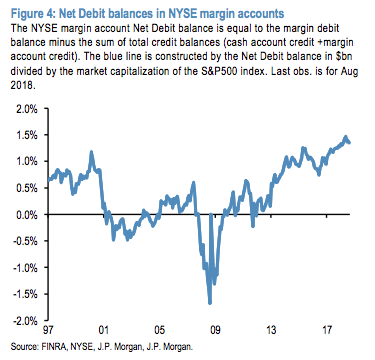

It's also worth noting that on Friday afternoon, in his latest note, JPMorgan's Nikolaos Panigirtzoglou flagged further risks to stocks including still elevated leverage in retail margin accounts and an under-hedged institutional crowd. But his analysis looks less geared towards addressing further pressure from systematic selling and more towards flagging the same set of ongoing risks he usually brings up, including in last week's note when he talked about the exact same margin account balances.

(JPMorgan)

(JPMorgan)

If you're wondering what Goldman thinks, the bank reminded folks on Friday that these types of drawdowns are by no means uncommon and in fact, this one came right on schedule (almost to the day). To wit:

https://seekingalpha...ff-really?ifp=0