This chart worries me a little as its a little to perfect!!

POWELL caved, BULLS on the rampage

#11

Posted 29 November 2018 - 08:46 AM

#12

Posted 29 November 2018 - 08:53 AM

This chart worries me a little as its a little to perfect!!

LOL

It's what has happened so far but I also find it almost text-book

Double bottom with with higher low

consecutive up bars

FED came in at the most opportune moment

game-changing large UP candle

now near the 200ma

and the G20 one trading away

BUT VXX & VIX are not cooperating with the rally, still many doubters, this could be fuel for more rally

Edited by dTraderB, 29 November 2018 - 08:54 AM.

#13

Posted 29 November 2018 - 08:56 AM

Busy morning so far....4 NQ trades

Not to keen to chase the market up, at least not as yet

Prefer a pullback, see how the market reacts to that, and then decide

In December, I usually don't trade as much as the rest of the year.

#14

Posted 29 November 2018 - 09:00 AM

Yeah, want to see VIX drop below 15 before I go in with max position in the rally

Market is still playing defense!

The recent rally of the S&P 500 index off the lows near 2600-2625 is nice but is it sustainable?

The Relative Rotation Graph above shows the rotation of the 11 SPDR sector ETFs against SPY and the message is very clear!

https://stockcharts....ng-defense.html

#15

Posted 29 November 2018 - 09:02 AM

by phil - November 29th, 2018 8:47 am

Wow, what a comeback!

Wow, what a comeback!

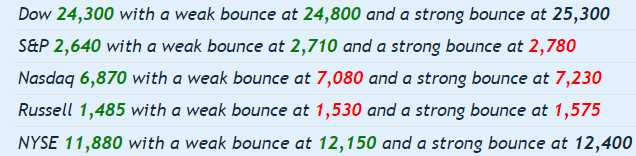

Fed Chair Jay Powell said some words and the market jumped up over 2%, adding $2Tn to the global market cap in a matter of minutes. He should say those words every day, right? Actually, he didn't have to say anything as the Dow (/YM) began rising from 24,900 (already up from 24,800 at 5am) at 11am to 24,950 at noon – before the text of Powell's speech had even been released and, by 12:05, we were already up around 25,200 and we continued on to a high of 25,370 at the close, up 600 points for the day (2.4%).

The market's exuberance hinged essentially on a single sentence from Powell's speech:

"Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy--that is, neither speeding up nor slowing down growth. "

Rather than focusing on "still low by historical standards" the media chose to focus on the much vaguer "just below the broad range of estimates" which shows a complete lack of understanding of what a range is – whether intentional or otherwise. Fortunately, we know exactly what range Powell is talking about as it's the Fed's famous "Dot Plot" that shows exactly what the range for rate expections is among the 12 Fed Governors.

As you can see from the chart of Sept 26th, the RANGE of the expectations is from 2.25%-2.5% at the end of 2018 (we're at 2.125% now) but the RANGE next year is between 2.25% and 3.75% and, by 2020 – there is only one outlying dot that shows 2.25% while the middle of the range is about 3.25% – that's 4 quarter-point hikes from now.

Also, not at all covered by the media – Powell also had slides (as well as 14 other pages of text) and he was also concerned about the massive increase in Corporate Debt, now well above the economic collapse levels of 2009 and matching the post-crash levels of 2002. The difference was, in 2002 and 2009 the Fed was able to LOWER rates significantly to reduce the stress of outstanding Corporate Debt but, without…

#16

Posted 29 November 2018 - 09:09 AM

This chart worries me a little as its a little to perfect!!

LOL

It's what has happened so far but I also find it almost text-book

Double bottom with with higher low

consecutive up bars

FED came in at the most opportune moment

game-changing large UP candle

now near the 200ma

and the G20 one trading away

BUT VXX & VIX are not cooperating with the rally, still many doubters, this could be fuel for more rally

Lol!!! I think if the market makes it through the weekend we could see a rally into year end, time will tell....

#17

Posted 29 November 2018 - 09:17 AM

Semiconductor stocks often lead the S&P 500 on the way up and down.

Global trade tensions have pummeled shares of semiconductor companies like Advanced Micro Devices, Micron Technology and Nvidia. More pain may still be to come.

Investors are looking to the G-20 summit that starts Friday for updates on trade policy, and any further pressure on chip stocks could spell more trouble for the broader market.

The S&P 500 and the semiconductor group have moved in similar directions in recent years since the pair had a correlation of 0.94 at the beginning of 2016, when chip stocks began their steady ascent, according to FactSet.

Correlation is measured on a scale of minus-1 to 1. A reading of minus-1 means two assets are moving perfectly in opposite directions, while a correlation of 1 means they are moving perfectly in tandem.

The PHLX Semiconductor Index has tumbled 9.9% from the start of October as semiconductor shares have been caught in the crosshairs of escalating China-U.S. trade tensions. Their products are used in several hot areas of growth: data centers, gaming and artificial intelligence.

Despite a 31% slide since Oct. 1, AMD shares are still the S&P 500’s best-performing stock this year, with a gain of 108%. Micron shares have tumbled 14% from the beginning of last month, pushing them into the red for the year with a decline of 5.9%. And Nvidia shares, which have lost 43% of their value since early October, have plunged more than 20% in the past two weeks alone.

The PHLX index has underperformed the broader S&P 500, which has shed 5.8% since the beginning of last month. The sector, though, has gotten some relief this week, with the PHLX index rising 2.3% Wednesday.

More clarity about their path going forward should come after President Trump’s trade talks with Chinese President Xi Jinping in Buenos Aires.

#18

Posted 29 November 2018 - 09:19 AM

More FED-speak

Will they try to talk back some of the dovishness

Key Events

U.S. jobless claims, out at 8:30 a.m. ET, hit a nearly five-decade low in September but have been inching up since. Economists expect 220,000 for the latest week, down slightly from the previous reading of 224,000.

U.S. personal income and consumer spending for October, due at 8:30 a.m., are both expected to increase 0.4% from the prior month.

The personal-consumption-expenditure price index excluding food and energy for October, released at 8:30 a.m., is expected to increase 1.9% from a year earlier, showing scant sign of inflation pressure.

U.S. pending-home sales, issued at 10 a.m., are expected to rise 0.3% from a month earlier.

Natural-gas stockpile figures are scheduled for 10:30 a.m. Analysts expect inventories to have fallen by 74 billion cubic feet in the week ended Nov. 23, per the average projection of 10 analysts, brokers and traders surveyed by the Journal.

Minutes from the Federal Reserve's last policy meeting are posted at 2 p.m.

Fed speakers: Boston Fed President Eric Rosengren kicks things off at an economic development conference at 2:05 p.m. Cleveland's Loretta Mester, Chicago's Charles Evans, Philadelphia's Patrick Harker, Minneapolis's Neel Kashkari and Dallas's Robert Kaplan are all set to participate in the event.

#19

Posted 29 November 2018 - 09:20 AM

As far as the market, one thing to note is that the indexes essentially closed at the 61.8% Fibonacci retracements from the Nov 7th highs to last week's lows. Lately that 61.8% Fib has been an important one. We'll see what happens tomorrow. Generally after a big rally day you get an inside day. The best thing for the 'bulls' in the short term would be for the market to not have a big retracement, more than 50% of today's candle range - taking back more than 50% of today's candle range would be bearish.

Matt

#20

Posted 29 November 2018 - 09:23 AM

In other news, the Bank of England warned that sterling could drop by 25%, house prices could crash by 30%, and interest rates could go as high as 5.5% in the event of a no-deal Brexit.

Haha! See what I did there?

Markets know well enough by now to ignore the haverings of Nostradamus Carney over at the BoE.

But the soothing tones of Jerome Powell at the Federal Reserve? That’s quite another matter.

As Michael Purves of Weeden & Co told Bloomberg: “We’re talking about getting back into Goldilocks here. Mediocre growth with a friendly Fed.”

It looks as though the Santa Claus rally is on

What does this mean for investors? I would think that we’re gearing up for the Santa Claus rally to be on.

To be clear, I don’t think this should make any odds to your investment strategy. Unless you’re a short-term trader then you really shouldn’t worry too much about what US stocks are going to do over the next month or so.

And I am still struggling to believe that 2019 is going to be good for markets. I think the key difference between my bearish view and most people’s bearish view, is that most are still concerned about deflationary forces and a major slowdown, which I think is a red herring.

Instead, I reckon the risk is that inflation will kick in hard, and then after a possible initial bout of euphoria, investors will realise that the game is up.