Looking to buy a few stocks for LT

https://www.barchart...ws?timeFrame=3m

https://www.barchart...gs?timeFrame=3m

Posted 08 March 2019 - 06:46 AM

Looking to buy a few stocks for LT

https://www.barchart...ws?timeFrame=3m

https://www.barchart...gs?timeFrame=3m

Posted 08 March 2019 - 08:25 AM

Bought QQQ pre-NFM report to try to bank some of this decline

Still holding 31 QQQ JUN puts after closing 9 yesterday

Posted 08 March 2019 - 08:51 AM

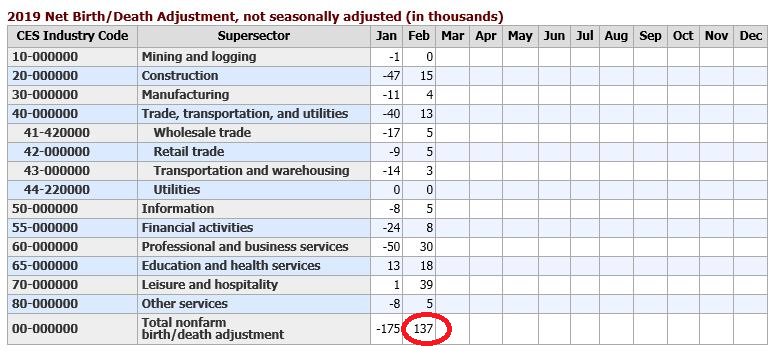

Would have been a disaster today, but the BLS B/D model rescued them, adding 137,000 jobs...

Posted 08 March 2019 - 09:46 AM

Taking off the big RUT position down here...we are right at the hourly 900 now on the futs...

I love rising wedge breaks...seems like they sometimes take forever to get started, but man does it come fast once they get started!

If RUT futs bust the hourly 900 then this could get super ugly...but odds favor a bounce here....

Edited by K Wave, 08 March 2019 - 09:47 AM.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

Posted 08 March 2019 - 10:41 AM

hectic day

this market could collapse and crash today or next week.

Posted 08 March 2019 - 12:55 PM

Trannies back testing the big round number level....also conjunction of daily 50 over 72 MA crossover...

Edited by K Wave, 08 March 2019 - 12:55 PM.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

Posted 08 March 2019 - 01:12 PM

There is a critical point in a down market, that moment of realization by bulls that it's not coming up back today or tomorrow or longer... rush to the exit follows, aka crash

Not saying that moment is now but it could happen in this current market condition

On the other hand, there could be many who missed out on the 2019 rally and want to buy at these lower levels.... if there are enogh such buyers who have more motivation that those who want to get out, then this market can reverse today.

Posted 08 March 2019 - 02:01 PM

The key in today's data was the 0.3% drop in the index of aggregate hours worked to a 3-month low. Even if you love the HH survey, who cares how many bodies get hired when they’re twiddling their thumbs and watching the clock (it sure is nice to get paid for doing nothing)?

An old Merrill pal tipped me off that cheerleader Kudlow called for a recession in May/16 when NFP came in at +38k. Ahhh...the difference between being a TV host when Obama is in charge and being in the WH under the "alternative facts" DJT regime.

Not to mention that over 90% of the HH job gain last month came from those with no high-school education. Not exactly a harbinger of great productivity growth to come.

The Household survey did show a 255k pop but that only offset the 251k plunge in January. So netting out the government shutdown effect, Household employment growth is flat so far this year.

Of course, the same cheerleaders who were gushing over the nonfarm payroll headline in January conveniently turned their attention to the household survey today (as Larry Kudlow just did).

Lol... It's all good Brother!

" “There is only one side to the stock market; and it is not the bull side or the bear side, but the right side” Jesse L. Livermore

Posted 08 March 2019 - 03:38 PM

BREAKING: FBN: China's Xi has just removed a trip to US/Mar-a-lago to see @realDonaldTrump .