But LARRY is doing all he can to create excitement and close Q1 with a bang!

White House advisor Larry Kudlow says Fed should 'immediately' cut rates

This is a developing news story. Please check back for updates:https://www.cnbc.com...tes-report.html

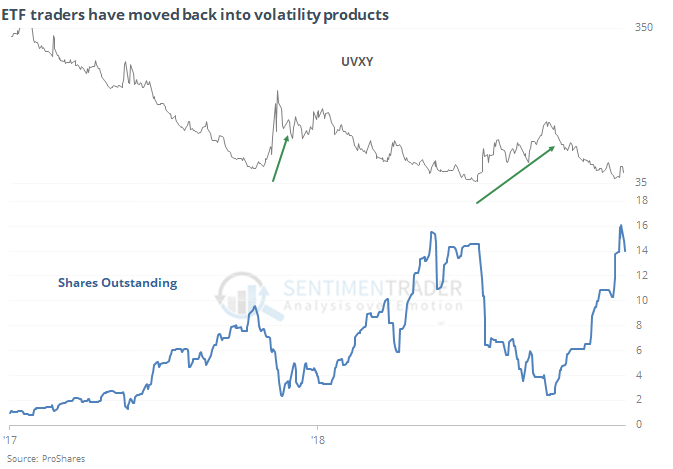

LOL.. My system is already back on a buy signal... It's all just noise to me Brother. However, I'm VST trading VXXB and he could cause me to break even or lose some Beer Money on my current trade "IF" he talks enough Bull crap to those that will listen. It's been many years since I had CNBS or any other channel on when I'm trading. How many guesses did you make, or did you read this week in the forums? LOL...Probably 100's is my guess.... Did any of them make you money VST or MT trading? Time for lunch. Good luck if you are VST trading because it really is gambling. I'm a very good gambler and I play Black Jack! LOL...No SLOTS!

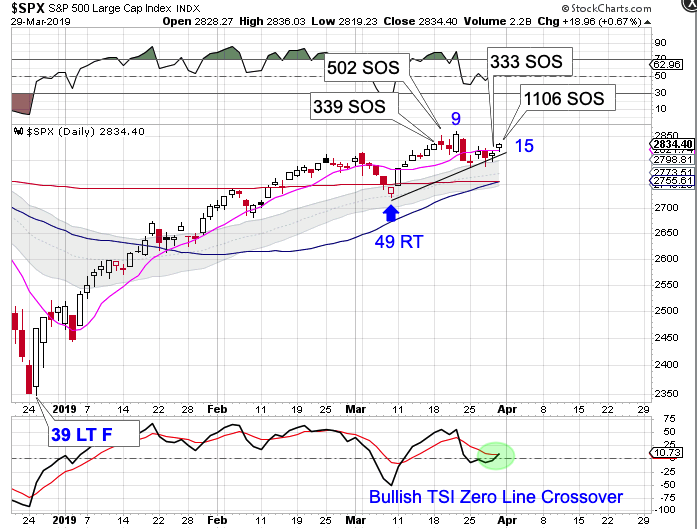

I'm about even for the day so far..... VXF is still making a lower high and I see NO BEEF! What comes? I don't guess, but I'm back on a buy signal for now.... That could change by the close.... I don't care since I go from VXF to cash and there is NO CHARGE on my trades.... Make all the guesses you want on what will happen in 2020 and 2021... That goes for all you silly rabbits based on the current market setup... Risk/Reward is just not there for me, but trend traders just don't care!

Trend traders wait patiently for prices to tell them a trend has begun. Then they jump on board. If the trend fails, they exit quickly to control losses. Price tells them when to enter "and" when to exit. If the trend continues, trend traders have no predetermined profit goal. They stay with the trend until it reverses.

Cutting losses quickly and staying with a trend until it ends is how trend traders realize huge profits in the financial markets. The financial markets are trending "about" 80% of the time. That means trend traders are profitable 80% of the time. During the other 20% trend traders keep losses very small so that they are ready when the next trend starts.

This does not mean 80% of their trades are winners, just that they are in the plus column for that 80%. If you have three losing trades of 2% and one winning trade of 18% in a year, you finish with a 12% gain, even though most trades were losers. This fits the old saying, "cut your losses short and let your winners run."

Conclusion

Remember that "price" is determined by millions of investors and traders.

By using price, trend traders take advantage of the combined wisdom of millions of investors and traders to trade a successful and profitable market timing strategy.

Yes, it takes patience to be a successful trend trader. Yes, it takes discipline to follow the strategy and make the trades, which many times go against the prevailing wisdom. This is true of "all" winning market strategies.

But trend traders who use price to determine trends have been quietly "beating" the markets for many years. They will quietly continue to do so for many more.

https://www.fibtimer..._commentary.asp

Edited by robo, 29 March 2019 - 01:38 PM.