You can read why he concludes this, at the the link below.

Conclusion

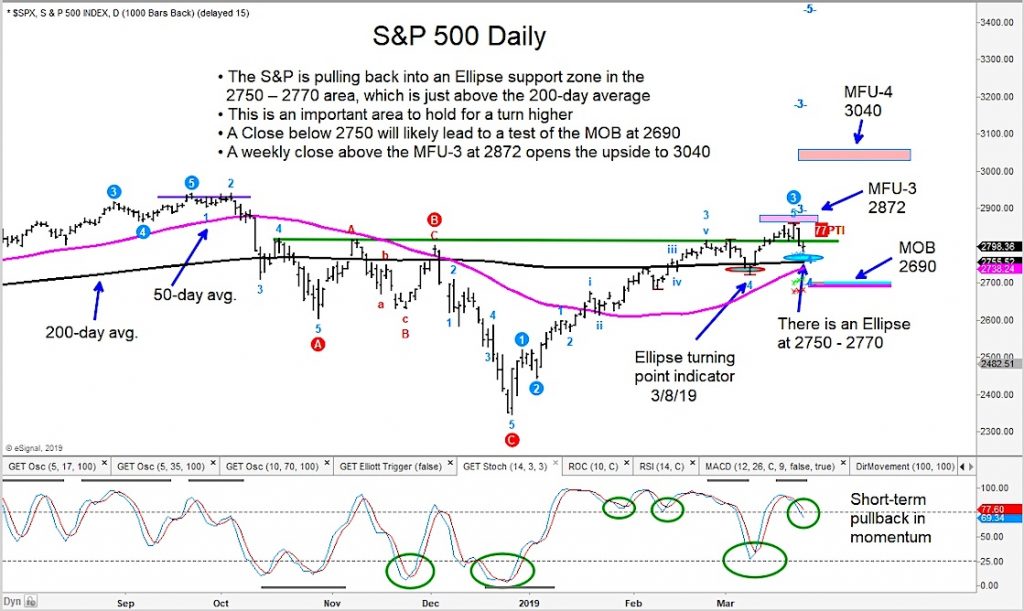

We are seeing slow global economic growth in many regions. The bond market is starting to price in rate cuts, earnings estimates are being revised downward, and I think it is unlikely that the U.S. consumer will be able to pick up the slack given the statistics seen in housing and other credit data.

I expect we will start to see the macro factors come through in 2019 reported earnings. Given the fact that valuations are still elevated, the risk reward on the downside looks far more attractive than on the upside. I have consequently started to short the S&P 500 where the global data points can surprise even more to the downside.

It is certainly possible that the Fed can cut rates or return to quantitative easing with force, to boost the market. But I think we are unlikely to see that until the equity market has had a more significant correction.

https://seekingalpha...-look-appealing