Guestimate for monday

#1

Posted 05 January 2007 - 04:20 PM

#2

Posted 05 January 2007 - 04:39 PM

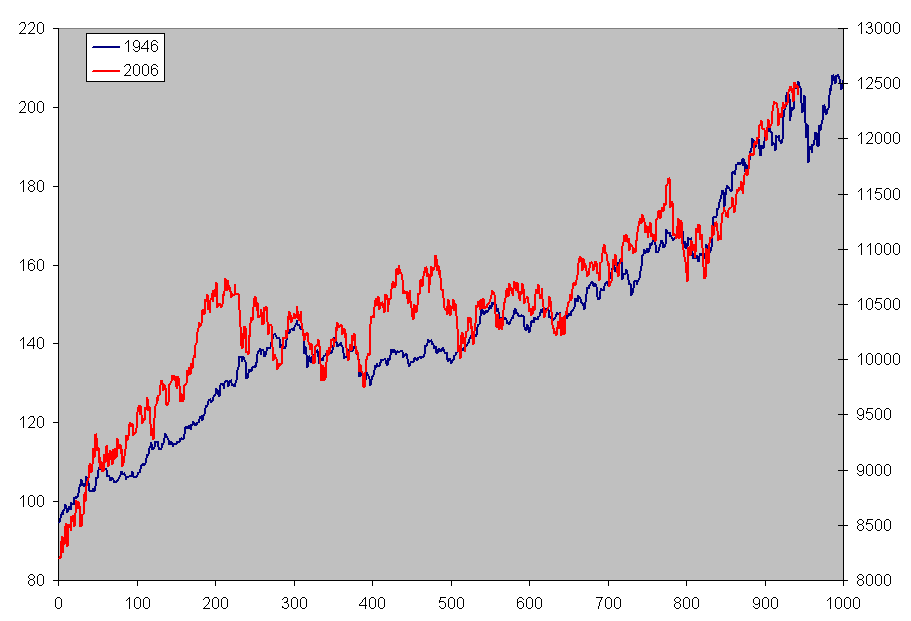

36 model also predicts down, but not as far down as this, and is a lesser slide.

No COT report today due to reduced trading, so can't tell where the large traders are. Guess is they're unloading still and will likely finish up in 2 weeks when many will be short. Then comes the scorch up on breadth problems is my guess.

#3

Posted 05 January 2007 - 05:34 PM

#4

Posted 05 January 2007 - 05:47 PM

I think just the opposite.

We may gap down into 1410/1405 area (ESH7) then up for the rest of the day till tuesday

Guessing is free, but useless unless you have a reason why it will unfold that way.

As I explained, the gap up is to close today's gap. And following the breadth, sentiment, and 36, 46 models, I'm still seeing multi week downslide, hence why I predict more down for monday. So I gave at least a madness to my guesses.

#5

Posted 05 January 2007 - 06:21 PM

#6

Posted 05 January 2007 - 06:33 PM

#7

Posted 05 January 2007 - 06:57 PM

#8

Posted 05 January 2007 - 07:02 PM

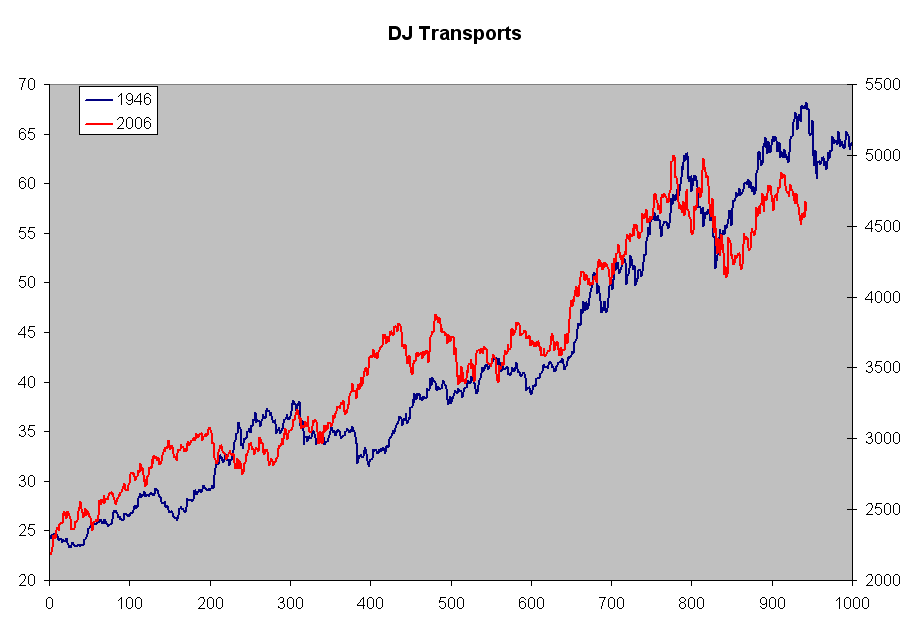

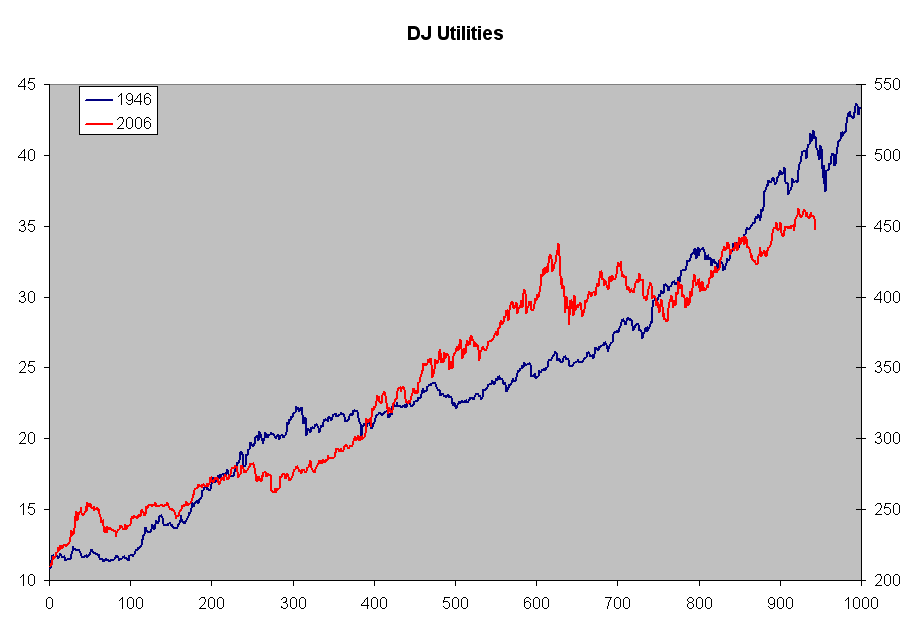

dcengr....I really like your comparison charts, do you generate those or do are they available from a website ?

Thanks

I generate them using Excel.

#9

Posted 05 January 2007 - 09:28 PM

#10

Posted 05 January 2007 - 09:33 PM

very nice work.

Thanks for your feedback.

Np.

I'm guessing someone wrote some software to do this automatically, so I'll look for that as well.

I'm still interested in getting a copy of Paul Tudor Jones DVD where more of his methods are described. I'm sure he uses more than just price correlations to map direction... I do know for a fact he uses sentiment (he subscribes to practically all newsletters out there).

He does use fundamentals, but I'm not sure how...