Edited by alysomji, 15 August 2009 - 01:12 AM.

This Wall Will Take at Least a Bit of Time to Get Through

#1

Posted 15 August 2009 - 01:10 AM

-Scott O'Neil (son of William O'Neil), Portfolio Manager at O’Neil Data Systems, when asked where the Dow would go in the coming months

#2

Posted 15 August 2009 - 01:24 AM

Keep Calm and be Long

My opinion on markets, or anything, is a health hazard. Follow or fade at your own risk!

#3

Posted 15 August 2009 - 01:50 AM

Edited by alysomji, 15 August 2009 - 01:52 AM.

-Scott O'Neil (son of William O'Neil), Portfolio Manager at O’Neil Data Systems, when asked where the Dow would go in the coming months

#4

Posted 15 August 2009 - 02:14 AM

Thanks again and good luck.

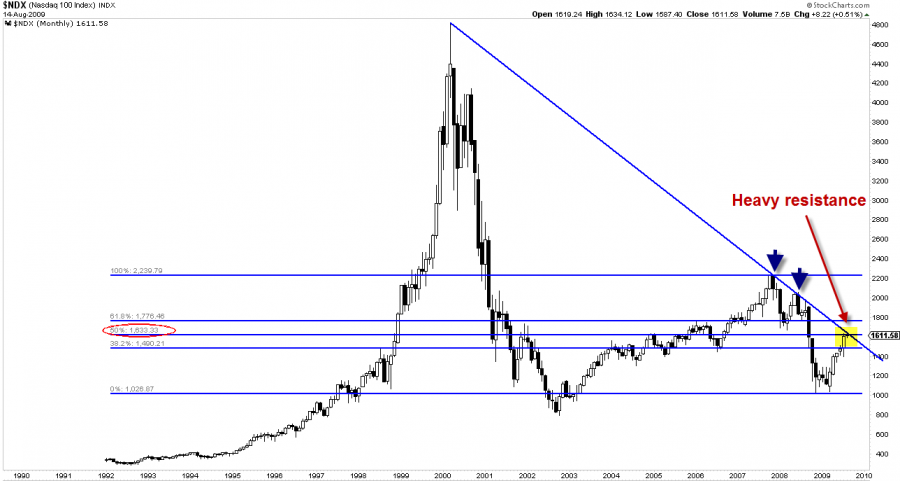

Based on the fact that the S&P and Dow have not yet retraced even 50% of their decline from late 2007 to March of this year (only at 38% so far), and that the typical post-crash retracement is 62% and in rare cases 50% (notice Nasdaq above is at 50%), and the fact that the Dow has a high-probability head-and-shoulders pattern on its weekly chart indicating a measured move to close to 11,400 (or 10,680 if you factor in likelihood of reaching measured move), etc.

Well, you can see, it's likely to me we break through that trendline, even before factoring in all the internal indications of a bull market I've come across, all suggesting that there should be more to this cyclical bull market than just what we've already seen (also keep in mind cyclical bulls typically last a minimum of one year). However, it's possible the Nasdaq could also decouple from the Dow and S&P, to allow the Dow and S&P to reach their 50-62% retracements, while Nasdaq starts drifting lower. I see this as a pretty low probability scenario, however.

At this time, regardless of the seemingly odds above of breaking through the trendline, one must be open-minded and also keep in mind that if the trend line is going to be broken, it may take some longer than anticipated tossing and turning. Nothing goes straight up. This could be the first real impediment for this rally.

To me, NDX has led this rally and will likely also lead the end of it, so it should be watched very closely.

Keep Calm and be Long

My opinion on markets, or anything, is a health hazard. Follow or fade at your own risk!