So much opportunity for downside abuse under 125...

Today's Forecast for XAU:

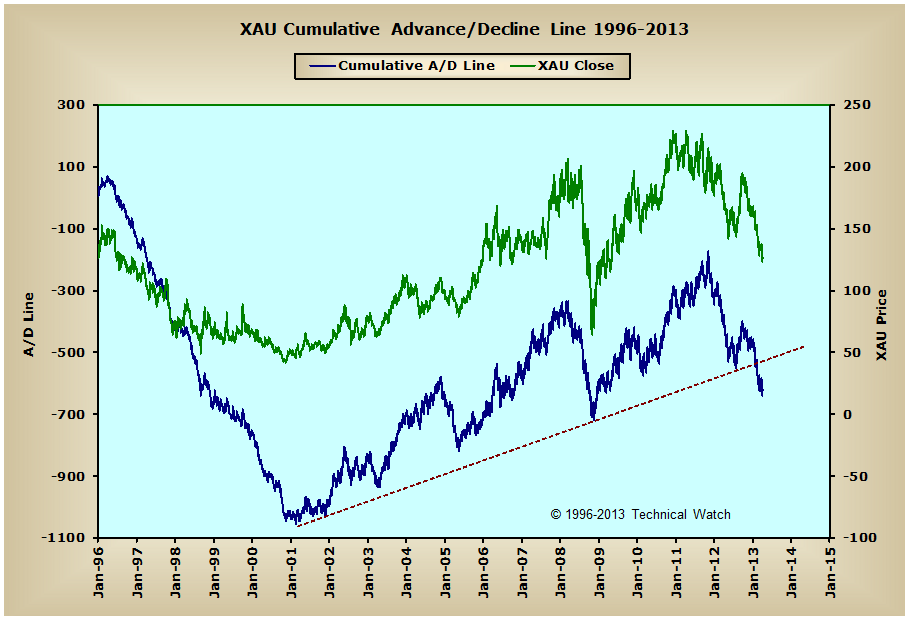

XAU collapsed again on Wednesday, fell under the July 2009 Low of 125 with a low of 122, closing at 123.24 or down another 5.46 on the day. So this was a very ugly close for the XAU, and as previously discussed here, we think this can drop all the way from here to 108-113. That doesn't mean we won't see a bounce though. Short term resistance now 125, 128, 131 and support at 121, 118, 116, 113. More insights premarket.

Premarket:

Volume exploded to the downside on Wednesday as XAU crashed and burned with more than 50% of the previous session's elevated volume. Can't touch these gold stocks now until we see a sign of strength.

See Key XAU Pivot here from July 2009 at 125.81

http://bigcharts.mar...&mocktick=1.gif

Not only is nomimal XAU price below 2009 low, but also, $XAU:$GOLD (when Gold was under $700), and the ratio now @8% is the lowest in history, including the inception of the Gold bull market, when Gold was $275 AND at the lows of 1941, after the Pearl Harbor attack.

In every instance when the $XAU:$GOLD bottomed, a very substantial rally ensued.

http://stockcharts.com/freecharts/gallery....;XAU:$GOLD

I liken the now ratio of 8% as a long term call option on the price of GOLD, as obviously Miners profits are tied to GOLD.

And anecdotally, the 8% ratio to Gold, is like having the VIX at 8 (when the all time low is 10) for the SPX, except that the term duartion is not 3 month, but long term, as the Miners produce Gold in perpetuity.....kinda like a put option on the SPX with a 20% lower premium that the all time low on the VIX of 10. (10-8=2 divived by 10-20%)....with the SPX at all time highs.

Something has to give to bring reversion to the mean in that XAU:GOLD ratio......GOLD to 1200, 1300, 1400.? What then would be the XAU ratio to Gold be....5%.....are their proven and probable reserves near worthless.? Already they are valued at the lowest since 1941 when compared to the prevailing price of GOLD.

Can they go lower.? sure, if GOLD goes lower than 1500. But it may not be a timely speculation, just as shorting the VIX may not be at 8.

For a bear on the Miners, it may be a better trade to short GOLD by buying the inverse GOLD etf, like GLL.

http://stockcharts.c...allery.html?GLL on the assumption that GOLD will catch up to the downside with the Miners.

Often when a historic low or high is bettered, it is a bear or bull trap....like the INDU high in 2007 over the 2000 High was a bull trap.

Similarly, the recent XAU low taking out the 2009 low, may very well be a bear trap, as all stop loss orders were triggered.....volume yesterday was climatic at over 40 million shares...and over 5 million in NUGT, including my measely 50 share purchase....LOL