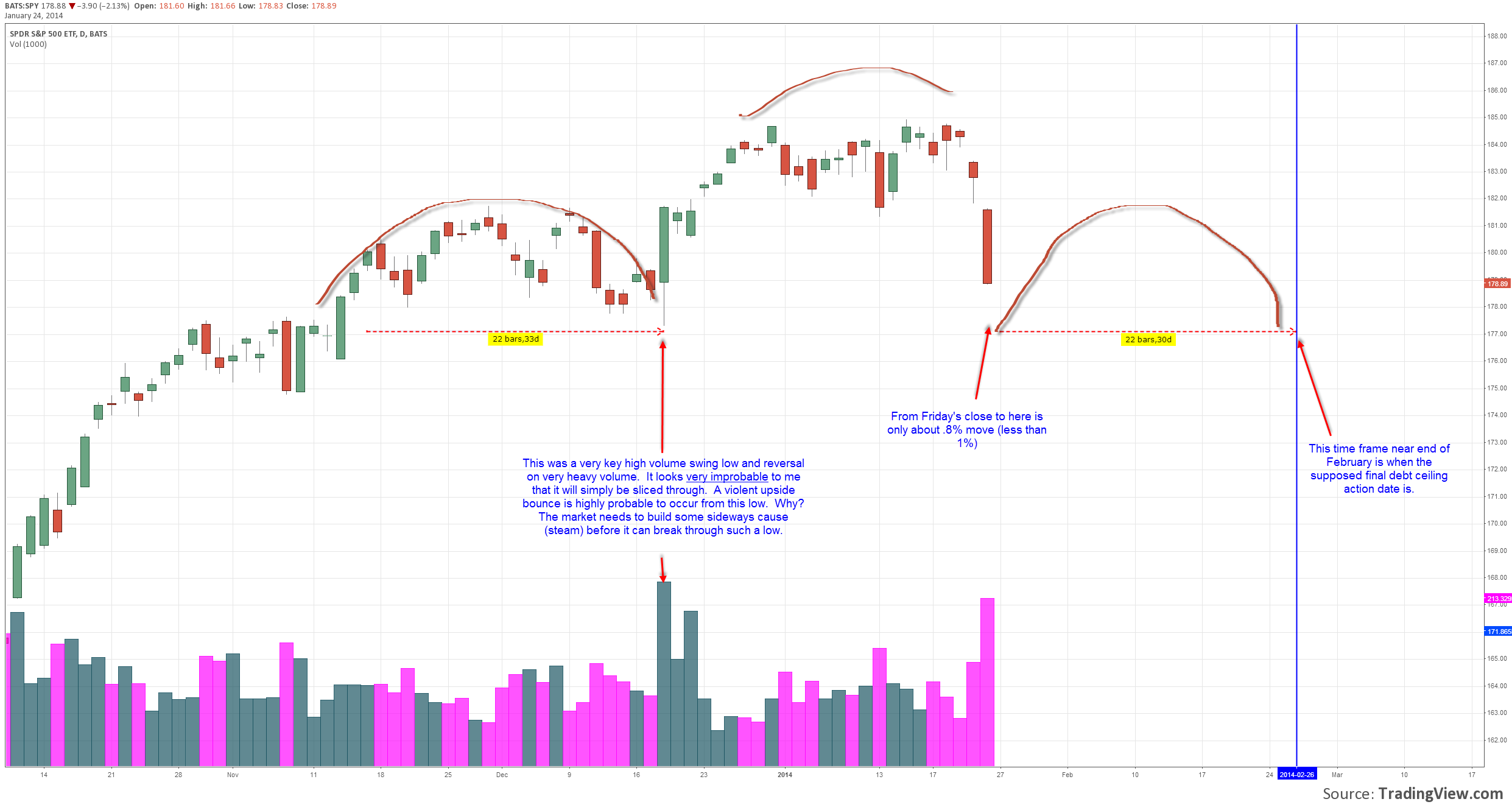

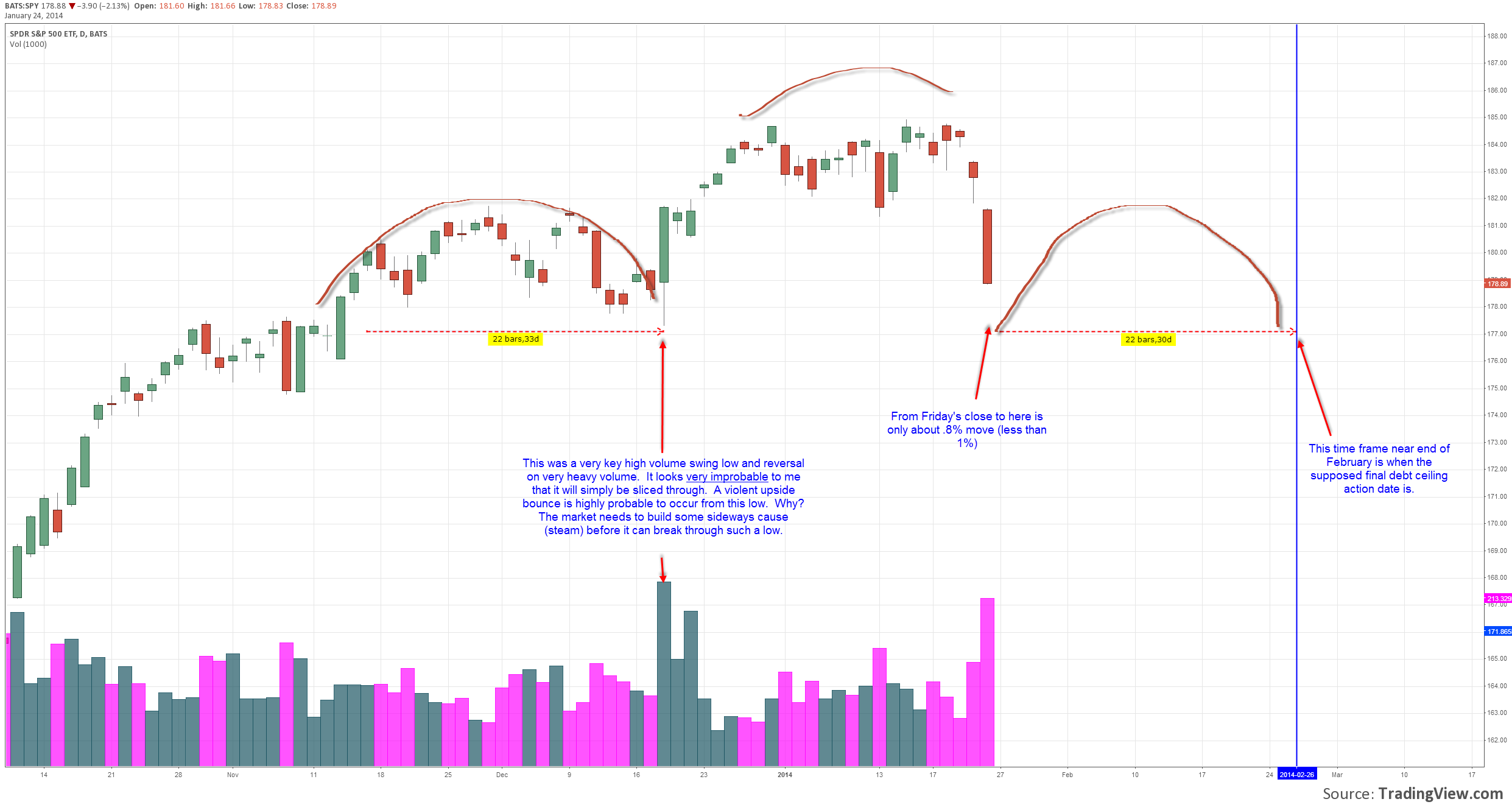

All of my projections have a confluence around 1760. This is where we will see a pretty decent bounce. I still have projections up to 1830-1840 for early February. The operators are more than likely to try to save the first decline, it always happens that way. We barely begun to correct now. I am bearish for the IT with projections as low as 1680-1700 zone, however the volatility is not going to be one way.

The strongest timeline for a short term low in my work is around Monday and especially on Thursday, perhaps the day of the Fed day possibly. You would think Fed will say something soothing to trigger some sort of short covering rally, or not enough and we sell and bottom that day for a short term low (LOL)...

I have 2/7-2/10 as a top and 2/13-2/18 as a bottom, cyclically and statistically. Probably a consolidation or a strong bounce and then more down into February. The 2/7-2/10 is especially dangerous. Notice also that SPX closed outside of the 3rd standard deviation of 20 dma. This is usually where you get a bounce or a crash. As bearish as the outlook is, I honestly still do not expect a crash, however I will not voice any opposition to the crash callers, it can happen as the bull is literally collapsing under its own weight. Fed is really cornered too...

I am willing to catch the falling knife though if the market gives us an easy entry by overdoing what it is doing right now, it is already getting excessive, but it was already excessive on the upside at SPX 1850.

Best of luck in your trades...

SPX 1760 - mid week?

Started by

arbman

, Jan 24 2014 07:12 PM

4 replies to this topic

#2

Posted 24 January 2014 - 08:01 PM

last I looked, the market hasn't followed any rules in a long time...why does it have to start now? expect the unexpected.

#3

Posted 24 January 2014 - 08:42 PM

I am looking for 177.32 on the SPY to hold the market firm. I am not sure what that equates to on sp500. But 177.32 is only about .8% more down from where we closed today. Then maybe be open minded to some whipsaw action for a couple weeks or even a good part of February.

#4

Posted 24 January 2014 - 11:11 PM

last I looked, the market hasn't followed any rules in a long time...why does it have to start now? expect the unexpected.

Astute observation!

Today's decline was small in larger context of how far the market has ascended.

I do not expect any major correction until March at the earliest. When Margin calls

begin going out, only then you might see serious fireworks. Until then just

bouncing up and down around 1800 as pivot point.

Edited by pdx5, 24 January 2014 - 11:14 PM.

"Money cannot consistently be made trading every day or every week during the year." ~ Jesse Livermore Trading Rule

#5

Posted 25 January 2014 - 01:50 AM

Very much in agreement with all of you, but I also don't think this time is much different...