thank you excellent technical analysts; i benefit from your work.

fwiw: my current hypothesis is that the market will not provide a worthwhile swing tradable turn until Price moves above the 50dma for a few days and the 50dma turns up and maybe even the 200dma turns up.

please alert me when any of those happen, as i do not follow them closely.

a portion of the fast $$$ sitting on the sidelines will come into when/if that happens. many swing trade funds use those ma's, though with different filters, such as a requirement that Price be above the XXX/YYdma for Z days.

anyway, i do not expect an explosion when we/if get above these, just a steady rise as the $$$ flow in.

imho: this scenario is a sine qua non for the next tradable decline, whenever and whereever that may start.

comments?

Edited by humble1, 15 December 2008 - 03:47 AM.

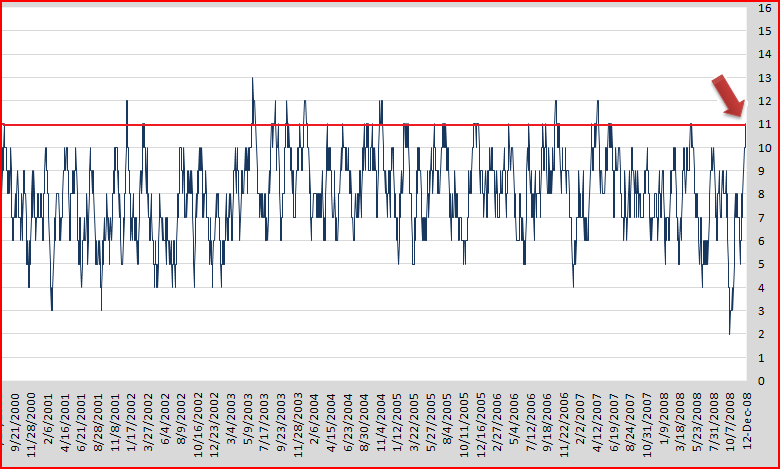

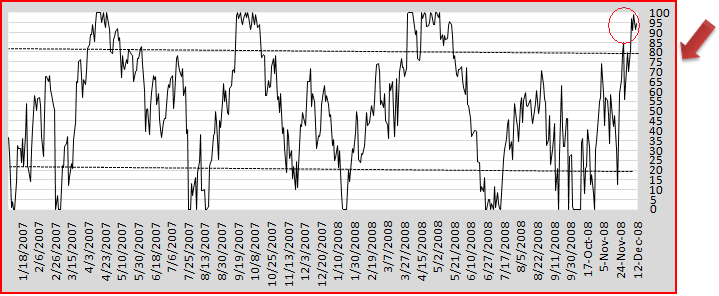

Market weakness could start immediately, although several up days are possible which will then lead to several down weeks into Christmas. Note the area where previous reversals took place.

Market weakness could start immediately, although several up days are possible which will then lead to several down weeks into Christmas. Note the area where previous reversals took place.