Our T-4 Turn Indicator went out at 40, again, which is well awayfrom a signal. Typically we want to see readings above 80 or higherbefore we look for worthwhile turns. This indicator doesn't catch everytop and bottom, but it is a great "Heads up!"indicator.

Options Sentiment

Daily P/C ratio: 0.90. Neutral.

10-day P/C ratio: 0.81. Sell.

Equity P/C ratio: 0.55. Weak Sell.

OEX PC ratio (not a fade): 1.71. Sell.

OEX 10-day PC ratio: 1.23. Neutral.

OEX $-weighted* P/C ratio: 1.19. Neutral.

NDX $-weighted* P/C ratio: 1.55. Neutral.

QID (Ultra Short QQQQ) P/C ratio: 0.53. Sell.

SDS (Ultra Short SPX) P/C ratio: 0.25. Weak Buy.

ISEE Sentiment Index: 122. Neutral. The big drop was Bullish.

10-Day ISEE Sentiment Index: 135. Caution. (H/T to persistentsubscriber)

Relative VIX: Neutral.

Daily VIX: Neutral.

The options data are a bit Bearish for the market, especially the OEXP/C. I'd have expected more Bearishness and that's a problem. MarketHarmonics' Options Buyers Sentiment Gauge (thank you, Tony Carrionhttp://www.market-harmonics.com)is just a bit away from a Sell.

The ISEE Sentiment Index indicator is contrarian; traditionally, over200is too optimistic, under 100 is too pessimistic. *$-weighted P/C datacourtesy of Fari Hamzei ofwww.hamzeianalytics.com .Readings over 2.0 are Bullish and near 0.5 are Bearish. OBSG providedbyTony Carrion of Market Harmonics.

General Public Polls

AAII reported 39.09% Bulls and 44.55% Bears vs. 42.14% Bulls and40.00% Bears last week. That's a drop in Bullishness and a solid riseinBearishness. This is back in Buy territory. No Bear marketlikely.

Investors Intelligence reported 46.70% Bulls and 24.40% Bearswhich is just outside of Sell Territory. Less Bulls than last week, butthat's it. Not much help. Last week they had 47.80% Bulls and 24.40%Bears.

Mark Hulbert's HSNSI shifted up to net long 45.2%. TheNasdaq advisors moved to 50% long well up from 28.6% long net long twoweeks ago. That's somewhat Bearish overall.

Lazlo Birinyi's site, Tickersense, reported 33% Bulls and 27%Bears. That's nearly dead even, which often bring selling, near term.Ithas no import longer term.

Last week, TheStreet.com poll has readings of 56.7% Bulls and34.2% Bears. This is a big Bullish lean, and it may signify a problemforthe market..

TSPTalk reported 55% Bulls and 35% Bears. That's technically aBuyby their new measures but I view it as somewhat Bullish, though notextremely so. Still, more Bulls than we've seen recently and yesterdaythere were many more. They are now using their Bull MarketFilter.

Conclusion

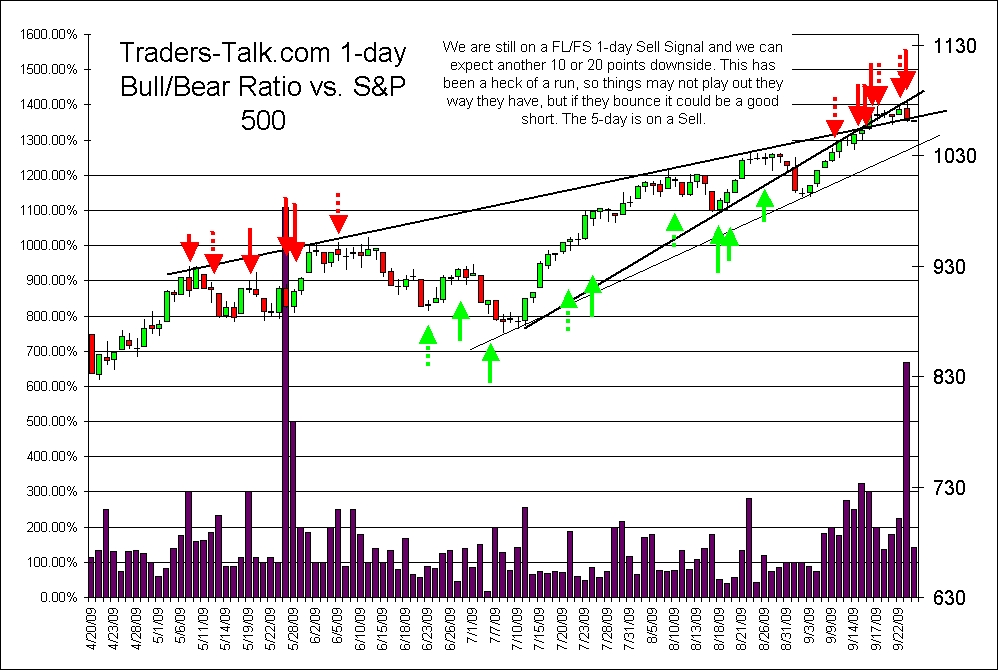

Last time, I said that the wild Message Board sentiment need not bemajor market movers by itself and that we must trade them only withconfirmation, be it volume or price or money flow, or probe small atwellestablished resistance points. Yesterday, the market rallied right uptoresistance after the Fed thing and died. Now, the back of the rally hasbeen broken, short term, so we can look for another 10 or 20 poitnsdownside, at least. We just want to be careful in a market that hasbeenthis strong. The first pullback will get bought. After that is spent,however, we can probably get some more selling. It will be imperativetowatch the sentiment over the next few days, if we get some moreweakness.Bearishness should rise quickly. If it doesn't, we're in trouble. Thegood news is that AAII showed increased Bearishness on just one day ofdecline. Near term, with caution and on the short side is how to playthis market, but intermediate-term investors should not be shorting byany means until there is good reason.

We are on twitter and we offer comments and trade updates throughouttheday as we have time or as we see sentiment of interest. You can followusathttp://twitter.com/WallStSentiment.

The Mechanical Senticator Model and the Subjective Senticator Modelwillboth sit flat this week. Remember, these models must trade in thedirection of the Senticator or not at all.

We are looking for motr pullback. Since we've been publishing our STSentiment Signals, we've had 130 trades and 87 winners.

Ideal ETFPortfolio (trackingportfolio):

25% QLD at 34.30

50% QID at 33.21

25% QLD at 26.09

Past performance is no guarantee of future returns. All informationincluded in this missive is derived from sources we believe to bereliable, but no guarantee can be made to that effect. None of theforgoing should be construed as an offer or solicitation to buy or sellany security. The publisher may have a long or short position in thefunds or securities discussed at any given time. We aren't youradvisor,unless you have a signed contract with us. Please review any trade thatyou do with your trusted advisor FIRST.

Note that we are publishing on our private area on Traders-talk.com,providing on-line access to our charts and research.

http://tinyurl.com/sentimentology You'll need to register and sign in on Traders-talk and you'll need anadditional password to access the board. If you are a subscriber andyoudo not have a password, please contact us

For more on using Wall Street Sentiment and the various sentiment dataincluded, click here:

Editor

859-393-3335

818-MARKETS