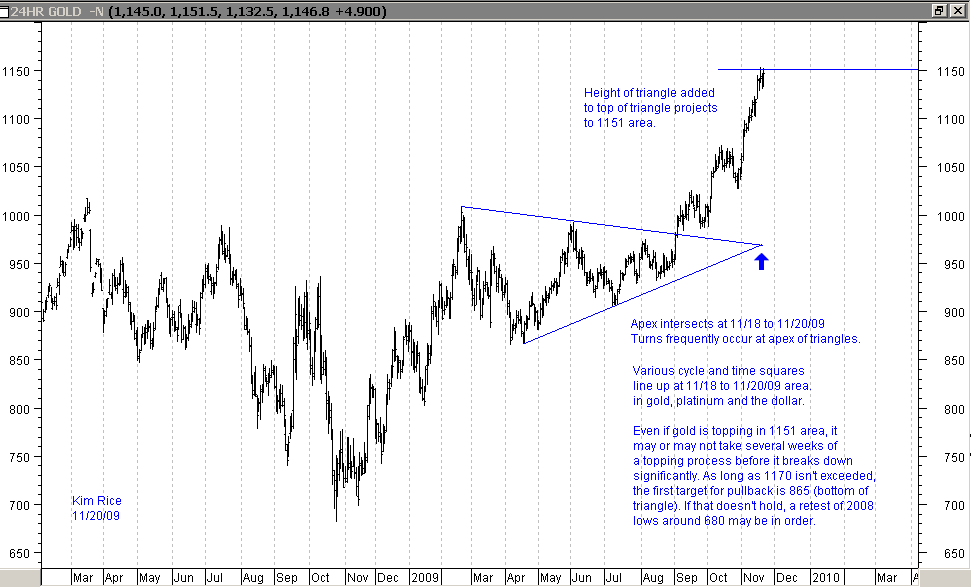

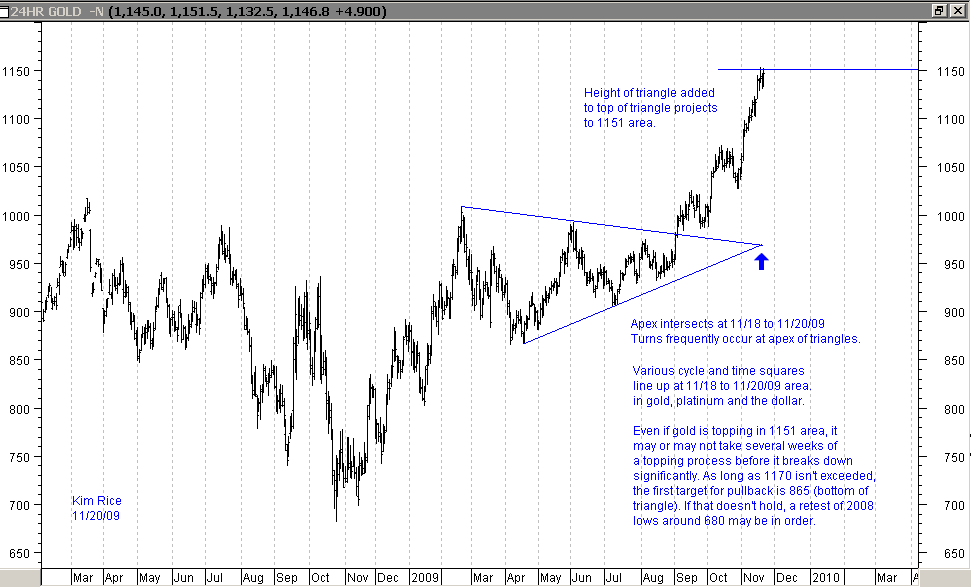

I bought a moderate position in April calls on GLL (double short gold) on the close 11/20/09. Even if the current blow-off continues, history shows that parabolas are fully retraced. We'll see if it's different this time.

Kimston

Posted 21 November 2009 - 02:47 PM

Posted 21 November 2009 - 07:18 PM

Posted 21 November 2009 - 10:03 PM

thanks Kimston: as far as i can tell very few are prediciting such a stepp pullback: most thinking that 1000 is the proven floor in here, with chinese and indian buying plus the large hedgies like paulson

your view is refreshing: and we all remember how your last major short foray was a home run

Posted 22 November 2009 - 11:08 AM

Edited by JGUITARSLIM, 22 November 2009 - 11:10 AM.

Posted 22 November 2009 - 12:35 PM

thanks Kimston: as far as i can tell very few are prediciting such a stepp pullback: most thinking that 1000 is the proven floor in here, with chinese and indian buying plus the large hedgies like paulson

your view is refreshing: and we all remember how your last major short foray was a home run

Posted 22 November 2009 - 07:45 PM

go ahead trade on sentiment!thanks Kimston: as far as i can tell very few are prediciting such a stepp pullback: most thinking that 1000 is the proven floor in here, with chinese and indian buying plus the large hedgies like paulson

your view is refreshing: and we all remember how your last major short foray was a home run

Dougie,

When I shorted the 2008 top in gold, I recall getting stopped out twice for fairly small losses before catching the move down. Picking the top of a blow-off move is very difficult but also very profitable once the market peaks and collapses. One has to plan on it taking several tries when dealing with a lot of leverage. I think I got stopped out three times in the crude oil blow-off before that market collapsed. So far on the current gold rally I've been stopped once and wouldn't be surprised at all if I get stopped out several more times. The 1151 area is just a projection point where a turn may occur. I also have projections in the 1210 area, 1350 area, and Jguitarslim has a projection to 1500 that may or may not get hit.

I think I agree with J that this may just be a pullback into Dec with potential top next year. Mid Jan to early Feb of 2010 shows up as very important timing for a potential top (which may be higher, lower, or a double top) in my work.

Lastly, 97% bulls is the highest reading ever recorded in the Daily Sentiment Index for gold. However, the top in the bond blow-off last December registered 99% bulls for 2 weeks before that market ultimately peaked and collapsed. So the sentiment can get more extreme, but it is dangerously high right now.

Kimston

Posted 22 November 2009 - 08:09 PM

go ahead trade on sentiment!thanks Kimston: as far as i can tell very few are prediciting such a stepp pullback: most thinking that 1000 is the proven floor in here, with chinese and indian buying plus the large hedgies like paulson

your view is refreshing: and we all remember how your last major short foray was a home run

Dougie,

When I shorted the 2008 top in gold, I recall getting stopped out twice for fairly small losses before catching the move down. Picking the top of a blow-off move is very difficult but also very profitable once the market peaks and collapses. One has to plan on it taking several tries when dealing with a lot of leverage. I think I got stopped out three times in the crude oil blow-off before that market collapsed. So far on the current gold rally I've been stopped once and wouldn't be surprised at all if I get stopped out several more times. The 1151 area is just a projection point where a turn may occur. I also have projections in the 1210 area, 1350 area, and Jguitarslim has a projection to 1500 that may or may not get hit.

I think I agree with J that this may just be a pullback into Dec with potential top next year. Mid Jan to early Feb of 2010 shows up as very important timing for a potential top (which may be higher, lower, or a double top) in my work.

Lastly, 97% bulls is the highest reading ever recorded in the Daily Sentiment Index for gold. However, the top in the bond blow-off last December registered 99% bulls for 2 weeks before that market ultimately peaked and collapsed. So the sentiment can get more extreme, but it is dangerously high right now.

Kimston

while i agree we are in resistance

selling short the prevailing trend is no way to get rich

take a look @the forbes 400

1300 by the 1st quarter, your #s are very imaginative.

when the broads top, there will be a correction and i suspect that happens next year

all the best

dharma

Posted 22 November 2009 - 08:10 PM

go ahead trade on sentiment!thanks Kimston: as far as i can tell very few are prediciting such a stepp pullback: most thinking that 1000 is the proven floor in here, with chinese and indian buying plus the large hedgies like paulson

your view is refreshing: and we all remember how your last major short foray was a home run

Dougie,

When I shorted the 2008 top in gold, I recall getting stopped out twice for fairly small losses before catching the move down. Picking the top of a blow-off move is very difficult but also very profitable once the market peaks and collapses. One has to plan on it taking several tries when dealing with a lot of leverage. I think I got stopped out three times in the crude oil blow-off before that market collapsed. So far on the current gold rally I've been stopped once and wouldn't be surprised at all if I get stopped out several more times. The 1151 area is just a projection point where a turn may occur. I also have projections in the 1210 area, 1350 area, and Jguitarslim has a projection to 1500 that may or may not get hit.

I think I agree with J that this may just be a pullback into Dec with potential top next year. Mid Jan to early Feb of 2010 shows up as very important timing for a potential top (which may be higher, lower, or a double top) in my work.

Lastly, 97% bulls is the highest reading ever recorded in the Daily Sentiment Index for gold. However, the top in the bond blow-off last December registered 99% bulls for 2 weeks before that market ultimately peaked and collapsed. So the sentiment can get more extreme, but it is dangerously high right now.

Kimston

while i agree we are in resistance

selling short the prevailing trend is no way to get rich

take a look @the forbes 400

1300 by the 1st quarter, your #s are very imaginative.

when the broads top, there will be a correction and i suspect that happens next year

all the best

dharma

Posted 22 November 2009 - 08:13 PM

Posted 22 November 2009 - 08:28 PM

i thought you were experienced! and you are.go ahead trade on sentiment!thanks Kimston: as far as i can tell very few are prediciting such a stepp pullback: most thinking that 1000 is the proven floor in here, with chinese and indian buying plus the large hedgies like paulson

your view is refreshing: and we all remember how your last major short foray was a home run

Dougie,

When I shorted the 2008 top in gold, I recall getting stopped out twice for fairly small losses before catching the move down. Picking the top of a blow-off move is very difficult but also very profitable once the market peaks and collapses. One has to plan on it taking several tries when dealing with a lot of leverage. I think I got stopped out three times in the crude oil blow-off before that market collapsed. So far on the current gold rally I've been stopped once and wouldn't be surprised at all if I get stopped out several more times. The 1151 area is just a projection point where a turn may occur. I also have projections in the 1210 area, 1350 area, and Jguitarslim has a projection to 1500 that may or may not get hit.

I think I agree with J that this may just be a pullback into Dec with potential top next year. Mid Jan to early Feb of 2010 shows up as very important timing for a potential top (which may be higher, lower, or a double top) in my work.

Lastly, 97% bulls is the highest reading ever recorded in the Daily Sentiment Index for gold. However, the top in the bond blow-off last December registered 99% bulls for 2 weeks before that market ultimately peaked and collapsed. So the sentiment can get more extreme, but it is dangerously high right now.

Kimston

while i agree we are in resistance

selling short the prevailing trend is no way to get rich

take a look @the forbes 400

1300 by the 1st quarter, your #s are very imaginative.

when the broads top, there will be a correction and i suspect that happens next year

all the best

dharma

Ignorance of sentiment will not be bliss when a prevailing trend turns into a blow-off followed by a full retracement. In my 30 years of trading stocks and commodities, some of my biggest windfalls have been from identifying blow-off patterns and the sentiment that inevitably comes them, and then shorting via options. The prevailing trend was up for gold into Mar 2008. I stopped out of a few attempts at shorting futures, but started accumulating puts in Feb and made over 400% on that trade. I may be early on this one as well, but I think the April puts will probably be enough time. Targets of 1210, 1350, 1500 and probably higher are fair game if we match the crude oil blow-off. As I mentioned it's a moderate size trade. I'm more focused on getting short the broad market with Sep and Dec 2010 puts for a position trade.

party on....

Kimston