Looking for a big deflation scare

#1

Posted 17 June 2010 - 03:35 PM

The future is 90% present and 10% vision.

#2

Posted 17 June 2010 - 05:39 PM

#3

Posted 17 June 2010 - 08:12 PM

#4

Posted 17 June 2010 - 08:27 PM

I wonder....

Edited by SemiBizz, 17 June 2010 - 08:29 PM.

Richard Wyckoff - "Whenever you find hope or fear warping judgment, close out your position"

Volume is the only vote that matters... the ultimate sentiment poll.

http://twitter.com/VolumeDynamics http://parler.com/Volumedynamics

#5

Posted 17 June 2010 - 10:53 PM

http://www.traders-t...howtopic=119619

cheers,

john

#6

Posted 18 June 2010 - 08:27 AM

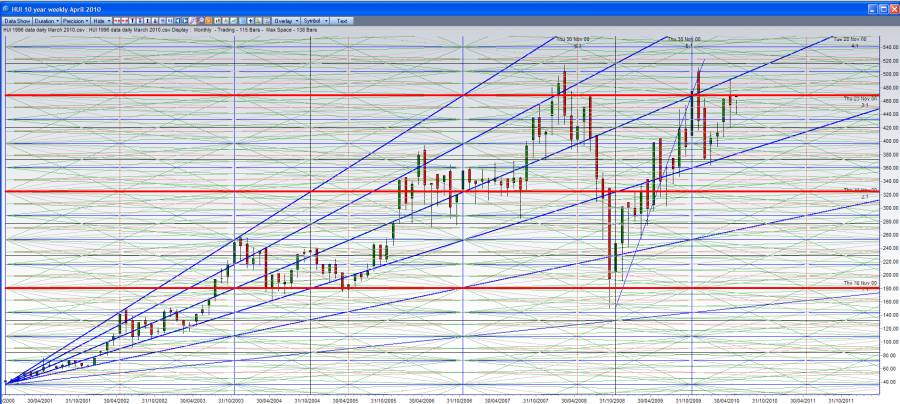

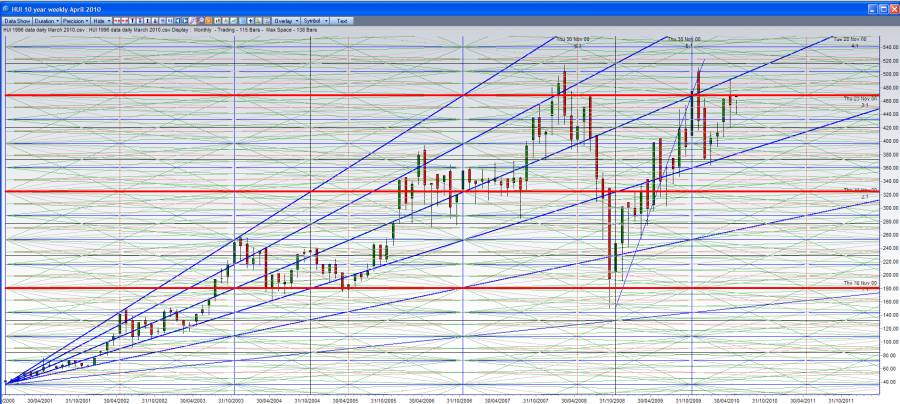

Not sure why you are thinking negatively on gold for a deflation scare. All I know is that a 4.5 and 9 year low was made earlier this year or as early as Nov. 2008. Take a look at what gold did out of the 2001 low, then the summer 2005 low (more of a consolidation actually). If we were to get a sizeable correction later this summer, I'll be adding to holdings.

http://www.traders-t...howtopic=119619

cheers,

john

Thanks John, I like your work. I am waiting fo rthe good entry, but sure a top in the next few weeks. Perhaps we see a blow off first.

Watching.

The future is 90% present and 10% vision.

#7

Posted 18 June 2010 - 08:38 AM

Edited by SilentOne, 18 June 2010 - 08:42 AM.

#8

Posted 18 June 2010 - 08:46 AM

Hi John,Gold and the HUI put in a new 15 week cycle low May 21. A 3.5 week low was made June 14th. The 4.5 and 9 year lows are behind us. I plan to add again at the next 15 week low. Last add was mid-May, prior to that Feb/March. As long as the major cycle lows are behind us, you add at cycle lows and ride it. GL/GT

cheers,

john

Your next 15 week low..would that be around the end of Sept? Thanks

Irene

#9

Posted 18 June 2010 - 08:59 AM

Please let me know your thoughts on summer trading. Positive seasonals only kick in by August, but long term cycles may overwhelm seasonals this year.

cheers,

john

Please let me know your thoughts on summer trading. Positive seasonals only kick in by August, but long term cycles may overwhelm seasonals this year.

cheers,

john

Edited by SilentOne, 18 June 2010 - 09:05 AM.

#10

Posted 18 June 2010 - 10:07 AM

Hi John,hi Irene,

The next 15 week cycle low could be as early as mid-August and could stretch into Sept. A 7/8 week cycle low is due early mid-July, which could be another cycle low buy.

I should point out that the last 15 week cycle (Feb. 5 - May 21) was extremely bullish and very right translated.

The key level to watch is HUI 467. I have posted in the past that monthly closes above this level confirm a new range and a breakout for the HUI and XAU is imminent.

Please let me know your thoughts on summer trading. Positive seasonals only kick in by August, but long term cycles may overwhelm seasonals this year.

cheers,

john

i agree with you on August. Merriman said back in Dec that the low you want to buy in gold is in August due to the positive seasonality in Sept/Oct for gold and silver. Silver is suppose to get a low within 19 weeks of Dec 17th which is a 111 week cycle low..that puts silver's beginning cycle for that on August 6th where a low can begin till Dec 17th. I find that gold and silver are running more hand in hand but silver still hasn't broken its 2006's highs of 21 1/2+..wherever it was- so that could be considered intrabearishness too. I'm thinking the reason for that is because it's also an industrial metal and once gold takes off into 2011 so will silver.

Here is what he said in his summary for gold from his 2010 forecast book which was finished in Nov 2009- Prices are likely to continue higher into 2011-2013. Gold should not fall below 800 unless the new 8.5 cycle is turning bearish. However, a smaller 22 month cycle low in gold is due May-Dec 2010, as a 200-300 pt decline is posible form the highs that preceeded the trough. . The crest of this 22 month cycle is due while Saturn is in its waning square which lasts till Aug 21st.... that if the first price target of 1249 is exceeded, then above that the price target for the crest of th 4.25 and 8.5 yr cycles are 1460 +/1142 with a possiblity of 1940 +/- 200. A change in Fed monetary policy that would support the dollar could quickly negate this outlook. HE says to watch closely for signs of this possibly between May and Sept 2010. I'm not a cycle gal but try to put it with other cycles like yours to see how it fits in.

Yesterday I believe was within his turn date of Jun 11-14 plus minus 3. His next date is July 30- Aug 1 and then Aug 21 plus minus all with 3 days. I get the feeling Dharma's cycle top is approaching and then we consolidate for the summer with no real major breaks to be concern about. Some have called some major downside but I will be on alert for that if gld hits 114

because on point and figure that would show demand is losing its strength and supply is taking over. But I'll get some alerts before that based on the relative strength going negative...which recently (last week) it went postive on pnf.

I just let the market show me rather than forecast big moves. If gld hits 124 then that is a pnf buy signal and a much higher price obective will be issued from where it is now a target of 160. But those targets most times are not achieved but it will show us the demand is building.

The action of new highs on gold seems to have been more subtle..enough to confuse some longs and create more confidence in shorting imo. Like Dharma has said, it's dangerous to short in a bull market and what gets me is I dont see it technically why they would..just because the "trade" is too crowded or you are seeing everyone talking about gold. Maybe this time being a contrarian is not good for your health? We'll see. But no matter I do think jumping on long right here can be dangerous.

On the equity side for point and figure, they came out from being on defense and now are offense...meaning demand is taking over. Typically these indicators dont get whipped around especially the NYSE BB...so we that could last for a month or 2 going into Laudry's original end of AUgust double top senario. However, there was only one time I recall in Dec 2008 that it flipped back and forth to defense and offense and defense. So I"m cautious there too especially when I see some important indexes getting the bear cross..ie; xle, oih, shanghai, France, Spain and many more smaller indexes. Now if oil is showing signs of bear cross and they dont recover that should keep the S&P from making any new highs...seeing oil stocks make up about 20-25% of the Spx. I follow Laundry and I think he will be correct stating we are in a bear market. That said, I'm always flexible and manage risk first over profits. There will be a time when things become more clearer. I think we are in a transition from bull cyclical to bear secular

One thing for sure is as long as the vix is hi and money in treasuries, fear will stay with us for the summer..astrowise that also points to it.

These are my thoughts but I do allow the market to tell me and will watch to see if something changes.

Good trading.

Irene