(This is an excerpt from June 10, 2011 issue of the blog for Decision Point subscribers.)

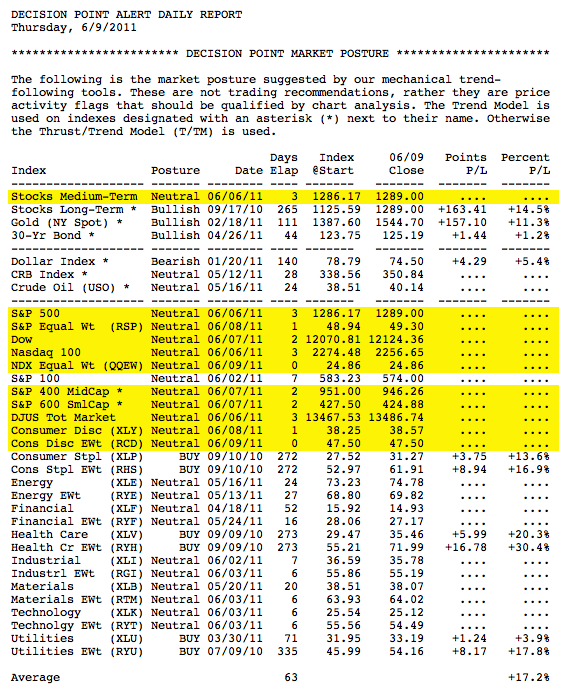

Last week 16 of the 27 market and sector indexes we track as primary market indicators were on buy signals. This week we lost 10 more of those buy signals as our mechanical timing models changed them to neutral. Currently there are only 3 sector indexes and their unweighted counterparts still on buy signals, and all of them are in declines. At the top of the table we have highlighted the line that shows that Decision Point's medium-term posture for the stock market (as tracked by Timer Digest) has changed to neutral.

Whenever our market posture changes to neutral we get questions as to what "neutral" means and why are we neutral versus a sell signal. Neutral means that the model has detected sufficient weakness in the trend to warrant changing from a buy signal to having no market exposure, either by moving to cash or to a fully hedged position.

A sell signal (selling short) is not generated because in each case the 50-EMA of the price index is above the 200-EMA, which by our definition means that the index is still in a long-term bull market, and we do not go short in a bull market.

A neutral signal may be the model's belated reaction to a small correction, or in fact it may signal the beginning of a bear market. We have no way of knowing until after the fact. By moving to neutral we are able to avoid losses if a serious decline develops, and we also avoid the added risk of being short in a bull market.

Bottom Line: We are observing price weakness across an assortment of broad market and sector indexes. Both cap-weighted and equal weighted (which tend to be stronger) are being affected. The topping process has been fairly typical, meaning that the top has so far been rounded and fairly gradual. We have no way of knowing how serious a decline there will be, or if it is nearly over, but we are comfortable being on the sidelines until the weakness has been resolved.

* * * * * * * * * * * * * * * * * * * * *

Technical analysis is a windsock, not a crystal ball.

* * * * * * * * * * * * * * * * * * * *

Carl BIO: Carl Swenlin is a self-taught technical analyst, who has been involved in market analysis since 1981. A pioneer in the creation of online technical resources, he is president and founder of DecisionPoint.com, a premier technical analysis website specializing in stock market indicators, charting, and focused research reports. Mr. Swenlin is a Member of the Market Technicians Association.

* * * * * * * * * * * * * * * * *