FWIW, Jim's angels are squares.

out on a limb! bottom for wave 2 in !?

#421

Posted 08 August 2019 - 07:04 AM

#422

Posted 08 August 2019 - 08:02 AM

#423

Posted 08 August 2019 - 10:05 AM

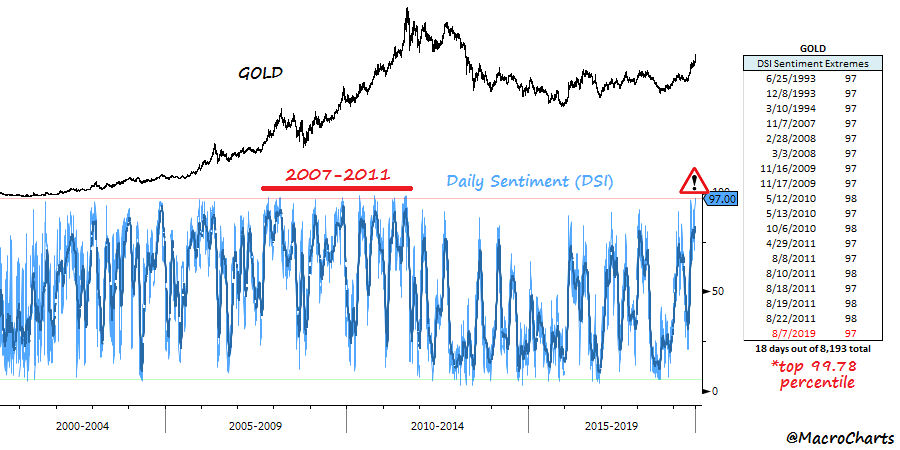

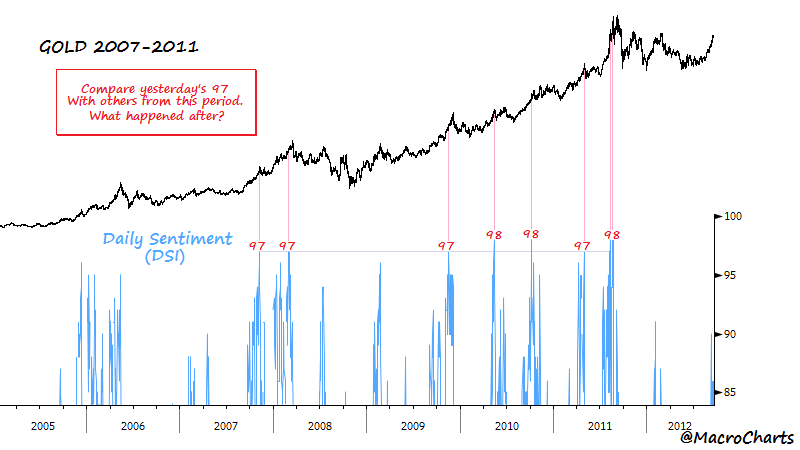

dsi=97% certainly the highest i remember we either topped yesterday, or will top tomorrow(for the record 98was the highest dsi)

none of that matters to me at this point the trend is your friend.i will use the correction to get back on margin, no hurry.gold is leading @some point down the road silver will be the leader.cbs are trapped and have entered a vicious cycle of lowering rates. folks have thought this is due to deflation, well it is partly , but it will be stagflation. and that is what will drive people to gold. it will be ugly.. in spite of the rise in miners ,they are still undervalued

this bounce in the stock market will be short lived, its the dip buyers in action

2-3 weeks of corrective action. it will have a different tone as new buyers come in and the fear of gold correcting got a chunk of the bugs out way too early.

its a race to the bottom for cbs. the fed will make the same mistakes as the ecb. the emperor has no clothes. the magic is gone. when the public wakes up to this. this small sector will become crowded. be careful what you wish for!!!

dharma

ps for commodities wave 5 is the big wave.

there is no fever like gold fever. -if you like jingles

Edited by dharma, 08 August 2019 - 10:10 AM.

#424

Posted 08 August 2019 - 05:17 PM

its a powerhouse just enjoying it

#425

Posted 09 August 2019 - 07:47 AM

dsi=97% certainly the highest i remember we either topped yesterday, or will top tomorrow(for the record 98was the highest dsi)

none of that matters to me at this point the trend is your friend.i will use the correction to get back on margin, no hurry.gold is leading @some point down the road silver will be the leader.cbs are trapped and have entered a vicious cycle of lowering rates. folks have thought this is due to deflation, well it is partly , but it will be stagflation. and that is what will drive people to gold. it will be ugly.. in spite of the rise in miners ,they are still undervalued

this bounce in the stock market will be short lived, its the dip buyers in action

2-3 weeks of corrective action. it will have a different tone as new buyers come in and the fear of gold correcting got a chunk of the bugs out way too early.

its a race to the bottom for cbs. the fed will make the same mistakes as the ecb. the emperor has no clothes. the magic is gone. when the public wakes up to this. this small sector will become crowded. be careful what you wish for!!!

dharma

ps for commodities wave 5 is the big wave.

there is no fever like gold fever. -if you like jingles

perspective ...

#426

Posted 09 August 2019 - 11:04 AM

ryanoo nice study thanks good info that chart is a keeper

dsi=92

weekly close today.over 1500 would be nice

market remains firm. there are alot fo situations that have boiled up

dharma

Edited by dharma, 09 August 2019 - 11:07 AM.

#427

Posted 09 August 2019 - 01:16 PM

Analyst Ross Clark's silver take.... "The rallies such as the current one (1972, 1994 and 2003) have developed into false breakouts (1972) or double tops (1994 & 2003). The 20-day moving average was a key support (currently $16.21). Once broken, prices dropped to the 50-week ema (currently $15.50). The total declines were 12% to 15%. If prices top here, then support would be expected between $15.20 and $14.70. These declines gave up 50% to 62% of the rally, currently offering support at $15.77 to $15.41. Sequential 9 Buy Setups were seen around the bottom of each of the three examples. Once a correction has run its course, the next level of important resistance will be around $26, a 50% retracement from the 2011 top"

"In order to master the markets, you must first master yourself" ... JP Morgan

"Most people lose money because they cannot admit they are wrong"... Martin Armstrong

http://marketvisions.blogspot.com/

#428

Posted 09 August 2019 - 01:44 PM

ryanoo nice study thanks good info that chart is a keeper

dsi=92

weekly close today.over 1500 would be nice

market remains firm. there are alot fo situations that have boiled up

dharma

dharma, the LT chart has an interesting DSI feature in it.

The two horizontal lines for DSI (red line near 97 and green line on the lower side):

During the 7-yr bull run (2005-2012), DSI touched many times the red line but not once the green line.

During the 7-yr bear (?) (2012-2019), DSI touched many times the green line, but not the red line, even once, until two days ago.

Perhaps a change in the LT character, for next several years?

#429

Posted 09 August 2019 - 02:09 PM

ryanoo nice study thanks good info that chart is a keeper

dsi=92

weekly close today.over 1500 would be nice

market remains firm. there are alot fo situations that have boiled up

dharma

dharma, the LT chart has an interesting DSI feature in it.

The two horizontal lines for DSI (red line near 97 and green line on the lower side):

During the 7-yr bull run (2005-2012), DSI touched many times the red line but not once the green line.

During the 7-yr bear (?) (2012-2019), DSI touched many times the green line, but not the red line, even once, until two days ago.

Perhaps a change in the LT character, for next several years?

ryano thanks for the heads up. the feeling in this market has definitely changed. we have gone from consolidation to bull market. i suspect corrections will not be long in duration or that deep. the cue to get on board is long w/new money and the bugs taking profits prematurely. the market has taught that lesson. the key is in bull markets to ride. when i started every sale resulted in higher buys. its a lesson i havent forgotten. there are some riders here. i look foward to their posts

dharma

#430

Posted 09 August 2019 - 03:02 PM

anyone jump on chpgf +16%

dharma