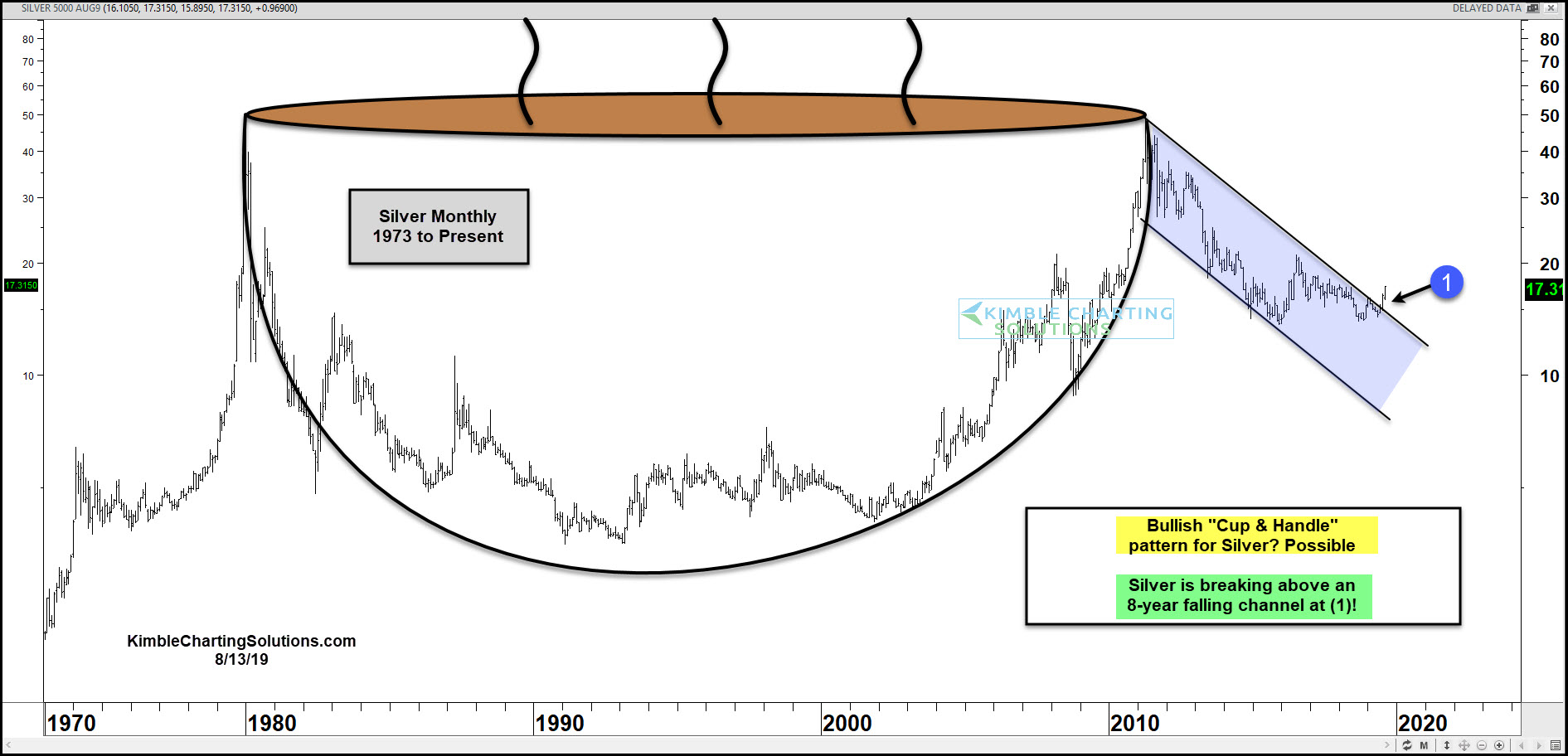

is silver breasking out of triple resistance hereabouts?

out on a limb! bottom for wave 2 in !?

#451

Posted 13 August 2019 - 01:23 AM

#452

Posted 13 August 2019 - 07:03 AM

Silver finally getting final pop I was looking for on this move....could last a couple more days, but I think we are getting pretty close to taking a breather once this leg runs out of steam...

At worst, I would expect to see a pull back to test the now busted 900 MA...at about 15.50 on SLV.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

#453

Posted 13 August 2019 - 08:28 AM

Negative yielding debt drives money to precious metals! I like this simple theory.

#454

Posted 13 August 2019 - 08:54 AM

Negative yielding debt drives money to precious metals! I like this simple theory.

"There is a very Dark Cloud hovering over the world economy and at the center of this cloud lies not just Europe, but Germany – the strongest economy holding up all of Europe. The German manufacturing sector is in freefall. While central banks have tried to “stimulate” the economy, federal, state, and local governments are in dire need of money and have been raising taxes and increasing enforcement. Government pensions are wiping out budgets in Europe, America, and Japan. The forces of the central banks have been directly opposed by the political fiscal side of government. Capital has been shifting toward preservation rather than how much profit can it make today. Even the 10-year 3-month interest rates in the USA have tipped into the inverted yield curve confusing many that this is a sign of impending doom. They fail to read the tea leaves that capital is looking for a place to just park. Traditionally, inverted yield curves take place during recessions and we are in one globally heading into a major low come January 2020.

We are facing a very Dark Financial Storm from which there is no escape." https://www.armstron...f-bad-advisers/

Edited by Russ, 13 August 2019 - 09:01 AM.

"In order to master the markets, you must first master yourself" ... JP Morgan

"Most people lose money because they cannot admit they are wrong"... Martin Armstrong

http://marketvisions.blogspot.com/

#455

Posted 13 August 2019 - 09:05 AM

GLD looking a bit toppy on 15 min chart now....if it can't climb back out over 142 relatively soon, then this big leg up may be done....

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

#456

Posted 13 August 2019 - 09:23 AM

GLD looking a bit toppy on 15 min chart now....if it can't climb back out over 142 relatively soon, then this big leg up may be done....

that is my take as well

dharma

#457

Posted 13 August 2019 - 10:09 AM

#458

Posted 13 August 2019 - 10:18 AM

what i am saying is , it looks to me like we have put in a top here.there are several different counts.so the degree of the top ie andof wave 3 or 3of 3 and now 4of3.etc. so , its time for a correction.we will get more information. in any event , it could be a couple of weeks. i dont think this phone call w/china will amount to much and we are in the weakest time of year for stocks ie august-oct. i am looking for an event.the volatility in the broad market is impressive. so,if you missed out on this rally or you picked up some nickels, you will get another chance. the miners are still way under loved.

dharma

#459

Posted 13 August 2019 - 11:14 AM

5 to 7 trading days .the we would be set to launch imo

#460

Posted 13 August 2019 - 12:15 PM

Well, I am very bullish here, FWIW (assuming we hold today's lows through the close). Filled some gaps, eliminated some weak hands, and all on a news-driven reaction (they are always reversed).