Internal correction is over. Going long.

#1

Posted 29 June 2021 - 03:21 PM

SPY is up

QQQ is up

VIX is up

Both Nasdaq and NYSE breadth are negative.

Internals corrected nicely without any damage.

Long SPY, QQQ and ARKK on close.

I especially like ARKK, because those companies lose so much money, they cant possibly disappoint.

#2

Posted 29 June 2021 - 07:03 PM

what internal correction and when did it begin???

#3

Posted 29 June 2021 - 07:24 PM

#4

Posted 29 June 2021 - 08:55 PM

Read what I wrote. Monday and Tuesday. You cant just repeat the same bullish thing. 55% of US population is long the market. A few hundred traders are short. Being long is not a contrarian.

really??? AAII shows 60% out of the mkt and the CNN fear greed index is in the fear zone and NAAIM report shows managers cut back equity exposure by 30%.......and investors intell has yet to get to the bullish numbers it saw at the 2007 high....short interest is at historic highs ..what am i missing here,,,....remember few if any made it to the top of k2

Edited by da_cheif, 29 June 2021 - 09:00 PM.

#5

Posted 29 June 2021 - 09:00 PM

#6

Posted 29 June 2021 - 09:00 PM

#7

Posted 29 June 2021 - 10:56 PM

55% of US population is long the market via mutual funds, pension funds, stocks, ETFs and stocks. The whole American wealth is in the stock market. And you are looking at advisors who are always 100% long and report being cautious for marketing purposes. You are the definition of majority and you add no value.

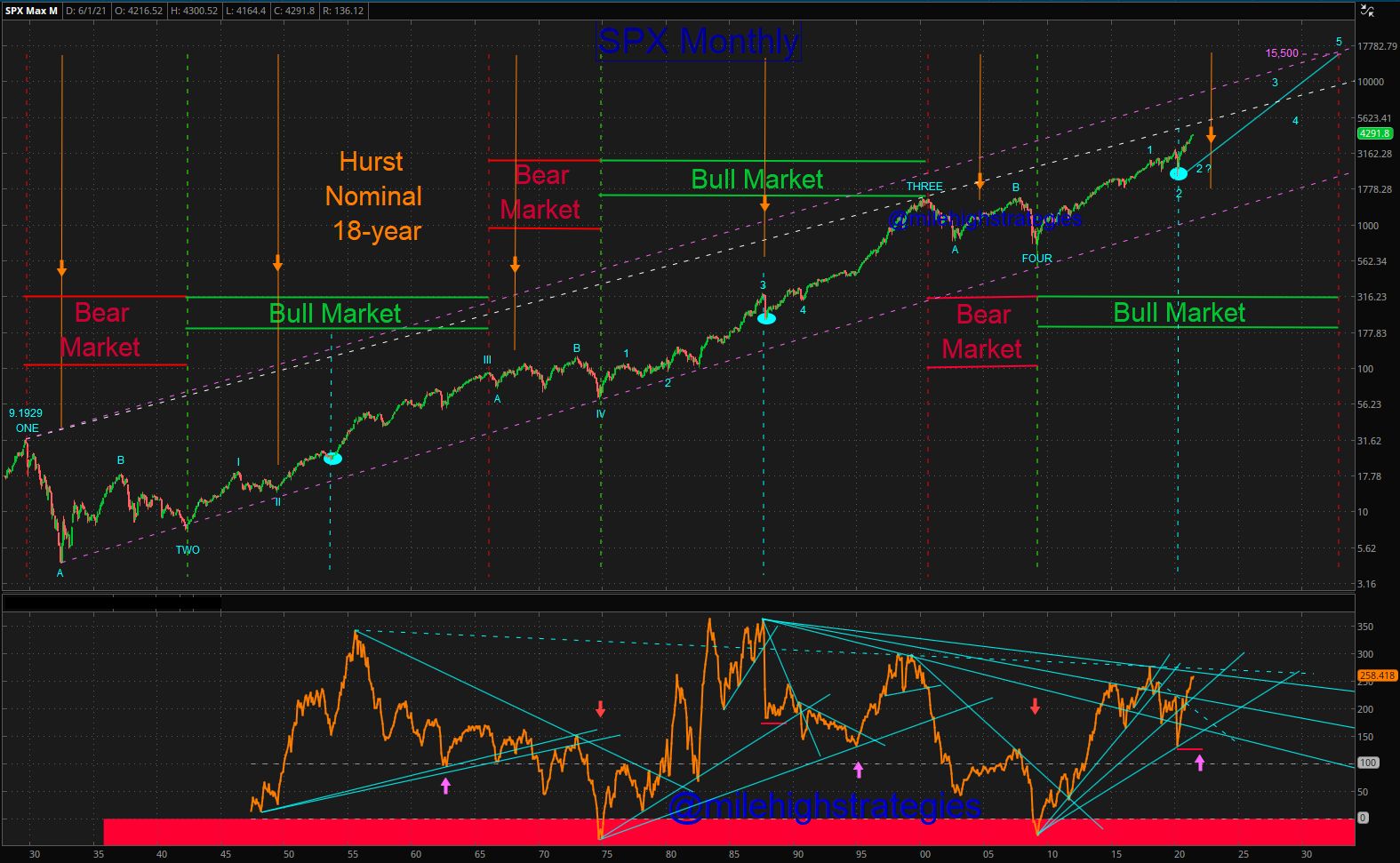

“3rd waves are ''wonders to behold'' and for many good reasons. Technically, this is the time where most analysts “recognize” that prices are now confirming what the internals told the analyst during wave 1 which was a change in direction was probable. This is also the time in which extremes in many indicators will show up - something in which I refer to as ''flags'' - which are later used in approximating the termination point of the entire 5 wave pattern sequence structure. In equities, these extremes will be measured in the raw data of both breadth and volume - and the strength or weakness of the indicators that use such information - as well as their relationship to each other. Price pattern wise, one will always be able to identify a third wave because of the fact that price patterns will break out of basic support or resistance areas that were previously controlling the price pattern up until that time. Psychologically, this is when the mind set is that we remember how we all got burned before and that in no way is this the start of a major move higher - also known as climbing the ''wall of worry''. Once the market gets high enough, people start throwing in the towel on their bearish mind set, and this continues to a point when all of the ''willing'' buyers are in the market. 3rd waves are also never the shortest wave in a 5 wave structure, and more times than not, are generally the longest wave in either price, percentage gain, or both, to what will eventually be the larger 5 wave pattern structure sequence overall.”

That aside, and not knowing your resource regarding the current percentage of those invested in equities, I would bet you a large lunch, at a drive thru of your choice, that there is more wealth investment in housing and other real estate than stocks at this time, with vehicle (cars, boats, planes, etc) and business interests (sole proprietorships, etc.) filling out the top four.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#8

Posted 30 June 2021 - 02:15 AM

For the most part I agree, Fib. Having said said, I am going to be a momentum junkie. Fast money is better than long term analysis.

#9

Posted 30 June 2021 - 06:33 AM

>.Fast money is better than long term analysis< and who told u that 675 ono

#10

Posted 30 June 2021 - 07:46 AM

>.Fast money is better than long term analysis< and who told u that 675 ono

LT analysis tends to keep you on the right side of the ST trade...