XGD daily...

Edited by Smithy, 21 September 2022 - 08:45 AM.

Posted 21 September 2022 - 08:45 AM

XGD daily...

Edited by Smithy, 21 September 2022 - 08:45 AM.

Posted 21 September 2022 - 09:10 AM

There's a limit as to how high they can raise rates - the Fed is trapped ...

-----------------------

"The Interest Expense on US Public Debt rose to $716 billion over the past year, a record high. At the current pace it will soon be the largest line item in the Federal budget, surpassing Social Security."

Charlie Bilello on Twitter pic.twitter.com/2U2vsSb4Ps

Posted 21 September 2022 - 09:17 AM

Posted 21 September 2022 - 09:41 AM

XGD daily...

you should add daily and weekly RSI, there is no divergence set up like this in years, guarantees nada but 19 out of 20 times IMO suggest a key low is very near, we see

Senor

Edited by senorBS, 21 September 2022 - 09:41 AM.

Posted 21 September 2022 - 10:01 AM

TheDailyGold Premium: Flash Update (09/21 AM)

Jordan <jordan@thedailygold.com>

Wed 9/21/2022 1:00 AM

09212022_TDGFlashUpdate.pdf

Good morning Mike,

This is nothing more than a quick (1-page) comment before the Fed meeting later today. There is the setup for a rally in the stock market as well as gold stocks.

The Fed will hike rates up to 3.25% and as we’ve stated very recently, the end of the hiking cycle is fast approaching and that is the case even if December is the last hike. After tomorrow there is only one meeting before the December meeting.

The market may be at peak tightness as it’s showing a terminal rate of 4.50% in six months. So, the Fed being aggressive has already been discounted by the market (for the most part). Meanwhile, the Atlanta Fed GDP Now estimate for Q3 has fallen to 0.3% growth. Economists, two months ago thought there would be 2% growth this quarter.

Any whiff of bad economic news or any softer Fed comments today or in the days that follow is going to give fuel to the gold stocks.

Also, note that since the first day of the month Gold and the S&P 500 have made lower lows but Silver and the gold stocks have not. That’s a non-confirmation of the breakdown in Gold. We’ll see if we get a rally after the Fed and if Gold can reverse its breakdown by the end of the month, which is also the end of the quarter.

Simply put, I would be wary about being bearish in the very short-term.

-Jordan

Posted 21 September 2022 - 10:50 AM

The bulls want to see K Wave's silver 5 min 900 ma hold ...

Posted 21 September 2022 - 12:06 PM

Hourly spot gold chart starting to bear a family resemblance to a contracting tri

Posted 21 September 2022 - 12:25 PM

or BUY THE THRUST down below 1654 out of a what currently appears a nice looking wave 4 contracting IF it occurs, IMO would be a rather high confidence scenario, we see

Senor

Posted 21 September 2022 - 12:42 PM

=Mercury Station Trine Mars=

Gold usually responds bullishly to a Mercury Station Trine Mars.

Sounds benign, but from a planetary power standpoint, it is not.

The Mercury Station Trine Mars was Sept. 10. It's a little late on the response this time.

However, I think the thing that sets off Gold is the Sun coming in to conjoin Mercury (Rx) to add to it

on Friday, Sept. 23, both trine Mars, but a little wide.

If not this week then next.

In the past, some of the best examples of a turn in Gold under this influence are shown here:

June 21, 1862

Sept. 11, 1864

Feb. 28, 1993

Oct. 12, 2007

E

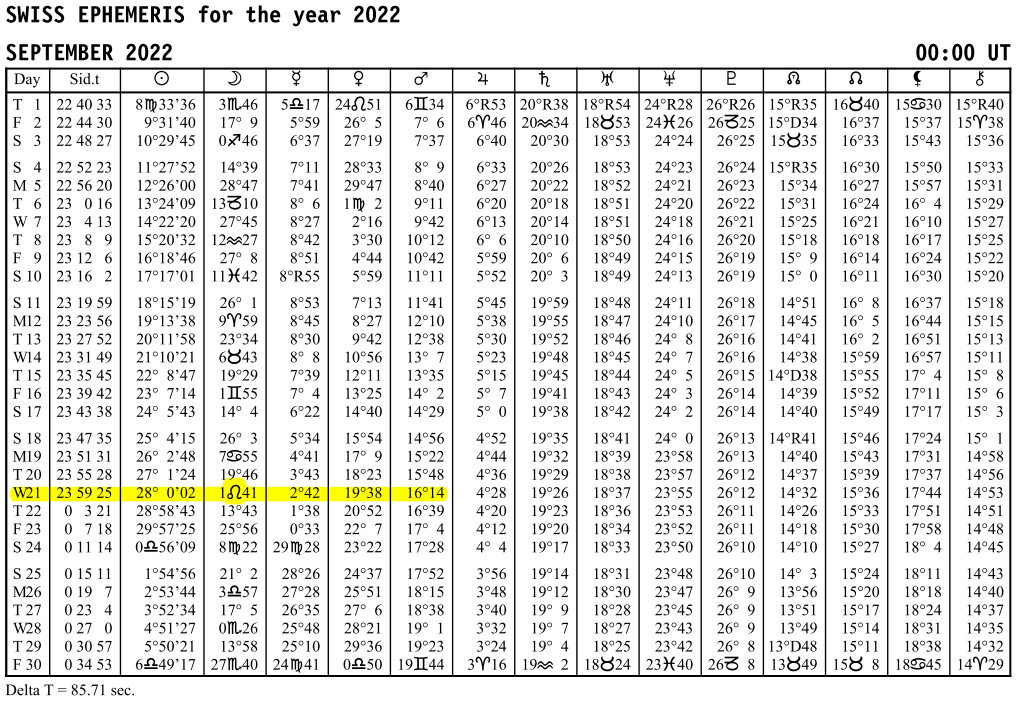

Tropical Positions

Swiss Ephemeris

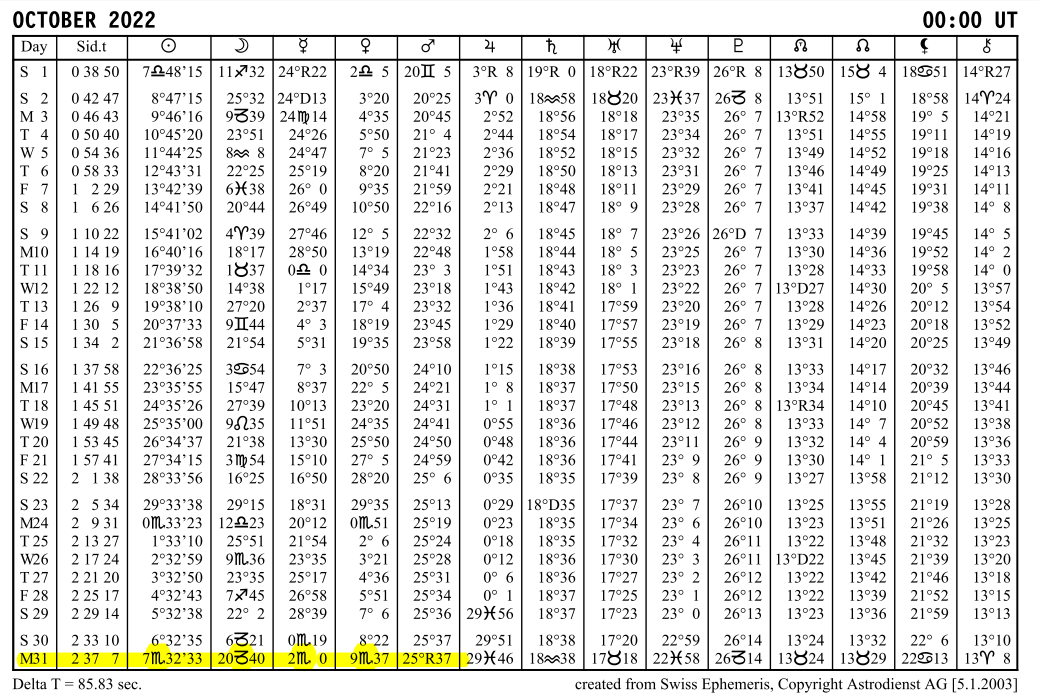

The other station, that of Mars Rx Station trine Mercury occurs October 31 and that should really get the ball rolling for Gold.

Posted 21 September 2022 - 12:45 PM

Oct. 12, 2007