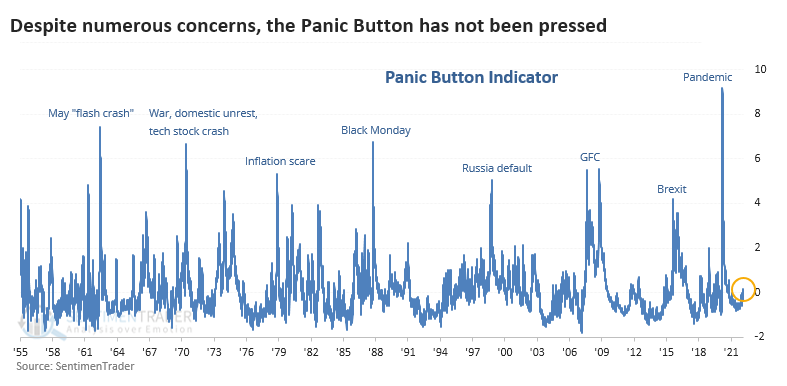

The FED fiasco played a major role in current crash - ongoing - but they will get a bit of reprieve when they raise rates by a pitifully inadequate 25bps. After that bounce it us back down again.

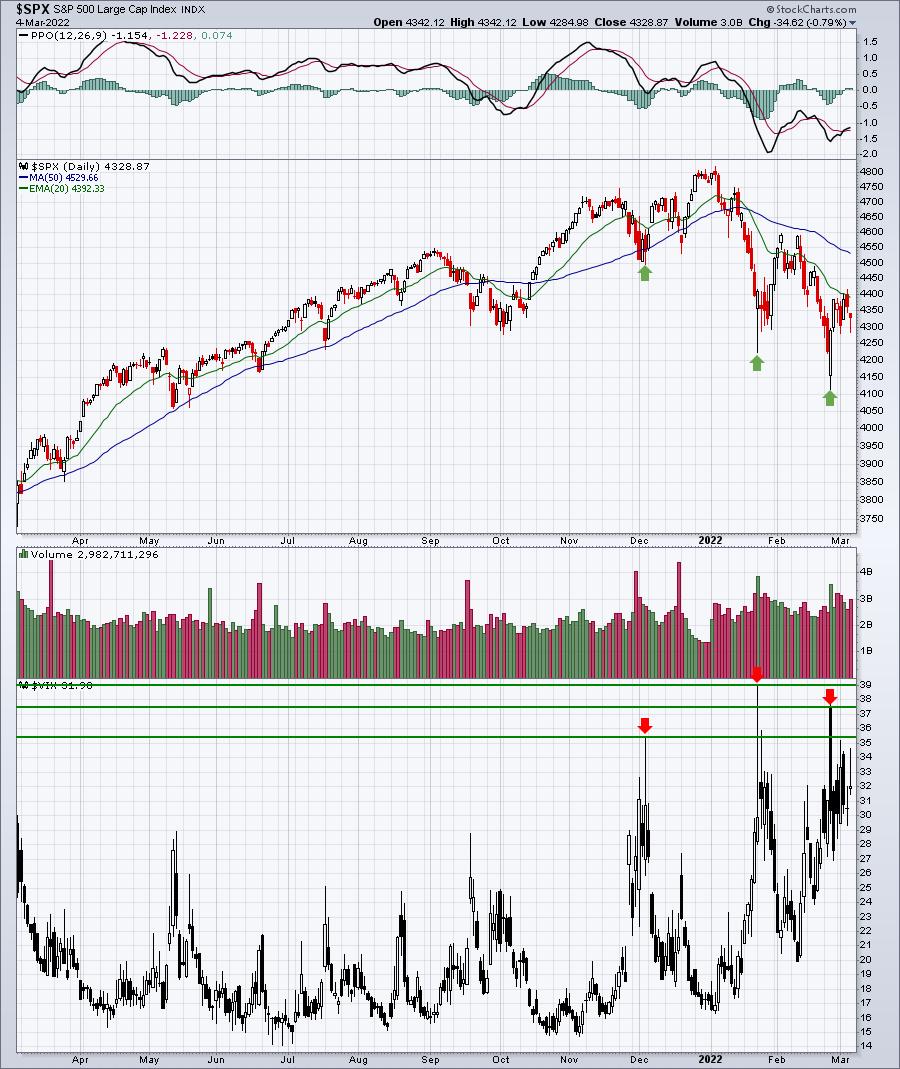

The current plunge should continue until at least the previous 2022 low with a strong possibility of a "doomsday" spike down to below ES 3800.

Here is one opinion:

".....in the meantime, I am going to give you just the basic parameters upon which you can focus for the coming weeks. Support in the market is in the 4170-4270SPX region. As long as this pullback holds that support (which I expect it will at this time), then the next target region to focus upon is the 4500-4600SPX region. Of course, I am leaving the greater detail in my analysis to the members of The Market Pinball Wizard. But, those are adequate parameters for long term investors over the coming weeks.

Even though we have been extremely accurate in our market prognostications for years, I would like to take this opportunity to remind you that we provide our perspective by ranking probabilistic market movements based upon the structure of the market price action, which tracks market sentiment. And, if we maintain a certain primary perspective as to how the market will move next, and the market breaks that pattern, it clearly tells us that we were wrong in our initial assessment.

But here is the most important part of the analysis: We also provide you with an alternative perspective at the same time we provide you with our primary expectation, and let you know when to adopt that alternative perspective before it happens. Clearly, our alternative perspective at this time is that if we break the support cited above, I believe we can drop to test the 4000-4050SPX region before the next major rally phase begins. But, I do not see this as the greater likelihood at this time...."