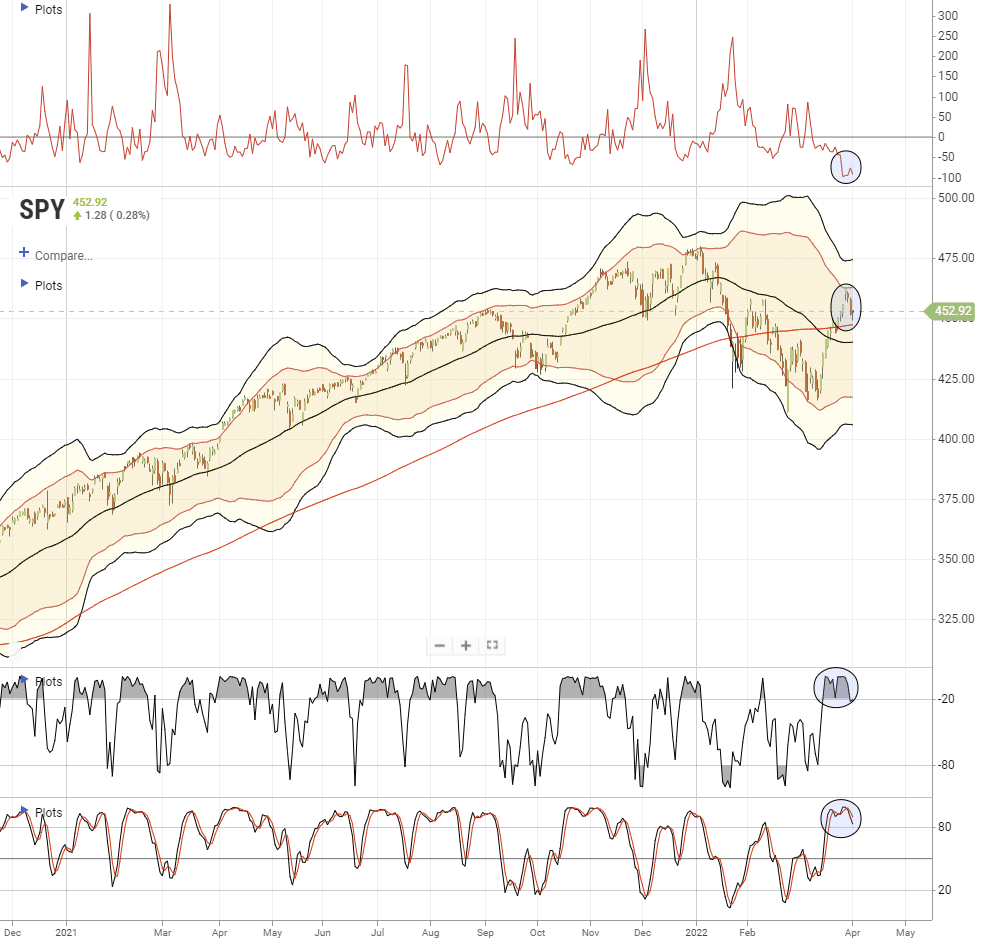

What an insane market, on edge, but the last few minutes on Friday swung it to the BULLS!

"... The current Fed interest rate cycle may more closely resemble 1994 when the Fed aggressively hiked rates from 3% to 6%. Similar to now, back then stock prices swung wildly throughout the year to eventually finish the year flattish.

If Things Are So Bad, Why Are Prices Going Up?

In the face of such horrible and scary headlines, how can prices still go up? The short answer is that companies are making money hand over fist and the economy remains strong (3.6% unemployment rate; record 11.3m job openings; 3% forecasted growth in 2022 GDP) in a post-COVID recovery world, where consumers remain financially healthy and are now looking to spend their shelter-in-place savings on vacations, houses, and cars (all healthy industries).

Not only are corporate profits at record levels, they are also expected to grow at a healthy rate (+10% in 2022, +10% in 2023) after mind-boggling growth of +50% in 2021 (see chart below)..."

https://investingcaf...d-ukraine-pain/