First the US$ may be making a low. It tested last year's June low and has bounced significantly. Once again, there is record extreme Short the Euro. When the Euro declines it means risk is in OFF mode

VIX is so low, it's about the same price when the market was at all time highs, The top that is. How odd that number should be so low here. Usually bottoms are made on high VIX numbers

The US treasury yield curve is inverted. Every time this has happened going back to the 1960's we experienced a major stock market decline.

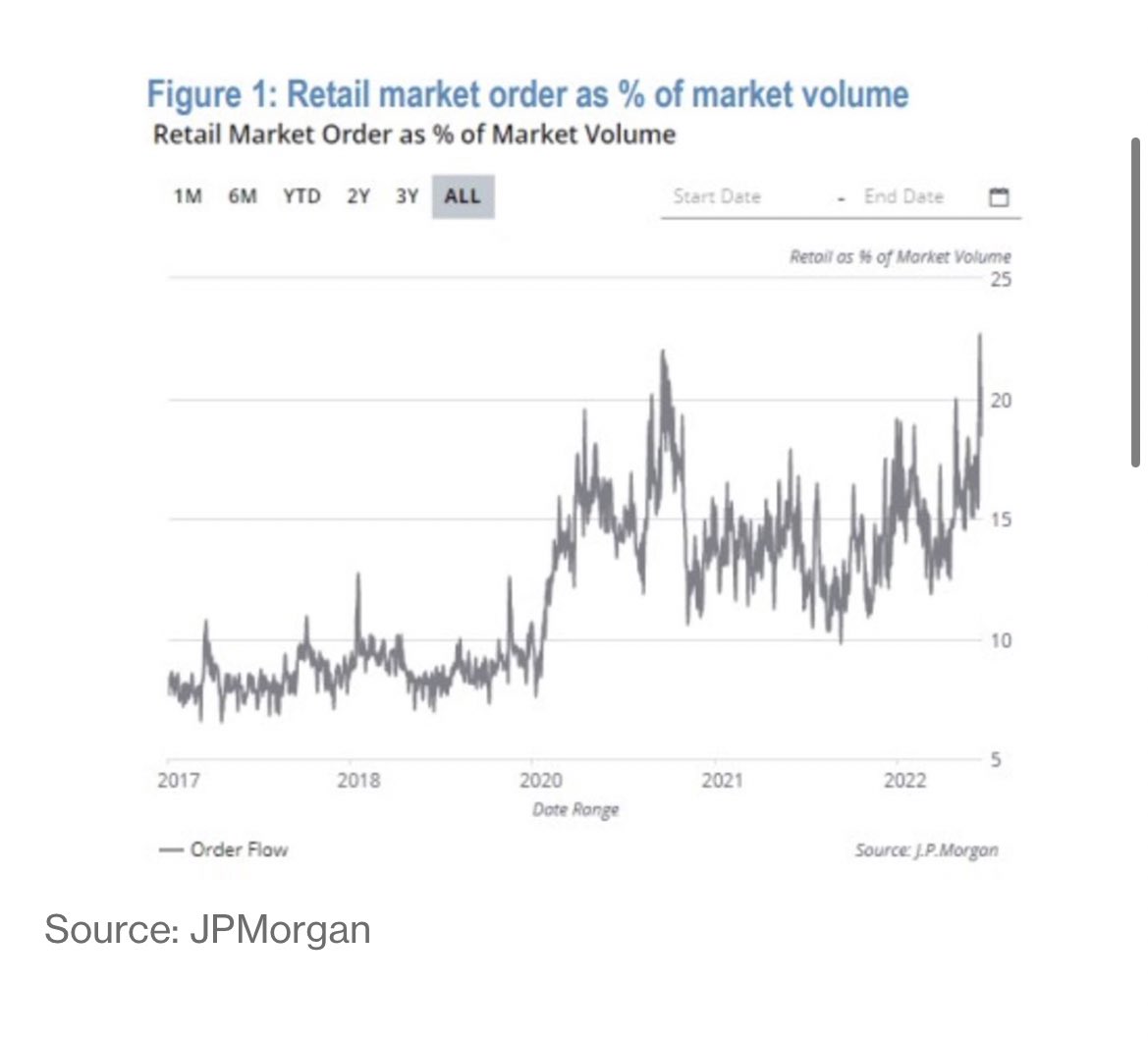

Retail Market orders as a % of market volume at extreme. The little guy is buying in like crazy. Is it early or late?

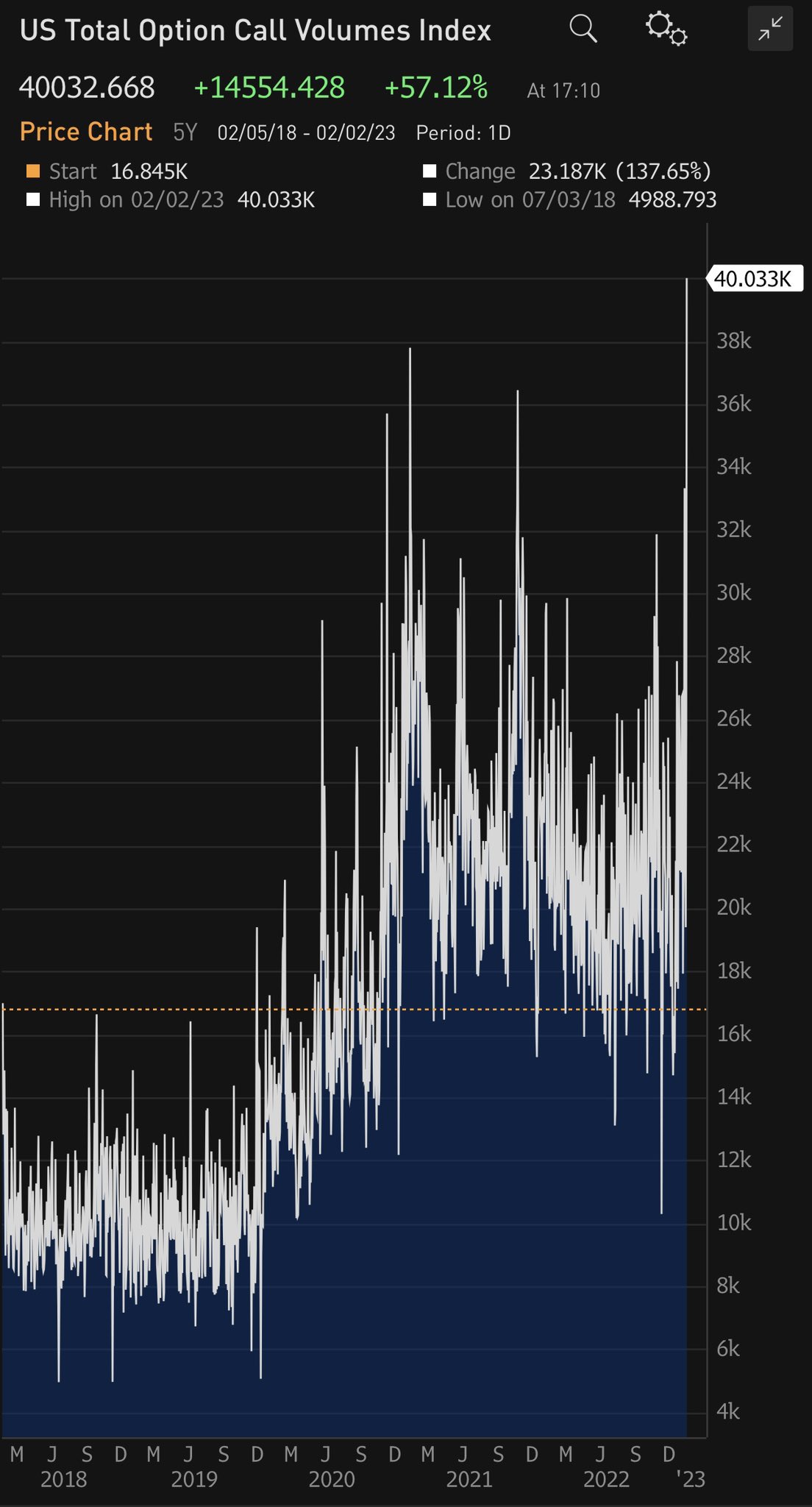

The total call volume for February 2, 2023 set a new all-time record

“They are encouraged by the recent rebound in small-cap meme stocks and cryptoassets which crashed last year,” Peng Cheng, a JPMorgan strategist, said in an interview. “Trading volume is overall lower and that also may have exaggerated retail market share.”

Finally two very accurate traders in the wrong way, i,e, the perfect contrary market callers said the sky is the limit and it's up, up and away. Their timing is usually pretty good but sometimes they are right for awhile

Edited by skott, 03 February 2023 - 11:53 AM.