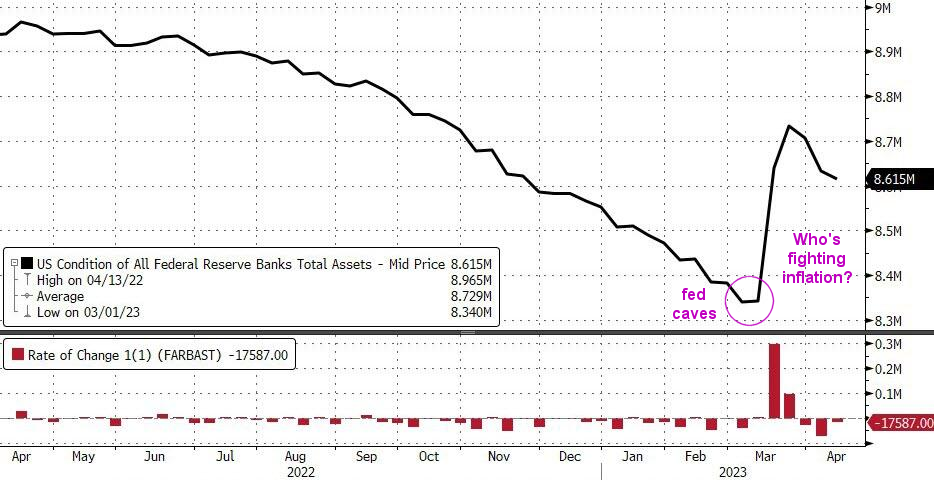

Pro's are not falling in love based on Hopium that inflation is going to collapse quickly and FED is going to pivot.

Federal Reserve Governor Chris Waller said Friday the Fed hasn't made much progress bringing down inflation based on the latest data while reiterating the view the central bank's job isn't done yet.

"Whether you measure inflation using the CPI or the Fed's preferred measure of personal consumption expenditures, it is still much too high and so my job is not done," Waller said in a speech at the Graybar National Training Conference in San Antonio, Texas.

"Financial conditions have not significantly tightened, the labor market continues to be strong and quite tight, and inflation is far above target, so monetary policy needs to be tightened further," Waller added.

"Money cannot consistently be made trading every day or every week during the year." ~ Jesse Livermore Trading Rule