Not sure the exact year.

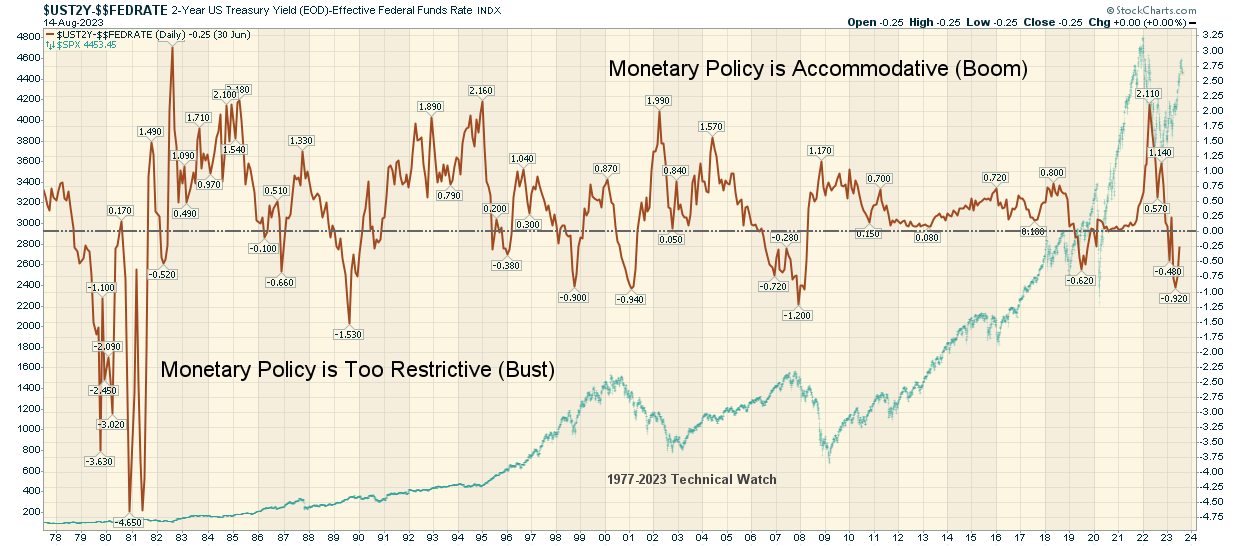

Stopped me in the parking lot and we talked econ for a bit... he pointed out the yield curve is inverted and that a very good indicator of a recession.

A year later it got messy, more pain than most predicted.

That stuck with me.

Here we are about a year into the inversion and the old saying is the bond market is smarter than the stock market.

We will see...