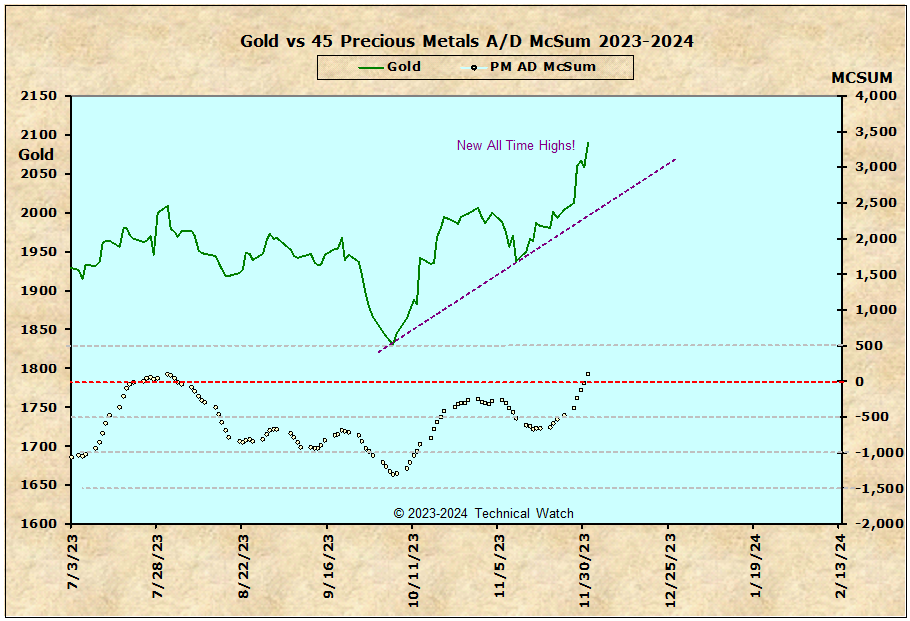

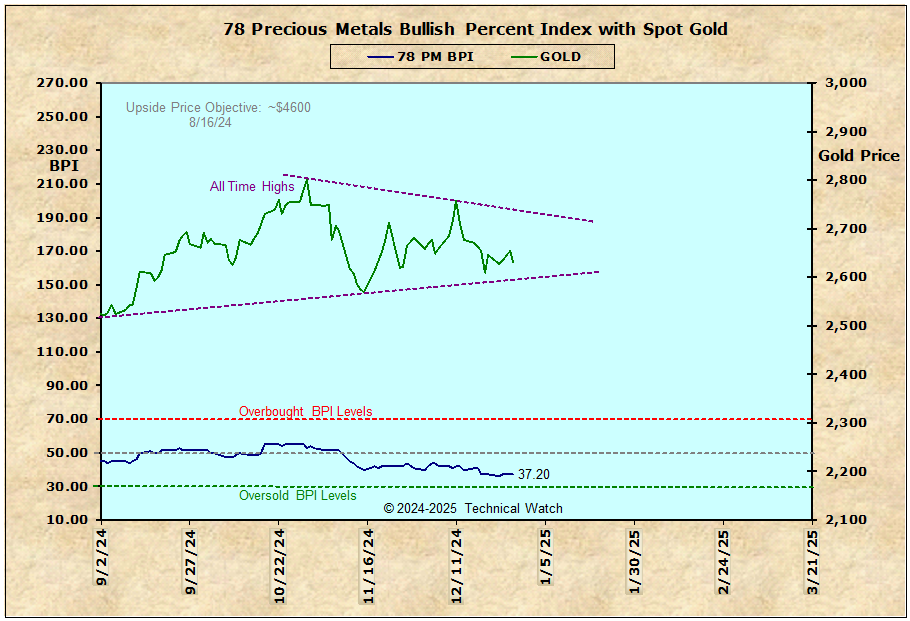

Without breadth participation, large counter trend moves like we've seen in gold and silver over the last 2 weeks are considered "rogue waves" and not technically sustainable. The focus for the metals is always the expectation of future inflationary forces brought on by increasing liquidity levels, and when the main asset classes become fully flushed with cash, any excesses then "bypass" into gold and silver. So as long interest rates continue to climb higher, once the current geopolitical emotionalism wanes, we should expect both gold and silver to quickly go back to where they started at the beginning of October...which may also include catching up on the downside toward the nesting of the next cyclical low which is traditionally due in December.

Of course, throw a nuclear bomb into the mix, or even a collapse of a western government, then technical conditions don't really matter, do they?

Place your bets as you see fit, but do consider any long positions with one foot out the door just in case the proverbial trap door opens.

Fib

Edited by fib_1618, 21 October 2023 - 07:29 PM.