I am stumped as to where we are short term. We can do anything from here. But looking further out, there is a major market low coming early next year. I suspect we flop around until then.

I had HUI 219-220 as my "line-in-the-sand" for the bull phase to continue. Now it looks like it will take some time. I think we can bounce this week and maybe even make a push back to the highs into Nov., but a breakout in the gold indices looks much less certain for 2005. In fact 2006 is more likely.

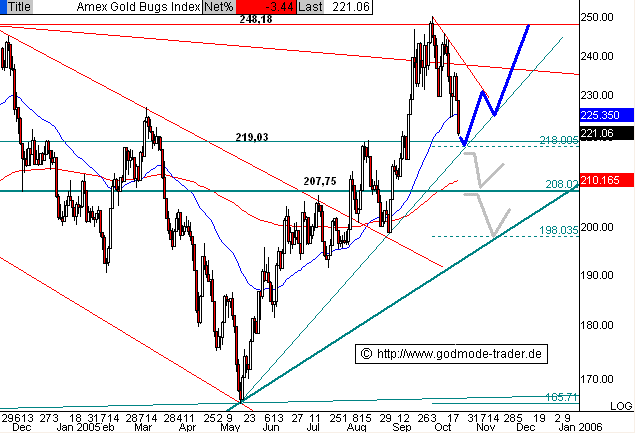

As for the Gann side of things, I still say HUI 224 and a cluster of fibs around this number are key. Look at this long term chart.

We are right there in terms of staying very bullish.

I suspect that I got my drawers dropped right at the wrong moment. If we pause or pullback on Monday, I'll play a long trade in a liquid name or two. Who knows, maybe the gold and silver stocks will surprise us yet. I'll play it for a trade right now, not committing beyond that.

We certainly can't get more bearish around here.

BTW - mss I was looking at your chart and trying to match major HUI lows. It seems the rate plot predicts or preceeds each low, but does not define the degree of the low. Thus I read the chart to say there will be another important low coming, but what will that be relative to the May bottom? Look at last year for example.

I should add one final thought. You know how to really make money in this PM game? Wait for the breakout to new highs before really getting long. I did it in 2002 and 2003. It has me thinking.

cheers,

john

PS I see that Jeff Kern is hedging his bets.